Trading has commenced on bitcoin (BTC) exchange-traded funds for the first time ever in the US, with tickers from Grayscale, BlackRock, Ark Invest, Fidelity and more going live in today’s trading session.

Chief among them is the $28 billion Grayscale Bitcoin Trust (GBTC), which is celebrating its ETF approval following a 10-year campaign.

NYSE Arca-listed GBTC was trading for $41.13 per share at the time of writing, while the ARK 21Shares Bitcoin ETF, sponsored by Cathie Wood’s Ark Invest business, was swapping for $47.54.

Market data is yet to emerge from BlackRock Inc (NYSE:NYSE:BLK)’s Nasdaq-listed iShares Bitcoin Trust ETF (IBIT).

Regardless, per-share prices of these competing ETFs should technically follow in lockstep with their sole underlying asset bitcoin.

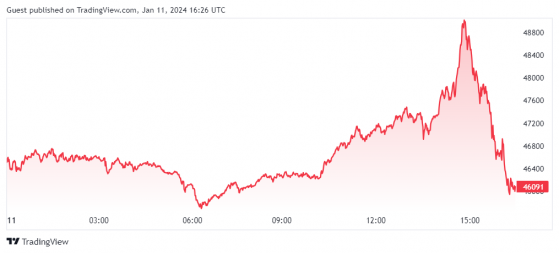

On that note, the world’s largest cryptocurrency’s short-term response to these sweeping approvals potentially was potentially underwhelming.

At the time of writing, the BTC/USD pair was 1.2% lower against the day, with more than 7% of intraday amplitude underscoring the volatile nature of the trading session.

“Although the approval is of course fundamentally very positive for the price of bitcoin, much of the expectation that the ETF will be approved is already priced in, and it is likely that we will see a ‘sell the news’ event after a brief upswing,” stated Eric Demuth, co-founder and chief executive of Bitpanda.

However, Demuth added that, in the long term, “the higher liquidity and volume will lead to a higher bitcoin price and could also help to reduce volatility”.

In fact, Demuth reckons that there “is every possibility” of bitcoin breaking the $100,000 mark as soon as this year.

“The Bitcoin ETF is another crucial step towards mass adoption of crypto assets,” he commented.

“At Bitpanda, we are seeing a growing number of enquiries from established banks regarding our white label solution, custody solutions and other B2B products.

“The interest of established players to get involved in the crypto space and offer products to their customers is huge. We are ready to support them in this endeavour.”

In the meantime, bitcoin was swapping for slightly more than $46,000 at the time of writing.

Bitcoin’s intraday volatile streak – Source: tradingview.com

Read more on Proactive Investors AU