Global markets have enjoyed a strong rebound this year following 2022’s rout, but recent turbulence suggests that previous highs reached will remain elusive for the near term.

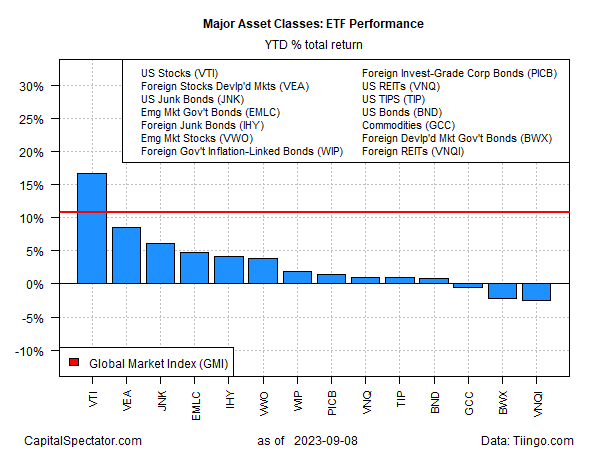

The good news for investors is that nearly all of the major asset classes are still posting gains year to date, led by US stocks, based on a set of ETFs through Friday’s close (Sep. 8). Even after the latest pullback, Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI) is up a sizzling 16.1% so far in 2023.

The only components of the major asset classes with losses this year: a broad measure of commodities (GCC), government bonds in developed markets ex-US (BWX) and real estate ex-US (VNQI).

In a clear sign of a generally rising tide for asset prices, the Global Market Index (GMI), maintained by CapitalSpectator.com, is up nearly 11% in 2023. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class portfolio strategies.

The rallies have stalled in recent weeks, which is unsurprising given the strength and persistence that, until recently, prevailed in markets around the world. But investors are now struggling to decide if the latest setbacks are clues of a bear-market rebound in 2023 or pauses that eventually lead to new highs in due course.

From a US perspective, a key component of the analysis centers on assessing the economy’s strength and how that will influence upcoming Federal Reserve decisions on interest rates.

“I worry that current good economic data are likely to keep inflationary pressures bubbling under the surface,” says Marija Veitmane, a senior multi-asset strategist at State Street (NYSE:STT) Global Markets. “That would keep the Fed and other central banks from cutting rates, which would eventually break the economy.”

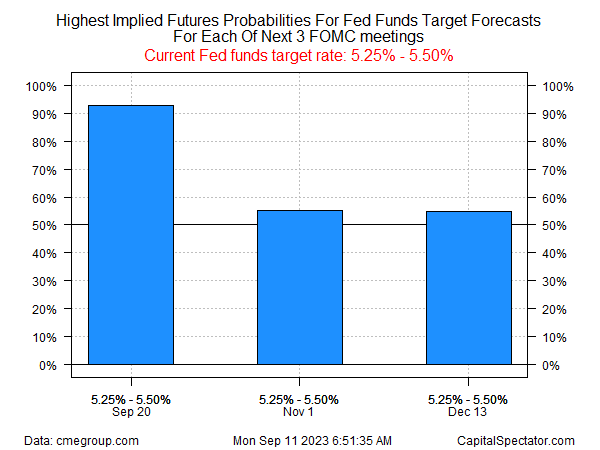

Fed funds futures are currently pricing in a high probability that the central bank will leave its target unchanged at the upcoming FOMC meeting on Sep. 20. Beyond the next rate decision. However, the market’s guesstimate is basically a coin flip.

“The data is stronger than expected and the Fed has highlighted that stronger than expected activity could lead it to hike rates again,” writes Tim Duy, chief US economist at SGH Macro Advisors, in a research note sent to clients today. “At the same time, however, lower inflation reduces the urgency to hike rates again, and the Fed is balancing policy against these two considerations.”

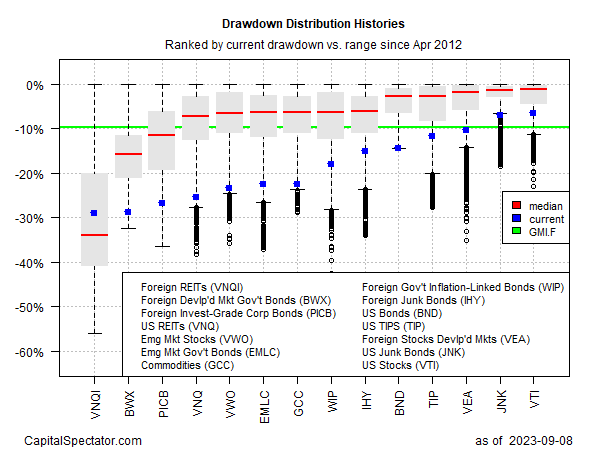

What is clear is that most markets are still well below their previous highs. Current drawdowns for nearly all the major asset classes are below -10% and deeper than GMI’s peak-to-trough decline.

The key factors that will likely determine how soon new highs arrive are a function of how the slide in inflation unfolds over the final months of 2023 and how the Fed reacts.

In other words, weighing the evolving odds for a so-called soft landing – reducing inflation with minimal blowback for economic growth — will be front and center for markets in the weeks ahead.

Even optimists expect that the path forward will be rocky. “We think we are still in a bull market that will hit new highs before the end of the year, but it will be a choppy road,” predicts Ed Clissold, chief US strategist at Ned Davis Research.