By Jesse Cohen

Investing.com - Stocks on Wall Street have mostly struggled this week, with the Dow Jones Industrial Average and the S&P 500 benchmarks both pulling back after their recent strong gains.

In a reality check to the stock market's recent euphoria, the Federal Reserve predicted the U.S. economy would shrink 6.5% in 2020 and unemployment would still be at 9.3% at year's end.

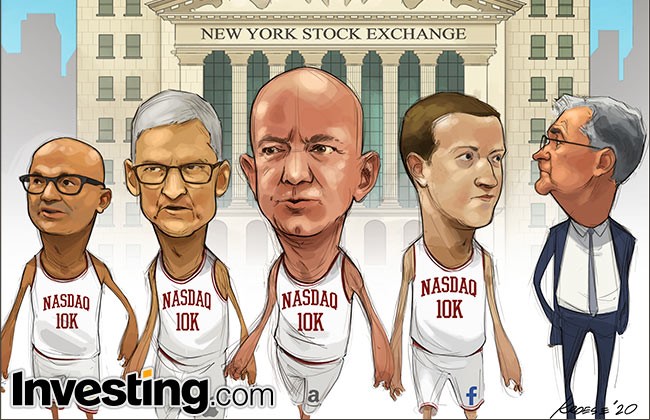

The Nasdaq Composite, however, managed to hold on to a good chunk of its rally after registering a closing record high above the 10,000-level for the first time in history on Wednesday.

Leading up to Thursday’s session, the tech-heavy index has reached new all-time highs each day this week, as investors bet on the sector’s strength amid the economic reopening.

The index has now rallied nearly 50% from an intraday low set on March 23, when coronavirus-related lockdowns shocked the stock market.

The Nasdaq's upbeat performance has come on the back of strong gains in many of the big-name tech-related shares, most notably Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), and Facebook (NASDAQ:FB).

All four companies have seen their shares hit all-time highs this week.

The combined market value of the four companies is now more than $5 trillion, with Apple claiming the top spot at nearly $1.53 trillion, followed by Microsoft at $1.49 trillion and Amazon at $1.32 trillion.

At $674 billion, Facebook is the only one of the group with a market cap below $1 trillion.

Google-parent Alphabet (NASDAQ:GOOGL) is the only one of the five largest tech stocks not to close at an all-time high. It’s still about 5% behind its all-time high of $1,524.87, where it closed on Feb. 19.

To see more of Investing.com’s weekly comics, visit: http://www.investing.com/analysis/comics

-- Reuters contributed to this report