- Optimism is climbing, but are valuations too high?

- Key risk indicators signal caution as sentiment soars.

- Investors face a tough balancing act in today’s market.

The market has come a long way since the October 2022 low, with optimism creeping back in. But with this renewed confidence comes a need to tread carefully. As investor sentiment heats up, some key factors demand closer attention.

Is Optimism Running Too High?

Howard Marks, a respected voice in investing, often breaks down market cycles into two broad phases: aggressive periods and cautious ones. Right now, we’re likely entering one of those times where caution is crucial. If you’ve followed my analysis over the past few years, you’ll know that I was one of the first to take a positive view during the Bear Market of 2022, and I’ve maintained that stance throughout 2023 and into 2024.

But today? After a strong rally, optimism is making a strong comeback—and perhaps, just maybe, it’s becoming a bit too much. In fact, market sentiment may be reaching levels that could soon challenge the bullish outlook we’ve seen in recent months.

Take a look at the charts I shared this morning on my Telegram Channel. They paint a clear picture of the current market climate.

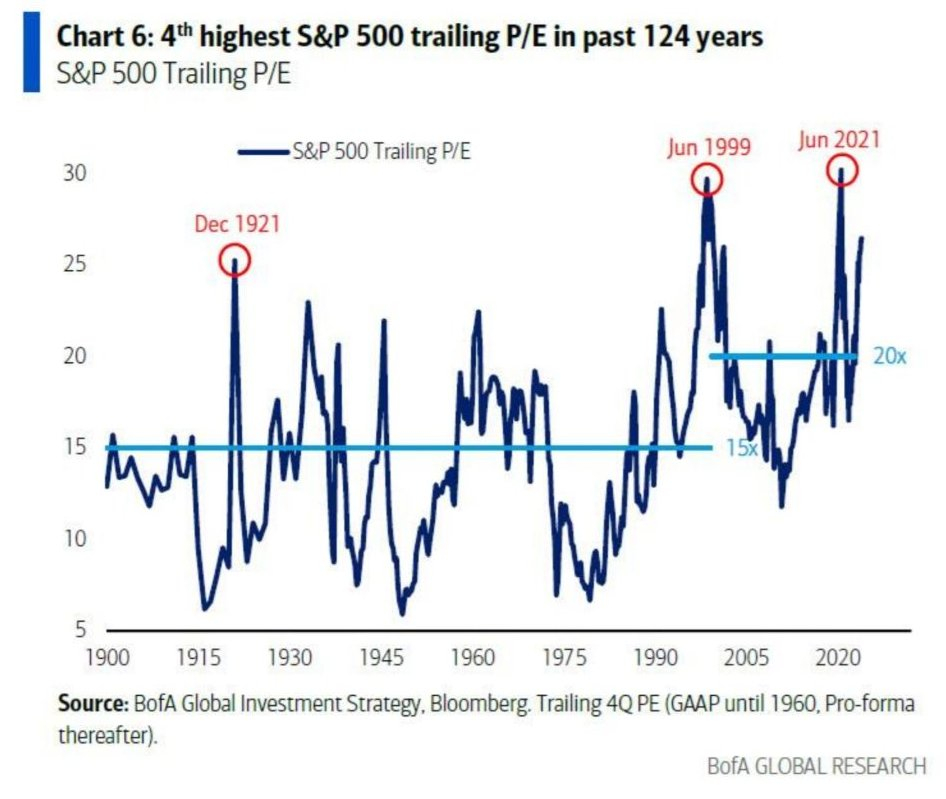

For one, the US stock market's valuation is at the fourth-highest point ever, based on trailing P/E ratios. This, combined with other indicators, reveals that investor sentiment—and risk appetite—are at elevated levels. It's clear that optimism is widespread, but is it becoming excessive?

