(Bloomberg) -- Federal Reserve Chairman Jerome Powell’s softer tone on possible interest-rates hikes in 2019 will remove the biggest restriction on China cutting rates, according to a report by Citic Securities Co.

"Restrictions confining domestic monetary policy will be significantly eased as pressure from further U.S. rates hikes is reduced," according to a report from Ming Ming, head of fixed-income research at Citic Securities in Beijing and a former official at the People’s Bank of China. "Cuts in interest rates can be expected as real financing costs are on a rising path" and that will weigh on industrial investment, he said.

The PBOC will likely cut borrowing costs of loans to commercial banks via the medium-term lending facility and may even cut benchmark interest rates in early 2019, Ming wrote. The reductions may come early in the second quarter due to national holidays and the National People’s Congress in the first quarter, he said.

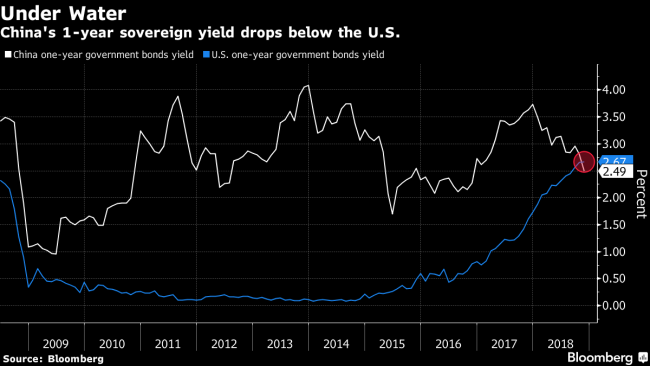

China’s monetary policy has diverged from the Federal Reserve’s tightening path this year, as the PBOC has eased to counter previous credit tightening and the slowing economy. The divergence has put pressure on yuan assets, pushing the yield on China’s one-year government bonds below the U.S.’s and helping make the currency one of the worst performers in Asia.

The PBOC raised the borrowing cost of one-year MLF loans three times in 2017 and once in 2018 to 3.3 percent, while keeping the 1-year benchmark lending rate unchanged at 4.35 percent since October 2015. A growing number of analysts are saying the PBOC could now cut rates, as financing conditions remain difficult for small and private firms and industrial profit growth has slowed.