Global bond yields are falling like rocks, many investors are paying governments to hold their money, and odds are increasing for more monetary accommodation from the major economies in the likes of the United Kingdom, the eurozone, and Japan.

In the U.S., expectations for a rate cut have essentially been moved off the table. So, under these conditions, it is not too surprising that Australia can continue to attract significant investor interest. Australia’s 10-year bond yields 1.88% (compare to the record low 1.36% for the U.S. 10-year at the time of writing; Germany’s recently went negative for the first time ever).

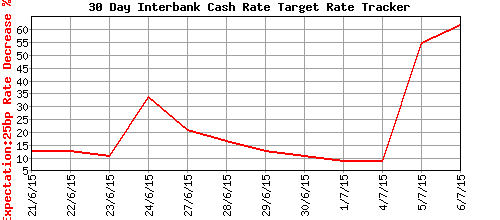

The Reserve Bank of Australia is sitting on a 1.75% cash rate. In a sign of the times, the Australian dollar (Guggenheim CurrencyShares Australian Dollar (NYSE:FXA)) continued its recent bout of relative strength even as the odds for a rate cut suddenly soared from 9% to 55% (and now 62%) in the wake of the RBA’s July statement on monetary policy.

The market prices in much higher odds of an RBA rate cut in August

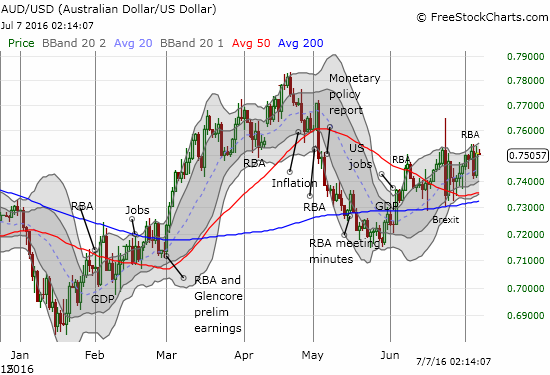

The increasing preference for the Australian dollar is seen across most major currencies. Against the U.S. dollar, AUD/USD looks like it is on the edge of a major breakout that could send it to a retest of the 2016 high set in April – much to the chagrin of the RBA no doubt! Such a move would make the Aussie a major buy.

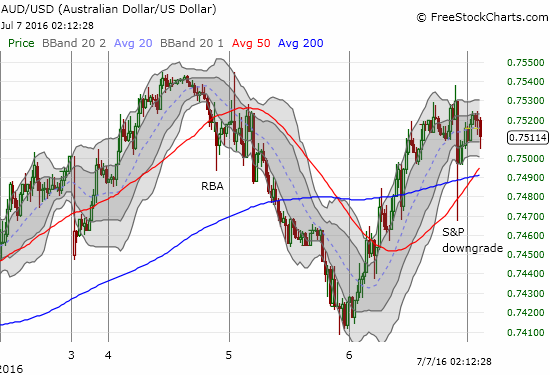

The initial reaction to the RBA was a quick drop that was reversed almost as quickly…only to find sellers regaining control for the next trading day.

Since the May low, the Australian dollar has remained resilient against the U.S. dollar through numerous catalysts.

The mixed reaction was understandable. On the one hand, the RBA was relatively sanguine about the Australian economy. For example:

“In Australia, recent data suggest overall growth is continuing, despite a very large decline in business investment. Other areas of domestic demand, as well as exports, have been expanding at a pace at or above trend. Labour market indicators have been more mixed of late, but are consistent with a modest pace of expansion in employment in the near term.”

On the other hand, the RBA noted again that inflation is running too low:

“Inflation has been quite low. Given very subdued growth in labour costs and very low cost pressures elsewhere in the world, this is expected to remain the case for some time.”

In the final conclusion, the RBA decided to leave rates at 1.75% and did not hint at whether it is preparing to cut rates again anytime soon. Note well that just ahead of the Brexit vote results, the Australian dollar almost recovered all its losses from the RBA’s rate cut on May 3rd.

I am guessing the inability of the last rate cut to effect a sustained weakness in the currency is not lost on the RBA. Note that the threat of a downgrade from Standard & Poor’s caused a brief disturbance but was essentially a net non-event.

My continued favorite way to play the Australian dollar on the long side is against the British pound. Outside of some brief relief rallies, the prevailing trend for GBP/AUD has been definitively down since September of last year.

The Australian dollar, like many currencies, has absolutely dominated the British pound for almost a year now.

Before Brexit, I was merely riding the prevailing trend. Post-Brexit, GBP/AUD is also serving as a partial hedge to my bullish positioning in the British pound using Guggenheim CurrencyShares British Pound Sterling (NYSE:FXB), GBP/USD, and EUR/GBP to find opportunity in the post-Brexit crisis of confidence.

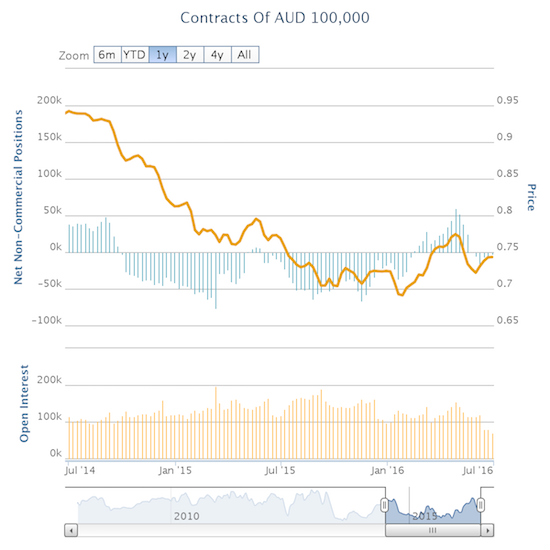

Perhaps most importantly, the resilience of the Australian dollar continues to suggest that the market is not quite as risk averse as seems to be the case with the prevailing theme of flight to safety. Indeed, in the wake of Brexit, speculators further reduced net shorts instead of ramping them against the Australian dollar.

Speculators have been MUCH more bearish on the Australian dollar for most of the past two years.

Be careful out there!

Full disclosure: short AUD/JPY, short GBP/AUD