Technology stocks took a battering in 2022 as rising inflation and interest rates took the sector by the scruff of the neck and shook it lifeless.

This year, tech has been one of the star performers, second only to Materials in the gains it has made, and the upward trend continued through the June quarter.

The S&P ASX 200 Information Technology index rose 3.52% in June and was up an impressive 30.9% YTD at the end of the quarter.

A similar trend has played out on Wall St, where the Nasdaq composite index had its best first half since 1983. The Nasdaq rose 6.6% in June and has surged 31.7% for the six months of CY23.

Tech stocks and the blue-chip S&P 500 index have been buoyed by breakthroughs in generative AI – led by the ChatGPT chatbot.

In this article:

- AI driving the tech recovery?

- In the spotlight: ASX tech stocks

AI driving the tech recovery?

Artificial Intelligence is certainly having an impact on the markets.

The rise of AI put Taiwan Semiconductor Manufacturing Company (TSMC) and Nvidia into the spotlight during the quarter.

Just recently, TSMC said it would invest close to $90 billion New Taiwan dollars (about A$4.28 billion) in an advanced chip packaging plant in Taiwan. The move offsets issues in the US, which provided for a downcast quarterly.

TSMC has generally set the benchmark for the development of the world’s most advanced processors. It produces chips for the latest Apple (NASDAQ:AAPL) products and this week came out to spruik the growing demand for AI chips.

“For AI, right now, we see a very strong demand. For the front-end part, we don’t have any problem to support,” said TSMC’s CEO C. C. Wei during the firm’s second-quarter earnings report last week.

“We are increasing our capacity as quickly as possible and we expect that these tightenings will be released next year, but in between, we’re still working closely with our customers to support their growth,” Wei said.

TSMC’s shares have risen 5.16% in the past six months. However, its latest quarterly could suggest a dip is coming in the next reporting period.

The company recently took its biggest fall in five months after it cut its outlook and postponed production at its Arizona project to 2025.

The dip suggests there is still a post-COVID-19 slump to navigate, despite the surge in demand for high-end chips for AI development.

“This is the third cut to its revenue outlook that TSMC has made this cycle,” Needham analysts wrote in a research note. That “may disappoint some bulls, but we see the lack of inventory rebuild through year-end will set up the company for strong growth in 2024″.

AI isn’t going anywhere and will continue to evolve. While we could see a correction for the sector, it is likely that it may only be a minor one.

US-based chip giants Nvidia and AMD are two of TSMC’s largest clients.

Nvidia’s high bandwidth memory chips (supplied by TSMC) support its latest A100 graphics processing units that train OpenAI’s chatbot ChatGPT.

Nvidia has become a trillion-dollar company and is now the poster boy for the tech revival.

Dan Ives, managing director at US financial company Wedbush Securities, said big tech was now the “torchbearer” for the stock boom around AI. He believes spending around AI will reach as much as $800 billion in the next decade.

“Heading into the second half of 2023, we see a much broader tech rally ahead as investors further digest the ramifications of this $800 billion AI spending wave on the horizon and what this means for the software, chip, hardware and tech ecosystem over the next year,” Ives said.

“We view this as a ‘1995 internet moment’... not a ‘1999 dot bubble moment’. We estimate for 2024 that AI could comprise up to 8% to 10% of overall IT budgets v [approximately] 1% in 2023,” he said.

Investors should still take a cautious approach. AI is a narrow barrow to push and retail sales continue to fall as inflation turns back. However, demand will continue to spike.

In the spotlight: ASX tech stocks

There was positive movement among ASX-listed tech stocks as well this quarter. Let’s take a look.

archTIS

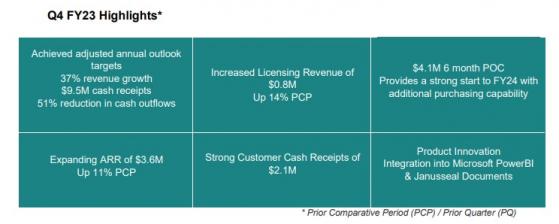

archTIS Ltd had a positive quarter with reduced cash burn and solid revenue growth,

The Australian Department of Defence continues to invest in the expansion and enhancement of its Kojensi and NC Protect products. It has also had several international customer wins which resulted in $3.6 million ARR, an increase of 11% from the PCP with net customer churn under 1% per quarter.

AR9 enjoyed revenue growth of 30%-40% from the prior year, with actual revenue growth achieved for the year clocking in at $6.4 million a 37% increase from the PCP.

