There was little in the way of bullish sentiment in the lead up to this year’s tech earnings season.

But now that most big-tech earnings calls are in, exactly how bad was it?

To little surprise, Meta Platforms Inc (NASDAQ:FB) (formerly Facebook (NASDAQ:META)) was, without doubt, the biggest loser in the tech rout.

Earnings per share (EPS) of US$1.64 came below already dire expectations of US$1.90, while revenues fell 4% year on year.

Mark Zuckerberg’s metaverse gamble has come at an astronomical cost, both to himself and Meta’s shareholders.

Over at Microsoft Corporation (NASDAQ:NASDAQ:MSFT), net income fell 14% to $17.6bn and diluted EPS declined 13% to US$2.35, though this was still above consensus forecasts of US$2.30.

The software giant expects growth to continue slowing, though some analysts see this as a buying opportunity.

Google parent Alphabet (NASDAQ:GOOGL) Inc (NASDAQ:GOOG) missed top-line and bottom-line earnings expectations, citing a slowdown in YouTube advertising revenues, though the company’s impressive cash reserves put it on stable ground.

Earnings per share were US$1.06, compared to Wall Street expectations of US$1.25.

There were some bright spots though.

Apple Inc (NASDAQ:NASDAQ:AAPL) managed to beat earnings expectations, with earnings per share coming to US$1.29 against a US$1.27 forecast.

That was despite a lukewarm response to the iPhone 14 launch.

Additionally, Netflix Inc (NASDAQ:NASDAQ:NFLX) had a smashing third-quarter earnings call last week, topping both earnings expectations and subscriber numbers (though Netflix’s position as a tech stock is a matter of debate).

Stock market response

So a mixed-to-disappointing bag all in all. Here are the straight share price results, both daily and over five days:

- Meta Platforms Inc (NASDAQ:FB): -25%/22.41%

- Alphabet Inc (NASDAQ:GOOG): -2.85%/-5.74%

- Microsoft Corporation (NASDAQ:MSFT): -1.98%/-3.41%

- Netflix Inc (NASDAQ:NFLX): -0.56%/+10.39%

- Apple Inc (NASDAQ:AAPL): -3.05%/+1.25%

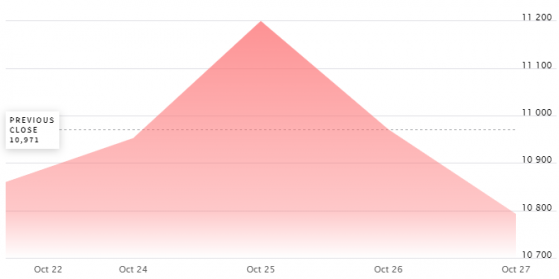

Unfortunately for the tech-heavy Nasdaq composite, this flurry of poor results stopped an early-week recovery dead in its tracks.

After reaching a three-week high on Tuesday, the index dropped over 1.5% come Friday as tech headwinds took a bite.

Nasdaq rallies and recedes of sobmre big-tech earnings – Source: nasdaq.com

Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown (LON:HRGV), said: “Disappointing results from Amazon and Apple have piled further pressure on the tech-laden Nasdaq composite, which shed 178 points in the last trading session.

“The wider concerns from (Thursday’s) results point to a weakening economy, which although we’ve been warned about, still has the ability to spook the market when we see the tangible effects.”

The net result of this week’s tech earnings season? A US$800bn market rout, reckons The Financial Times.

That stings no matter which way you slice it.

Read more on Proactive Investors AU