* Mining, energy shares up 2-3 pct in Europe

* Emerging markets at highest in almost two months

* Hopes for QE help investors shrug off weak data

* But BOJ's Kuroda holds off on fresh stimulus

By Lionel Laurent

LONDON, Oct 7 (Reuters) - A recovery in oil prices spread to stock markets and emerging market currencies on Wednesday, with the prospect of more support from the world's central banks offsetting more disappointing economic data.

After a dismal summer, which saw the worst quarter for global equities since 2011, traders say fund managers are ready to pile back in, hoping the recent market reversal was a hiccup rather than the end of a six-year bull market.

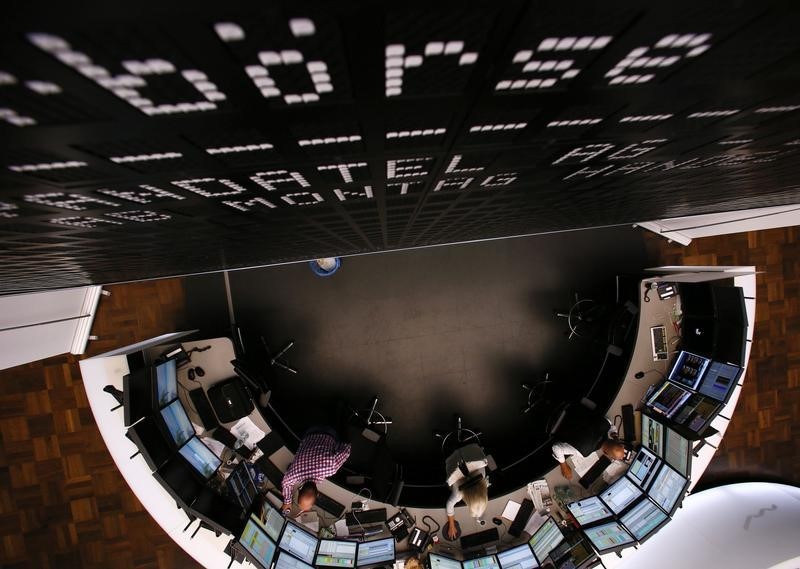

Mining and energy shares were the big winners in Europe, up 2 to 4 percent. Emerging-market stocks .MSCIEF also rose 2 percent, to their highest level since mid-August, although tourism and airlines stocks lost ground, on the prospect of a squeeze on profits from higher input costs.

Asian shares reached a seven-week high. South Korea's Samsung Electronics (KS:005930) 005930.SS improved sentiment when it issued a better-than-expected profit guidance.

All that left global equities set for their sixth straight day of gains.

The heart of the rally was a jump of more than $1 for U.S. crude oil CLc1 to $49.64 per barrel. However, the gain was largely driven by evidence of tighter supply and dwindling inventories after two years of heavy surplus and a collapse in commodity prices.

In fact, there was little reason for more optimism on the underlying economy on Wednesday. Data showed German industrial output fell in August at its fastest pace in a year and growth in Spanish output slowed. British retails prices dropped more in September than they had in August, according to the British Retail Consortium.

Although the Bank of Japan held off on expanding monetary stimulus on Wednesday, expectations of more support rather than less is growing, as worries mount over a global economic slowdown. This week, the International Monetary Fund cut its forecast for growth again.

"The sense is that interest rates are not going to rise in the foreseeable future," said Deutsche Bank (XETRA:DBKGn) Managing Director Nick Lawson, adding that after a rough September investors were ready to put more firepower into rebound bets.

"The market is proving its addiction to QE (quantitative easing)."

Investors have scaled back expectations the Federal Reserve will raise interest rates this year after surprisingly weak U.S. jobs data on Friday. Worries over the American economy grew after the largest expansion of the U.S. trade deficit in five months.

Beaten-up emerging markets, meanwhile, got a lift to their currencies amid the rally. The Indonesian rupiah surged 2.3 percent on Wednesday, taking its gains so far this week to over five percent. The Malaysian ringgit also jumped 2.4 percent.

The New Zealand dollar NZD=D4 popped to a seven-week high on a solid rise in dairy prices. The Australian dollar hit a two-week high AUD= of $0.7188 while the Canadian dollar firmed to C$1.3026, nearing its September peak of C$1.3013.

The euro traded at $1.1267 EUR=, near this week's high of $1.12895, before falling back to $1.1242. The dollar's index against six major currencies .DXY picked up slightly after falling to 95.327, its lowest level this week and near Friday's low of 95.218.