The company reduced its cash burn by 50% from the prior year and achieved average cash outflow across the four quarters of $5.2 million compared to $10.6 million the prior year, a decrease of 51%. Cash receipts were $9.5 million for the year with $3.7 million of accounts receivable received subsequent to the close of the quarter.

Managing director and CEO Daniel Lai said, “archTIS Q4 results demonstrated momentum in delivering on our strategy to be the preferred provider of policy-enforced Data-Centric Security (DCS) products to Defence and Defence industry.

“The pleasing aspect of the quarter has been that our Defence services engagements have created new opportunities for expanding the usage of our data-centric security products, as demonstrated by the recent $4.06 million Defence proof of concept deal.

"This contract provides a foundation for improving annual recurring revenue, cross-sell opportunity and gross margins in FY24.

"Additionally, the overseas NC Encrypt wins solve encryption and data sovereignty issues for both DHL and the Bank of Finland which demonstrates the appeal of our products in multiple vertical markets and validates our product acquisition investments.

"Most importantly, it has allowed archTIS to deliver on our stated FY23 market guidance and reduce our cash burn as we drive to become cash flow positive. Solid performance by the entire team sets archTIS up for growth in FY24.”

RemSense

RemSense Technologies Ltd (ASX:REM) continued its Virtualplant roll out during the quarter.

RemSense has developed virtualplant, a photographic asset visualisation platform that fulfils the promise of VR/AI technology as a digital representation of plant assets (digital twin) that integrates with existing business operations and asset management systems to deliver greater productivity, increased safety, and reduced cost.

Highlights of its quarter included:

- Operational cashflow near break even.

- Increased customer receipts.

- Software development expenses reduced with client-funded developments.

- Expanding virtualplant footprint

- Successfully delivered virtualplant scanning data to Chevron (NYSE:CVX) for its first of four contracted LNG facilities.

- Continued working with Programmed to deliver integration into IBM (NYSE:IBM) Maximo.

- Completed additional site trials with Newmont incorporating additional scanning features and virtualplant integration.

- Delivered new work pack generation tool within virtualplant for Woodside corrosion maintenance repair planning.

- Successfully completed third party cyber security penetration testing of new v3 virtualplant release.

- Continued to work with Peak Asset Management to finalise placement to fund nonorganic growth.

Spenda

Spenda Ltd (ASX:SPX) announced another quarter of growth, marking a significant milestone of 14 consecutive quarters of sustained growth. The company said the achievement showcased Spenda’s ability to deliver sustainable growth through a commitment to innovation and a strong client focus.

Leading indicators continued to perform strongly:

- Loan facilities: 68% growth in loan facility since inception with lending services peaking at $13.4 million in the quarter.

- Lending average yield: the company maintained an overall average portfolio yield 21.06% for the financial year ending June 30, 2023.

- Payment flows: 100% increase in payments volume from the prior quarter (from $22.5 million for FY23 Q3 to $44.9 million for FY23 Q4).

- Average transaction values climbed by 140%, whilst the volume of payments transactions processed decreased by 17% as customers began utilising batch payment services via Spenda Accounts Payable and PayStatement-By-Link Following quarter end, this strong growth enabled the company to achieve a key milestone, processing its first $100 million in payments.

- Customer growth: 8% increase from prior quarter, this upward trend is expected to continue into the future.

- Cash receipts from customers for the current quarter equated to $1.2 million a ~50% growth from the prior quarter and a 75% growth compared to Q4 FY22.

- Closing cash and cash equivalents was $8.3 million as of June 30, 2023.

- Net cash position of $7.7 million as of June 30, 2023.

- The company signed an extension to their existing relationship with the Capricorn Society into eCommerce through the delivery of a Digital Service Delivery (DSD) initiative.

- Private placement announced in the quarter, raising $3.9 million (before costs) from institutional and sophisticated investors and the Company’s Board and management.

Subsequent to the quarter’s end, the company announced the completion of the rollout of Spenda Services to the Carpet Court network and the signing of a five-year exclusive agreement to offer lending services.

ClearVue Technologies

ClearVue Technologies Ltd (ASX:CPV, OTCQB:CVUEF) was busy during the quarter, with a significant acquisition that boosted its offering.

CPV signed an asset purchase agreement with Netherlands-based Lusoco B.V. to acquire its intellectual property and associated assets.

Lusoco's technology has multiple applications including building and glazing façades (for advertising, artwork and directional messaging); public infrastructure (such as bus shelters, road barriers, as well as public art and advertising); automotive (glass and plastics); autonomous self-powered street signs and other directional signage; self-powered safety, security and exit signs; and a range of other signage types.

The smart building materials company also launched improved IGU and new solar façade solutions and secured a $2 million grant to locally manufacture its core technology.

