Investing.com - Apple Inc (NASDAQ:AAPL) is set to release its third-quarter earnings report on Thursday, August 2 at 6:30 AM AEST, after the US markets close. Investors are keenly watching this report, focusing on Apple's financial forecasts, share repurchases, and its strategy in the Chinese market.

In the last quarter, Apple’s board authorized $110 billion in share repurchases, marking a 22% increase from the $90 billion approved last year. Additionally, the company announced a 25-cent dividend per share, resulting in a 7% rise in its share price during after-hours trading.

⚠️Stay ahead of the curve this earnings season with InvestingPro! Our Mid-Year Sale is now on, use coupon code INVPRODEAL and save over 50%!⚠️

Significant financial metrics from the last quarter included a nearly 10% decrease in iPhone revenue to $45.96 billion, slightly missing the $46.00 billion estimate. Mac revenue rose by 4% to $7.5 billion, surpassing the expected $6.86 billion. iPad revenue came in at $5.6 billion versus the anticipated $5.91 billion, with no new iPad releases since 2022. Services revenue increased 14.2% to $23.9 billion, exceeding the expected $23.37 billion, driven by subscriptions like iCloud Storage, the App Store, and Apple Music.

However, wearables revenue fell over 10% to $7.9 billion, covering products like AirPods and Apple Watches.

Sales in Greater China, Apple’s third-largest market, declined by 8% to $16.37 billion but exceeded analysts’ expectations of $15.25 billion. This alleviated some concerns about the iPhone losing market share to local competitors such as Huawei.

Apple did not provide formal guidance for Q3, but CEO Tim Cook hinted at overall sales growth in the "low single digits" during the June quarter. For Q3 2024, revenue is projected to be $84.3 billion, with earnings per share (EPS) forecast at $1.34 compared to an estimated $1.53. In comparison to Q2 2024, revenue was reported at $90.75 billion with an EPS of $1.53.

Key metrics to watch in the upcoming report include iPhone performance, especially amid ongoing challenges in China, with expected sales to drop to $37.7 billion from $45.96 billion in Q2. Mac sales are anticipated to outperform the broader PC market with a 20.8% year-over-year increase.

Services growth is expected to continue strongly, driven by increased App Store sales and subscriptions. Gross margins are likely to rise due to a favorable sales mix of premium products and higher service sales.

⚠️ Use InvestingPro to track your favourite companies this earnings season! Our Mid-Year Sale is now on, use coupon code INVPRODEAL and save over 50%!⚠️

Investors will also be keen on updates regarding Apple’s generative AI software, Apple Intelligence, which could prompt a significant device upgrade cycle. Performance in the China market will be closely monitored, and insights into the guidance for Q4, especially around new technologies like Apple Intelligence, will be of particular interest.

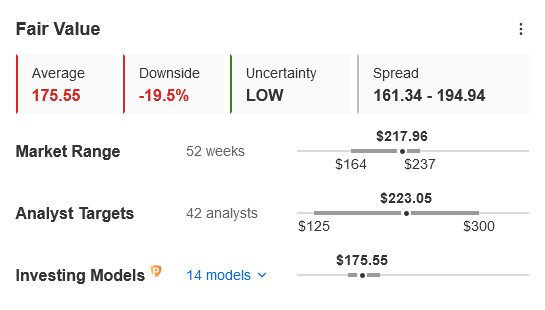

Apple's share price had a 60% gain from its early January 2023 low of $124.17 to a high of $199.62 in December 2023. Subsequently, the price consolidated within a range between $200 and $165.00 over the next five months.