By Suzanne McGee

(Reuters) - GMO LLC, the asset management firm co-founded by veteran investor Jeremy Grantham, will launch its first exchange-traded fund (ETF) on Wednesday.

The firm said it is rolling out the GMO U.S. Quality ETF seeking to tap into two big trends of 2023: intense investor interest in actively managed ETFs and in so-called high-quality stocks - or companies with high and stable profitability and strong balance sheets. Holdings in GMO's quality stock-focused mutual funds include companies like Microsoft (NASDAQ:MSFT), Johnson & Johnson (NYSE:JNJ) and Apple (NASDAQ:AAPL).

About 22% of all inflows into ETFs this year have been to active ETFs, which represent only 7% of total ETF assets, according to Todd Sohn, an ETF analyst at Strategas. ETFs focused on quality stocks have seen assets grow even more rapidly. CFRA Research noted that $10.8 billion in new assets has flowed into the iShares MSCI US Quality Factor ETF this year alone, helping to propel total assets to $33.6 billion.

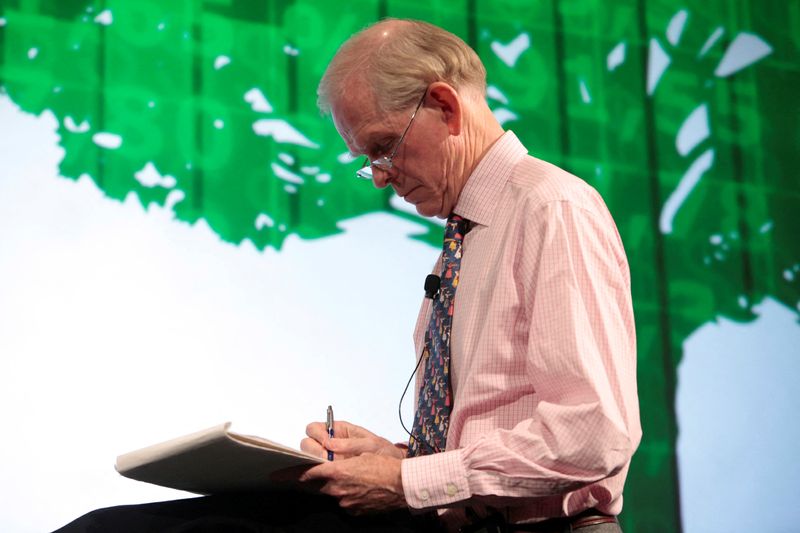

The fund will be managed by Tom Hancock, who has been running a $7.9 billion mutual fund with a similar focus, the GMO Quality III, since 2009. The biggest difference between the two will be the fact that the ETF will invest only in U.S. stocks.

The new ETF's fees will be 50 basis points, the same as GMO charges for the mutual fund.

The GMO launch is the second steered to market by the Goldman Sachs (NYSE:GS) ETF Accelerator, which offers asset managers consulting advice on each stage of the launch process.

GMO plans to roll out more ETFs in the months to come, Hancock said. The firm is evaluating its existing lineup of investment strategies to decide which might be most suitable.