This quarter, the company delivered on several of its previously announced plans, including:

- completing key changes to its board of directors and the appointment of a new global CEO in Martin Deil – a globally recognised leader from the façade industry; and

- most significantly, completing work on, and launching in London, an improved Generation 2 product design for its ClearVue PV® solar vision glass integrated glazing unit or IGU and a new integrated Solar Façade Solution to offer a comprehensive solution for the entire building envelope.

SensOre

SensOre Ltd (ASX:S3N) continued with its aim to become the top-performing global minerals technology company through the deployment of big data, artificial intelligence (AI)/machine learning technologies and geoscience expertise.

CEO Richard Taylor said of the company’s quarterly performance: “The team at SensOre is extremely encouraged by the performance of the group across all business segments this quarter and financial year.

"Operationally we reported another record quarter for invoices, an increase of 67% versus the prior quarter. TCV increased 25% compared to Q3 FY2023. Importantly for a high growth company, we achieved positive operating cashflow this reporting period.

“We continued to see strong demand from existing and new clients for our technology, with sales of key geochemistry and geophysics tools accelerating in the June quarter.

"Our lithium targeting with Deutsche Rohstoff is ramping up and we expect this to be a key focus area next year.

"Post the capital raise in the June quarter we are poised for another transformative year of growth across Technology Products, Services and Exploration.”

The company had a cash balance at June 30, 2023, of $1.88 million.

Total revenue and grants increased 80% year-on-year to $7.02 million (based on invoices for financial year 2023) when compared to combined SensOre-Intrepid 2022 performance of $3.89 million.

Total Contract Value (TCV) increased to $3.13 million up from $2.50 million in Q3 with several long-term software contracts being renewed, while significant milestones were achieved in software and services including:

- commercial sales of new products Cauchy Downward Continuation (CDC), Simclust and AGLADS;

- significant inbound interest coincident with positive global developments in Artificial Intelligence; advances in utilising natural language processing on continental-scale geological meta data.

Sprintex

Sprintex Ltd (ASX:SIX) completed manufacture and testing, and commenced delivery of the initial A$270,000 ecompressor order for the European €14 million sHyPs hydrogen-powered cruise liner decarbonisation program this quarter.

The program is expected to bring revenue to Sprintex of approximately $1.5 million for a six-ship trial. The program is funded by the EU government and includes the re-powering of six cruise liners, each with 16 modular hydrogen fuel cell power units of approximately 6mW each for a total of 96mW per ship.

This quarter, the company reported that cash receipts from sales increased 362% compared to the prior year and the cash outflow from operating activities improved 43%.

SPX also achieved 27-40% energy saving in efficiency testing on its G15 Turbo Blower.

The company is now set to start production on its range of e-compressors and industrial blowers, with initial production levels of more the 15,000 units per year which are expected to boost annual revenues.

Directors of the company are incentivised to achieve more than $20 million in revenue for the next 12 months.

Way2 VAT

Way2VAT Ltd (ASX:W2V) achieved record quarterly revenue, transaction volume and cash receipts in the June quarter.

“The quarter saw significant increases to record levels of transaction volume, revenue and cash receipts as business activity returns to more normal levels across our entire client base. This increasing business activity off our growing client base is expediting our pathway to profitability,” founder & CEO Amos Simantov said.

“In a sign of the growth our accounts receivable remains a healthy $2.6 million. These are predominantly fees due to be received upon payment of client VAT claims by government taxation authorities for foreign VAT. This also includes fees to be received from clients directly for domestic VAT work finalised during the quarter.

“We’ve signed major enterprise clients this quarter, including in the pharmaceutical, chemical, funds management and home security sectors which have expanded our ability to tap into the world’s biggest and most prestigious markets. As with many of our clients with international operations, these companies are looking to manage expenses more efficiently for staff.”

Highlights include:

- Transaction volume of $9.7 million, up 72% on previous corresponding period (pcp) ($5.6 million in Q2 FY22).

- Revenue of $961,000, up 75% on pcp ($548,000 in Q2 FY22).

- Cash receipts of $683,000 up 252% on pcp ($194,000 in Q2 FY22).

- Accounts receivable on client VAT claims already submitted to tax authorities remains a healthy $2.6 million.

- New patent by US patent office granted for unique Image-2-Line solution fully automating VAT reclaim submissions based on W2V’s proprietary AI technology.

- New large enterprise clients in Spain, UK and Israel to significantly boost transaction volume and future revenue after onboarding in Q3 FY23.

- Evyatar Cohen was appointed as the new chief financial officer.

Read more on Proactive Investors AU