Bitcoin (ETH) staged a recovery in the latter half of Wednesday’s trading session after initially plummeting as a result of the hotter-than-expected US inflation print.

Consumer price inflation in March sped up to 3.5% from 3.2% the month prior, surpassing forecasts of 3.4%.

Despite only being a bite-sized overshoot, stocks, cryptocurrencies and other risk assets tumbled as hopes of a June interest rate cut from the US Federal Reserve dissipated.

Bitcoin hit an intraday low around the $67,500 mark, before bulls seized the dip opportunity.

BTC/USD ended more than 2% higher, with further gains this Thursday bringing the pair to $70,722 at the time of writing.

Solid bitcoin ETF inflows supported the buoyant market, with Farside’s bitcoin ETF tracker showing nearly $124 million of cash added to the market yesterday.

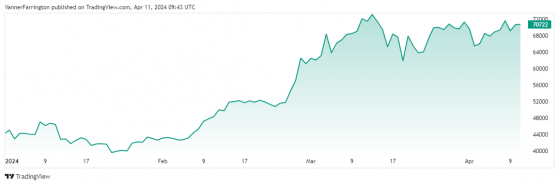

Bitcoin is up 67% year to date – Source: tradingview.com

Week on week, bitcoin is up 6.7%, while Ethereum, the second-largest cryptocurrency, is up 7.5%.

In the broader altcoin space, Binance’s BNB token, Ripple (XRP) and Dogecoin (DOGE) have added middle single digits to their market capitalisations over the past seven days, while Solana (SOL) is down 6.6%.

Global cryptocurrency market cap currently stands at $2.64 trillion, with bitcoin dominance at 52.8%.

Read more on Proactive Investors AU