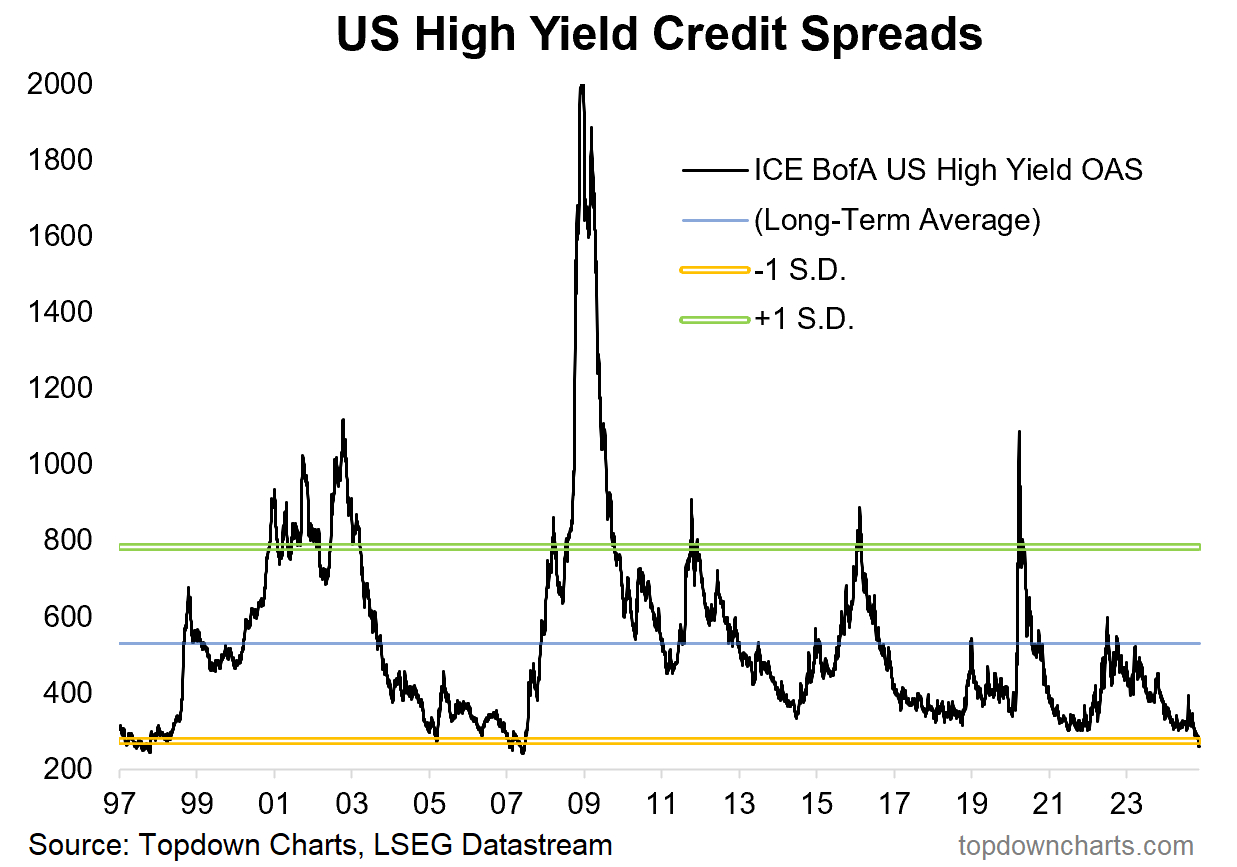

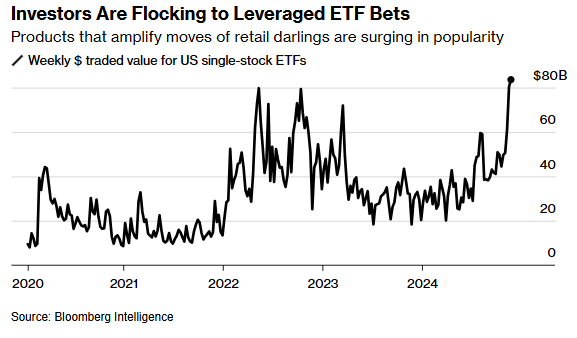

The charts below show that both high-yield spreads (which typically move in sync with equities) and riskier instruments like leveraged ETFs are all flashing warning signs of extreme optimism. When these indicators reach such high levels, it’s a sign that investors are willing to take on more risk in hopes of higher returns. Confidence in the market is high, but is it too high?

The big question on many minds is whether this signals the onset of a Bear Market. The truth is, no one can predict that with certainty. As history shows, Bull Markets can stretch far beyond what logic would expect. While we could be facing heightened risk, there’s also a chance that the markets could continue their upward march, potentially pushing valuations even further.

What to Do Now

So, what’s the investor to do in these uncertain times? It's a balancing act. We’re at a point of high valuations and sky-high optimism, but there’s also the risk of missing out on further gains if the market continues to rise. A “dear” market could get even “dearer.” And while the potential for a pullback exists, waiting on the sidelines may mean missing out on the next phase of market growth.

The answer, as always, likely lies somewhere in between. We need to stay aware of current risks while continuing to position portfolios to capture potential upside in the months and years ahead. The key is maintaining flexibility—being prepared for a potential downturn while staying open to the possibility of further gains.

In summary, it’s not an easy environment, and future returns may be lower than in the past due to high valuations and the need for more caution. But be prepared. At some point, when the situation looks worse than it does today, there will be an opportunity to step back in aggressively—ready to seize the moment when the time is right.

Until next time!

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.