Inside Monday’s Daily Market Update, we featured EUR/GBP as our Chart of the Day. As we’ve progressed further into the week, price action has thrown a spanner into the works which we’ll go through below.

Price has been trading inside a large weekly channel dating back to 2008. However, over the last few months, price has started to bottom out, seeing a short term 400 pip range form between 0.7388 and 0.6988.

This range has been significant for the force that price has been rejected with, as well as the fact that price has been unable to print a higher high after each attempt.

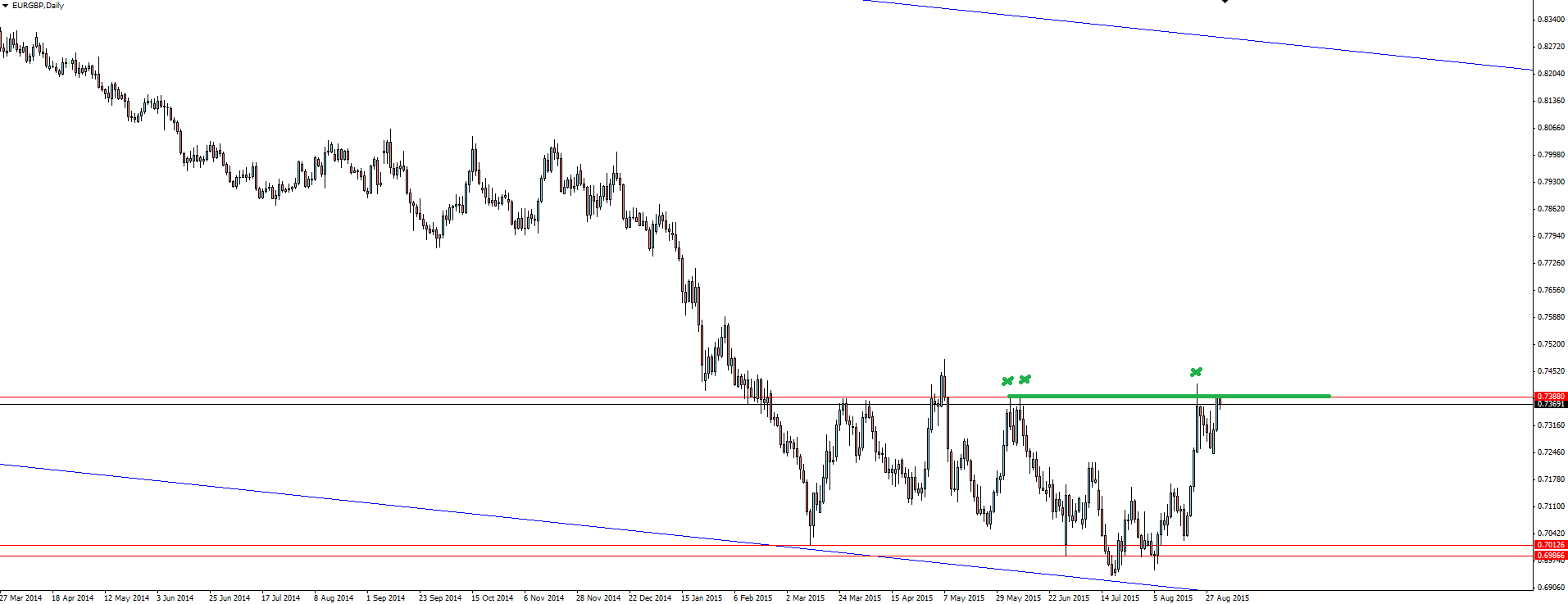

EUR/GBP Daily:

Zooming into the daily chart, we have marked the clean highs that price spiked through to clear out any lingering stops before being unceremoniously slapped back down to give us the weekly close we have marked on the previous chart.

Last week’s gravestone doji (well, as close as you’re going to get in reality on a weekly chart) is one to keep an eye on as it has formed right on the top of this daily range. But with 3 days yet to go in the current weekly candle, price has already shot back up to test its high.

That’s not what the textbook says!

In trading this setup, I see the path of least resistance still being to play EUR/GBP from the short side. You will be following the overall trend and price is still at the top of the short term range. Keep an eye out for bearish price action to end the week, possibly printing another long wick at resistance to confirm control for the bears.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd, does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. The research contained in this report should not be construed as a solicitation to trade. All opinions, news, research, analyses, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on the service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance