By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

With hours to go before the Reserve Bank of Australia’s monetary policy announcement, the Australian dollar extended its gains for a second day in a row to 0.7498, just 2 pips shy of the key 75 cent level. Monday’s gains had little to do with data as Australia's service-sector activity and inflation growth slowed. Job ads also grew by only 0.4%, down from 1.5% the previous month. These reports should make the Reserve Bank less optimistic but on a day like Monday when geopolitical events drove Aussie flows, that mattered little to FX traders. The decision by Gulf States to cut ties with Qatar sent AUD sharply higher. While Qatar is not a major oil producer, it is a major producer of liquefied natural gas. Australia is quickly becoming a major player in this market and should be a big beneficiary of Qatar’s diplomatic crisis. Saudi Arabia closed its borders and suspended air and sea travel between the 2 countries. In the long run, these developments will have a positive impact on Australia’s economy, but in the near term it may not be enough to please the RBA.

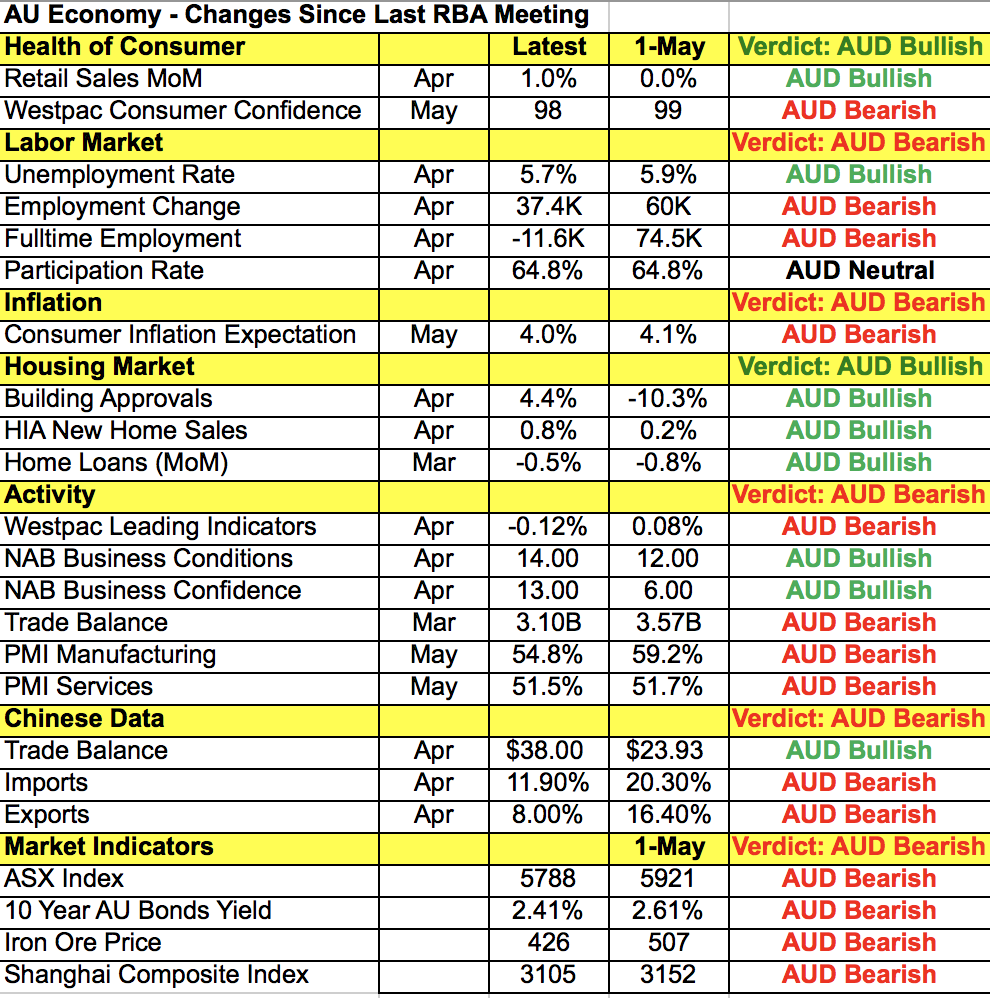

As seen in the table below, there’s been more deterioration than improvement in the economy since the last monetary policy meeting. Over the past month, labor-market conditions and inflation weakened as manufacturing and trade conditions deteriorated due to the slower Chinese export growth. Stocks, bonds and commodity prices also fell. There was some good news including Monday’s uptick in China's service-sector activity but that was offset by weakness in manufacturing. Australia’s housing market also saw gains but we don’t think that will be enough to squeeze some optimism from the RBA. Let's not forget that when the RBA last met, it was under the backdrop of stronger data and rather than recognize these improvements, it said its forecast for Australia’s economy has not changed much, sending the Australian dollar spiraling lower. So if the RBA doesn’t present some type of optimism, it will spoil AUD's rally. But if it says even one positive word, we could see AUD/USD hit 0.7550.

Although the Canadian and New Zealand dollars ended the day unchanged, they spent most of the North American trading session drifting toward higher levels. Oil declined but ended the day off its lows. No data was released from either country but on Tuesday, New Zealand has a dairy auction and Canada releases its IVEY PMI report, so we should see more volatility in both currencies.

US Dollar (JPY) failed to extend its losses despite mostly softer U.S. data. The non-manufacturing ISM index dropped to 56.9 from 57.5 as factory orders and durable goods declined. After the miss in Nonfarm Payrolls, slower service-sector growth did not catch anyone by surprise, which may explain why U.S. yields moved higher on Monday. Even with the rebound, rates are down from Thursday’s pre-NFP levels. There’s not much in the way of U.S. data this week but we believe it's only a matter of time before 110 is tested.

Euro and sterling moved in opposite directions Monday with the former slipping against the dollar and the latter rising. Interestingly enough, Eurozone PMIs were revised higher while U.K. Construction PMI declined. Investors are worried that after the euro's strong rise, the currency will pullback ahead of the European Central Bank’s monetary policy decision. Members of the ECB have taken every opportunity to emphasize the need for accommodation and while the political threat has faded, euro's recent strength may deter President Draghi from emphasizing the improvements in the economy. With that in mind, the ECB could upgrade its economic forecasts, which puts it a step closer to tapering asset purchases. Sterling on the other hand traded higher as polls show a small improvement in the Torie's lead over Labour. It seems that the latest terrorist attacks did not make Britons more skeptical of Prime Minister May’s abilities. In the lead up to Thursday’s election, sterling traders will continue to key off polls.