Anson Resources Ltd (ASX:ASN, OTCQB:ANSNF) has fielded results it describes as "exceptional" from recent drilling at the Ajana Base and Precious Metals Project in Western Australia's Mid-West.

The exploration efforts focused on uncovering high-grade zinc, lead and silver mineralisation, and they yielded positive results.

Revitalising overlooked region

The Ajana Project's significance lies in revitalising base metal discoveries in a historically overlooked region, presenting substantial potential for regional-scale mineralisation.

Mineralised values reached up to 29.5% zinc, 28.8% lead and 43 g/t silver, with drilling concentrated on shallow, high-grade zinc, lead and silver zones.

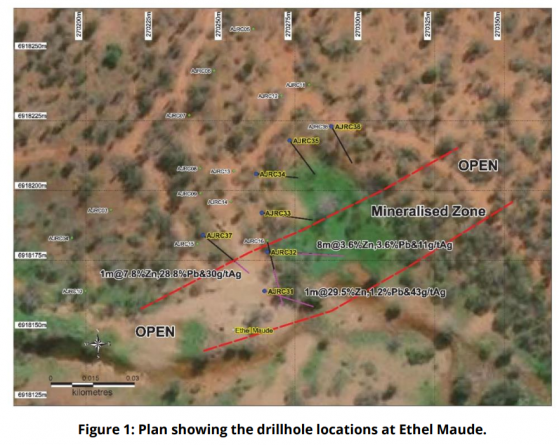

The drilling aimed to define maiden mineral resources at the Ajana Project and yielded strong results, particularly at the Ethel Maude and Surprise prospects.

Highlights

Notable results include:

- 7 metres at 10.9% zinc, 1.5% lead and 20.2 g/t silver from 0 metres, including 2 metres at 21.5% zinc, 3.3% lead and 39 g/t silver, and 1 metre at 29.5% zinc, 1.2% lead and 43 g/t silver;

- 36 metres at 2.2% zinc, 2.1% lead and 6.8 g/t silver from 18 metres to the end-of-hole, including 8 metres at 3.6% zinc, 3.4% lead and 11.0 g/t silver; and

- 2 metres at 4.5% zinc, 14.6% lead and 18.5 g/t silver from 30 metres, including 1 metre at 7.8% zinc, 28.8% lead and 30 g/t silver.

Re-assaying of high-grade zinc mineralisation is planned to evaluate critical minerals such as gallium, indium and germanium.

The successful drilling outcomes at Ethel Maude extend the mineralised zone beneath historical workings, reinforcing the company’s belief in the project's geological richness.

The Surprise, Surprise South and Galena prospects, situated on a sinistral tear fault, demonstrated promising ore shoots, particularly in lead-zinc-silver mineralisation.

Anson's exploration strategy, guided by geophysical surveys and historical data interpretation, has proven effective in identifying high-grade zones.

This success has led to plans for further drilling to delineate JORC resource estimates and refine exploration targets.

Future steps

The company will submit 1-metre samples for assay of anomalous mineralised zones detected in 3-metre composites.

The aim is then to define a maiden JORC-compliant mineral resource estimate for zinc, lead and silver at these two prospects.

After this, the company will refine and upgrade exploration target models and geological knowledge throughout the Ajana Project.

It will then complete reverse circulation (RC) drilling at the Two Boys, Surprise South and Block 1 prospects to define the extent of base metal mineralisation across the wider project area.

Read more on Proactive Investors AU