Bitcoin (BTC) is hinting at a new consolidation phase, with the world’s largest cryptocurrency seemingly unable to breach the $70,000 price point for any decent stretch of time.

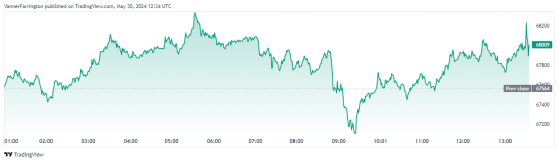

The BTC/USD pair saw a 1% drop below $67,700 on Wednesday and while the pair reclaimed $68,000 today, it still remains a couple of percentage points lower on a week-on-week basis.

Low trading volumes suggest a degree of apathy among traders at the moment, leading to speculation of a prolonged sideways trade.

Neil Roarty, analyst at investment platform Stocklytics, explained: “Back in February, bitcoin surged almost 50% in value in a single month. Since then, both bulls and bears have been frustrated by three months of relative stability.

“This consolidation in the $60,000 - $70,000 price range places Bitcoin in a strong position, but it does raise questions around what it will take to break one way or the other.

Given the advances in institutional adoption of bitcoin as an asset class, accelerated by the approval of spot-bitcoin exchange-traded funds this January, Roarty proposes looking towards traditional indicators to get a sense of where bitcoin is going.

“The answer could well lie in interest rates,” said Roarty. “The US Federal Reserve continues to hint at rate cuts, but so far has been reluctant to pull the trigger. We’re unlikely to see any this summer, and there are even some whispers they may not come until 2025.”

If the Fed’s hawkish faction continues to keep rates higher for longer, the associated high Treasury yields could limit the near-term appeal of risk-on assets like equities and bitcoin.

“The waiting game looks set to continue,” said Roary.

For now, bitcoin is hopping along at $68,000.

Bitcoin remains 61% higher year to date – Source: tradingview.com

Ethereum (ETH) has had a reality check following a spike in bullish action when the US Securities and Exchange Commission (SEC) signalled the approval of spot-ether ETFs last week.

The second-largest cryptocurrency has since retreated from a two-month high netted earlier this week. At $3,753, the ETH/USD pair is currently 4.7% lower week on week.

Global cryptocurrency market capitalisation currently stands at $2.53 trillion, with bitcoin dominance at 52.9%.

Read more on Proactive Investors AU