By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

Thanks to Janet Yellen the U.S. dollar moved higher against all of the major currencies Wednesday. Both the head of the Federal Reserve and 2015 Fed voter Dudley said interest rates could increase in December if data supports the move. While the last qualifying statement indicates that strong labor-market numbers are a necessary prerequisite to a rate hike, Yellen’s comment that the “FOMC thought it could be appropriate to move in December” is a sign that U.S. policymakers are eager for lift off to begin. Yellen expressed confidence in the economy, talked about how labor slack diminished significantly even though job gains slowed and pointed to rising wages as a sign of strength in the labor market. The latest ISM non-manufacturing report reinforced the bright prospects for the U.S. economy. Service-sector activity was expected to slow but instead expanded at its second strongest pace in 10 years. More importantly, the employment component of the index rose to its second highest level since August 2005. The last time we saw a number this strong was in July 2015, the month that nonfarm payrolls rose 223k. ADP declined slightly from 190K to 182K but the strength of ISM, low level of jobless claims and the optimism of the Fed make us confident that nonfarm payrolls will rise by at least 200K. However the dollar is rising not only because the Fed could raise interest rates next month but also because relatively speaking, the U.S. is currently the strongest major economy. We expect the dollar to remain firm going into and out of Friday nonfarm payrolls report.

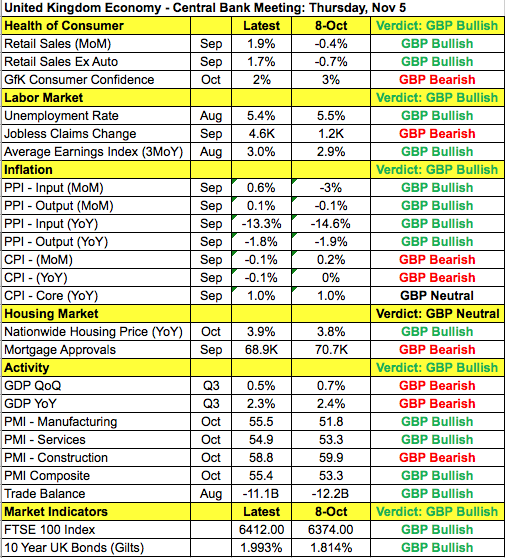

With a Bank of England meeting and Quarterly Inflation Report scheduled for release, GBP will be in play over the next 24 hours. While U.S. dollar strength drove GBP/USD lower Wednesday, we expect further gains for sterling on the back of the BoE. As shown in the table below, there has been significantly more improvement than deterioration in the U.K. economy since the last monetary-policy meeting. Retail sales rose strongly in September, the unemployment rate declined, wages increased and service along with manufacturing activity accelerated. Although consumer prices eased, which is a big problem for the central bank, the uptick in PPI and the rise in market indicators should keep the central bank optimistic. The BoE is not looking to raise interest rates at this time but the improvement in the economy could lead to upgraded economic forecasts and/or encourage one additional MPC member to join Ian McCafferty in voting for an immediate rate rise.

EUR/USD and NZD/USD were Wednesday's two worst-performers. Softer Eurozone and stronger U.S. data drove EUR/USD to a 2-month low. Service-sector activity for the region was revised lower causing a similar downward revision to the composite index. While France saw stronger activity, Germany continued to falter. Eurozone producer prices fell less than expected but on annualized basis, PPI printed at -3.1% vs. -2.6% in August. As U.S. data gets stronger, Eurozone data is getting weaker and this dynamic has and will continue to weigh on EUR/USD. Our initial target for the currency pair is 1.08 and we are not far from that price level. While we are looking for EUR/USD to remain weak, we don’t anticipate much in the way of further losses before the ECB meeting. Instead, we believe that the currency pair will find support next week once NFPs are behind us.

NZD/USD on the other hand is feeling the strain of Tuesday night’s disappointing labor data and the drop in dairy prices. Wednesday’s decline took the currency pair to the 100-day SMA. If NZD/USD extends its losses it would be the first time since May that the pair closed below the moving average. This is significant because it opens the door to a stronger decline in the pair including a possible move down to 63 cents. All of the recent NZ economic reports reinforce the RBNZ’s dovish bias and confirms that the door remains open for another rate cut by the central bank.

Despite better-than-expected economic data, the Canadian dollar traded lower against the greenback. USD/CAD resumed its rise as oil prices resumed their slide. The “reason” for Wednesday’s drop in oil was a stronger dollar. While the trade deficit narrowed, imports fell for the first time in 5 months as exports increased. The decline in imports signals the weakness of internal demand and raises our overall concern about Canadian economic activity. The IVEY PMI report is scheduled for release Thursday and we are looking for a slowdown in manufacturing activity.

The Australian dollar also traded lower Wednesday. Economic data was mixed with service-sector activity slowing, retail sales growth meeting expectations and the trade deficit narrowing more than anticipated. Initially investors interpreted these reports to be positive for AUD but by the end of the North American trading session, AUD/USD also fell victim to USD strength. While Wednesday’s Australian economic reports were not terrible, we don’t believe that they are extremely encouraging either. Yet AUD is looking better than other currencies such as EUR, NZD, JPY and CAD.