- Gold’s stunning rise in 2024 has captured attention, but uncertainty looms as rate cut momentum slows.

- Geopolitical tensions and recession risks could fuel further gains, while hawkish Fed policies pose a threat.

- Technical patterns suggest a decisive move ahead, with $2,800 and $2,500 as critical levels to watch.

- Kick off the new year with a portfolio built for volatility - subscribe now during our New Year’s Sale and get up to 50% off on InvestingPro!

Gold had a remarkable 2024, posting 27.5% growth in valuation. This rally was fueled by a potent mix of central bank rate cuts in the U.S. and Eurozone, which have put downward pressure on the US dollar, amplifying gold’s allure.

Yet, the precious metal’s meteoric rise has also sparked concerns, with some experts predicting a sharp correction.

Adding to the intrigue, gold reached historic highs near $2,800 per ounce shortly after Donald Trump’s election. However, recent market movements suggest a shift in sentiment.

Investors are now bracing for a potential slowdown in rate cuts by the Fed, which could bolster the dollar and drive up bond yields. With banks issuing more cautious forecasts, the stage is set for a year of uncertainty.

Let’s unpack the forces driving gold’s trajectory—and the risks that could derail its momentum.

The Case for a Continued Bull Market in Gold

Several factors could keep gold shining:

- Safe Haven Demand Amid Geopolitical Tensions

Heightened geopolitical risks, such as aggressive U.S. trade policies or tariff wars, could push investors toward safe-haven assets like gold. Tariff-induced disruptions might even prompt the administration to soften its rhetoric, creating room for the Federal Reserve to extend rate cuts.

- Economic Slowdown or Recession Risks

A slowing economy—or worse, a recession—could leave the Fed with no choice but to accelerate monetary easing, further boosting gold’s appeal.

- ETF Inflows Signal Renewed Interest

According to the World Gold Council, December marked the first positive capital flow into gold ETFs since 2019, with net inflows of $778 million—a bullish sign for the metal.

The Bearish Counterarguments

On the flip side, a few scenarios could pressure gold prices:

- Hawkish Fed Policies

If the Federal Reserve remains committed to tighter monetary policies while inflation persists, gold could face headwinds.

- Selling Pressure from Russia

Economic or political instability in Russia could prompt the country to offload its gold reserves, increasing supply and weighing on prices.

- Easing Global Risks

A resolution to geopolitical conflicts, such as in Ukraine or the Middle East, might reduce risk aversion, prompting a shift away from safe-haven assets.

Inflation Data: A Key Catalyst

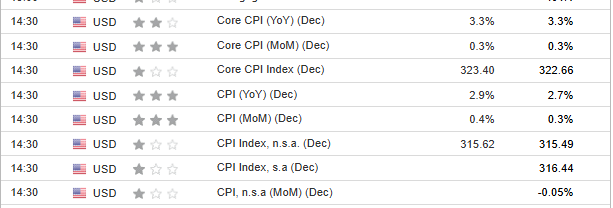

All eyes are now on today’s U.S. CPI release, forecasted to hit 2.9% year-over-year.

If today’s CPI data reinforces the Fed’s current stance, we could see a reduction in the number of rate cuts planned for this year.

The Federal Reserve has already hinted at halving the anticipated rate cuts compared to earlier expectations, which could weigh on gold.

Technical View

On the technical side, gold is currently forming a triangle consolidation pattern. These formations often precede significant price moves, and the breakout direction will likely determine the next trend.

- Upside Scenario: A breakout above $2,800 per ounce would signal strength, potentially paving the way for new all-time highs.

- Downside Scenario: A breakdown below $2,500 per ounce could trigger a deeper correction, with the support zone near $2,500 acting as the first target for sellers.

***

Curious how the world’s top investors are positioning their portfolios for the year ahead?

You can find that out using InvestingPro.

Don’t miss out on the New Year's offer—your final chance to secure InvestingPro at a 50% discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.