Asara Resources Ltd (ASX:AS1, OTC:GMRMF) has welcomed a new cornerstone investor, following a $1.4 million Placement.

The company has signed a binding Subscription Agreement with Barbet L.L.C FZ to raise US$950,000 (A$1.417 million), which will help it advance its flagship asset, the Kada Gold Project in Guinea.

The Placement complements AS1’s goal of focusing on Kada, while divesting non-core assets. Just yesterday, Asara updated the market on the sale of its Kouri Gold Project in Burkina Faso to private gold exploration company BIC West Africa Ltd in a transaction worth A$3.25 million.

Both the Placement and sale of its non core assets will enable Asara to continue exploration and resource definition work, as well as ongoing metallurgical studies at Kada. The funds from the Placement will be used to support initial baseline studies, exploration activities, and general working capital requirements.

Debt free and Kad focused

“We are delighted to welcome Barbet LLC FZ as a new cornerstone investor in the company. Following the recent sale of the company’s Kouri Gold Project in Burkina Faso, we are now debt-free and refocusing our efforts on advancing our flagship project - Kada in Guinea,” Asara managing director Tim Strong said.

“Kada’s current Mineral Resource Estimate contains almost one million ounces of gold, and we look forward to growing this inventory through a systemic exploration program over the next 18 months.

“Barbet LLC FZ consists of a team of seasoned experts with a proven track record of developing projects in West Africa, including Guinea. We are eager to collaborate with them and leverage their extensive knowledge and understanding of Guinea to advance the Kada project and unlock its full potential.

“It is expected that exploration will commence during the December quarter of 2024 after the conclusion of the rainy season in Guinea. I look forward to updating the market as we advance this exciting project over the next few months.”

About the Placement

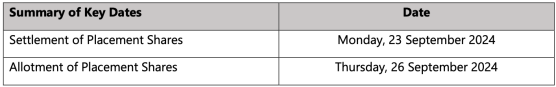

The placement consists will see Asara issue 118,090,890 fully paid ordinary shares at an issue price of $0.012 per share, raising US$950,000 (A$1,417,090.68) before costs. The issue price represents a 10% premium to the 10-day volume-weighted average price (VWAP) of $0.0109 per share.

Barbet has the right to appoint a nominee to the company’s board of directors as long as they hold at least 10% of the company’s issued shares. However, Barbet has indicated that they do not intend to appoint a nominee at this time.

Read more on Proactive Investors AU