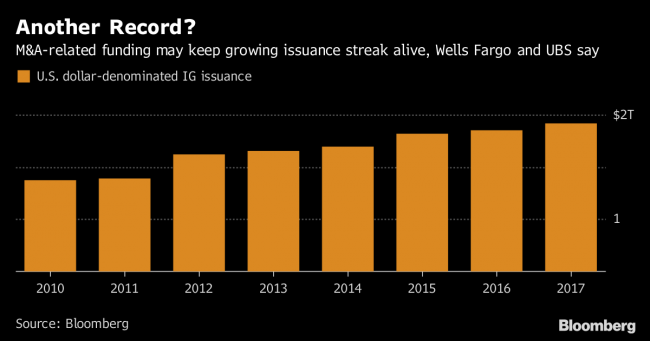

(Bloomberg) -- Get ready for what could be another record year for corporate borrowing.

The U.S. tax overhaul is freeing up cash for companies and the Federal Reserve is hiking rates, but chief financial officers are still eager to borrow, UBS strategists wrote this week. The Swiss bank and Wells Fargo both expect businesses to sell as much U.S. investment-grade and junk bond debt this year as they did in 2017, if not more, in part to fund an expected uptick in mergers and acquisitions.

If blue-chip corporate bond issuance sets another record, it would be the fifth year in a row that it reached a new high. The forecasts imply that the benefits from tax cuts are more likely to flow to shareholders than bond investors, and that for money managers, buying U.S. company debt may not be the sure thing that many previously thought.

“Companies are not going to pay down debt if investors aren’t worried about leverage,” UBS Group AG strategist Stephen Caprio said in an interview. “And investors aren’t worried about leverage.” Risk premiums for corporate bonds, or spreads, are tighter than can be justified by the tax overhaul, the strategists wrote.

So far investment-grade issuance is strong by historical standards. Companies sold $181.3 billion of the bonds from the start of the year through Thursday. That’s below 2017’s $238.5 billion, but above 2015 and 2016 levels, according to data compiled by Bloomberg. Net overall corporate debt levels, including non-financial investment-grade companies, high-yield borrowers and leveraged loans, have increased over the last several months, according to UBS strategists led by Caprio and Matthew Mish.

Recent jumps in longer-term bond yields may give companies more incentive to lock in rates while they’re still relatively low, said Tom Hauser, a high-yield portfolio manager at Guggenheim Investments.

“There’s definitely an incentive for companies to get borrowing done now, given where yields are,” Hauser said. Guggenheim manages more than $189 billion of fixed-income assets.

Wells Fargo & Co. strategists led by Trey Winslett forecast gross issuance to rise one percent from last year due to upcoming maturities and mergers and acquisitions related funding, they said in a Feb. 9 report. Such deals also bode well for supply of so-called reverse Yankee bonds -- euro-denominated debt issued by U.S. companies -- Wells Fargo (NYSE:WFC) strategists led by Nathaniel Rosenbaum said in a report Thursday.

‘Very Limited’

The tax overhaul passed late last year forces companies to pay a one-time tax on overseas earnings and other assets that were previously only taxable when brought back home. Now companies can repatriate their money whenever they like with no extra penalty, potentially reducing their incentive to borrow.

But there is “very limited” evidence that repatriation of offshore earnings at a reduced tax rate will spur companies to borrow less, the UBS strategists wrote. A law passed in 2004 gave American companies a tax holiday to repatriate offshore cash, and total investment-grade issuance rose that year and in 2005, the UBS analysts said.

The more than $3 trillion of overseas cash is concentrated on the balance sheet of a relatively small number of companies, albeit corporations that are some of the biggest borrowers, like Apple Inc (NASDAQ:AAPL). The equity market continues to give companies higher stock prices for loading up on debt, the UBS analysts wrote.

Deduction Limits

Other features of the tax overhaul could also have less of an impact than analysts had previously thought. Limits on interest-rate deductions for companies will only impact the most indebted borrowers. The companies most vulnerable to these limits are those rated CCC, which accounted for about 3 percent of junk-bond issuance since 2009, according to S&P Global Ratings.

Some investors and strategists still expect 2018 to be the year that would snap seven consecutive years of rising investment-grade bond sales. Anticipating that companies will use tax overhaul-related cash to pay down debt, Bank of America strategists led by Hans Mikkelsen see corporate investment-grade issuance dropping 16 percent this year.

“Most of the time equity investors want companies to use more debt, but not right now,” Mikkelsen said in an interview. A Bank of America survey released in February found that a record 24 percent of fund managers believe corporate balance sheets are overleveraged, higher than the figure at the peak of the financial crisis.

In the long run, companies may well cut their borrowings, said Matt Freund, co-chief investment officer at Calamos Investments. But the change will likely be gradual, happening over the course of years, not quarters, he said.

For now, as tax cuts improve cash flow, companies will likely use the money to directly help shareholders rather than bondholders, S&P analysts led by Diane Vazza wrote in a report in January.

In the corporate-bond market, "the impact in sum may prove muted," the analysts wrote.