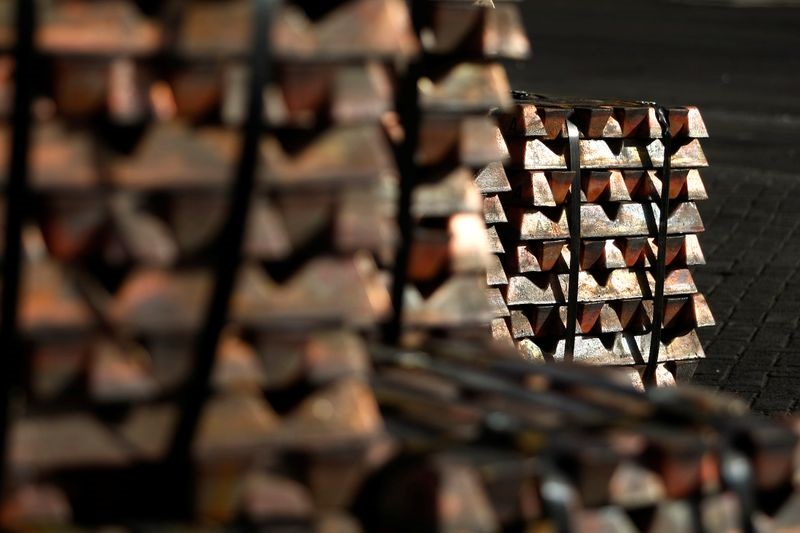

(Bloomberg) -- Copper powered to a seven-year high as the rush for growth played out in metals markets, with traditional haven gold dropping amid growing optimism for an end to the coronavirus pandemic.

Bullion extended losses below $1,800 an ounce and copper added to a four-week surge on bets the looming roll-out of Covid-19 vaccines will help drive an economic recovery. The moves deepen a wider pivot into risk assets in November, with global stocks heading for a record month.

“Robust price rallies in industrial commodities like copper point to an ongoing rotation from a risk-averse to risk-on asset market regime,” Citigroup Inc (NYSE:C). analysts including Aakash Doshi wrote in an emailed note. Gold faces a “more uncertain path in 2021” as global growth prospects improve, they said.

The latest boost for risk appetite came over the weekend, when two of America’s top health officials said a vaccine will be deployed across the U.S. before the end of the year. Elsewhere, an index of China’s manufacturing sector rose to a three-year high on Monday and the country is taking steps to boost domestic consumption, including of autos and home appliances.

“Macro factors are driving copper trading,” Chinese brokerage Jinrui Futures Co. wrote in note on Monday. “The market sentiment is really bullish right now amid a combination of vaccines, economic recovery, and a smooth U.S. presidential transition.”

- Copper rose as much as 2.6% to $7,692.50 a ton, the highest since March 2013. The metal traded at $7,634 by 9:55 a.m. London time and is heading for the biggest monthly gain since 2016.

- Iron ore also joined the rally, with Singapore futures up 1.3% and heading for a monthly gain of more than 11%. Prices briefly spiked more than 9% to touch $140 a ton, the highest since futures began trading in 2013, before swiftly paring gains.

- Gold fell 0.8% to $1,773.59 an ounce, on track for a fourth straight monthly loss. Silver dropped 1.8%.

Bullion is suffering as investors reverse this year’s hunt for havens amid deep economic ruptures and a fractious U.S. general election. But other factors that favor gold -- ultra-dovish monetary policy and the risk of steeper inflation -- remain in place.

”The current weakness of gold is all the more remarkable given that the U.S. dollar is likewise weak,” Carsten Fritsch, an analyst at Commerzbank (DE:CBKG) AG (OTC:CRZBY), said in an emailed note. “After the price fell below the support level at $1,800 on Friday, the technical picture became even more gloomy, which no doubt has prompted further short-term-oriented investors to withdraw.”

©2020 Bloomberg L.P.