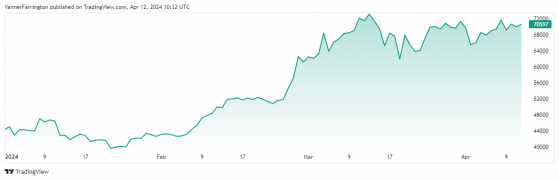

Bitcoin (BTC) gained ground against the US dollar in early Friday trades, with the BTC/USD pair adding a little over a percentage point to $70,597 at the time of writing.

It effectively cancels the losses chalked up by the benchmark cryptocurrency on Thursday and brings week-on-week gains close to 6%.

Risk assets including bitcoin had a ropey week in response to the macroeconomic calendar. US inflation came in a little hotter than expected, causing a latter-week flattening of crypto prices.

But with markets still pinning hopes on interest rates to fall this year, bitcoin remains in a strong position overall.

Buoyant bitcoin exchange-traded fund inflows in the latter half of the week provided some bullish support too.

The data shows more than $210 million of net inflows over the past two days, which has taken a chunk out of the $240 million of outflows in the front end of the week.

Bitcoin is 67% higher year to date – Source: tradingview.com

Second-largest cryptocurrency Ethereum (ETH) has performed better than bitcoin over the past seven days, climbing nearly 8% higher against the US dollar. At the time of writing, the ETH/USD pair was swapping for $3,513.

In the broader altcoin space, BNB has bounced 9% higher week on week and Dogecoin (DOGE) a bumper 17%. Ripple (XRP) and Solana (SOL) are also in the green.

Global cryptocurrency market capitalisation currently stands at $2.62 trillion, with bitcoin dominance at 53%.

Read more on Proactive Investors AU