By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

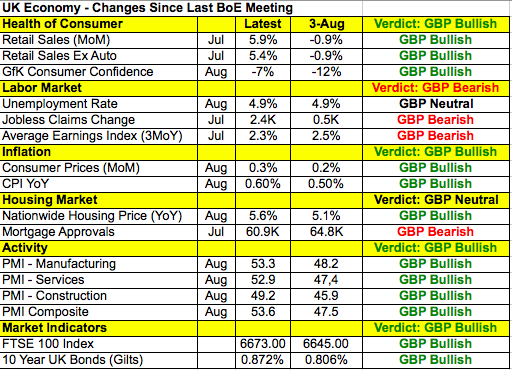

With U.K. retail sales and a Bank of England monetary policy announcement scheduled for release, Thursday will be a busy day for sterling. While GBP/USD spent the early part of the North American trading session under water, it staged a strong recovery to end the day in positive territory. At first, investors were not convinced that the BoE could be optimistic in light of mixed labor data but as the rate decision neared, everyone took stock of the broad-based improvements since the last monetary policy meeting. So while jobless clams ticked slightly higher and earnings excluding bonuses slowed, the following table shows broad-based improvements in the U.K. economy since the last policy meeting. Manufacturing- and service-sector activity is expanding once again, retail sales have been very strong and consumer prices are on the rise. Granted wage growth is very important to the BoE, including earnings, wages grew 2.3% yoy in July, which was weaker than the previous month but significantly stronger than anticipated.

Having just increased stimulus in August, the BoE won’t be eager to add bond purchases or cut interest rates again. If you recall, back in August the central bank made a big play by combining a 25bp rate cut with a 60 billion bond-buying program and a new initiative to purchase $10 billion of corporate bonds. This multi-step approach was aimed at sending a strong message to the market and to insure the economy against a post Brexit slowdown. Recent data shows how their efforts have paid off so while the BoE will leave the door open to additional stimulus (because they can’t anticipate the extent of the slowdown once Article 50 is invoked), they should note the improvements in the economy and signal to the market that they are in wait-and-see mode.

No changes are expected from the BoE on Thursday but the monetary policy meeting minutes will be released after the rate decision and investors will be eager to see how policymakers voted. Last month all members voted for the rate cut but a handful voted against more QE and the introduction of a corporate bond scheme. So chances are the decision to leave policy unchanged this month will be unanimous and if we are right, sterling should rise. However if the BoE puts greater emphasis on the possibility of additional easing over the improvements in the economy and investors see the main takeaway as the BoE will ease again, sterling will fall.

The U.S. dollar traded lower against all of the major currencies Wednesday with the exception of the Canadian dollar, which was hit by the continued slide in crude prices. Treasury yields declined but considering that rates abroad also fell, the move in bonds cannot explain the move in the dollar. Instead we believe investors are positioning ahead of Thursday’s U.S. economic reports. It's been a quiet week for U.S. data but that changes Thursday with retail sales, producer prices, Empire State, Philadelphia Fed and industrial production reports scheduled for release. The decline in gas prices, weaker wage growth and disappointing labor-market report points to weaker consumer spending. Even Johnson Redbook reported lower sales in August compared to July. Retail sales are always important but particularly so this month because we are days away from FOMC and some investors are holding out hope that the Fed will tighten in September. Weak spending data will seal the deal for no change in September and send the dollar plunging. However if consumer spending beats it will spark hope for a rate hike next week and undoubtedly send the dollar sharply higher.

Weaker-than-expected Eurozone industrial production numbers failed to stop EUR/USD from rising. The currency pair has been consolidating all week and after falling to the 50-day SMA on Tuesday, it rebounded on Wednesday. We have the Eurozone’s trade balance and consumer price report scheduled for release on Thursday. CPI is predicted to rise and it needs to increase after the sharp decline in July. If it fails to do so, it is bad news for the euro.

The Swiss National Bank also has a monetary policy announcement on Thursday. Inflation is still very low (-0.1%) but year-over-year rates have improved significantly since their last meeting in June. Exports also grew 5.5% in July, up from -0.4% in May, which is a testament to the central bank’s effectiveness in keeping the franc weak. The latest GDP report has the economy expanding 0.6% in Q2 vs. 0.3% in Q1. There are areas of weakness also with consumer spending continuing to fall and manufacturing activity slowing. Therefore we expect the SNB to remain neutral and cautiously optimistic.

Wednesday night was shaping up to be a big night for the Australian and New Zealand dollars. To start, both currencies traded higher against the greenback despite mixed data. New Zealand reported a larger-than-expected current account deficit, coming in at -0.945b vs.-0.295b expected. Australia’s Westpac Consumer Confidence levels showed an increase of 0.3% to 101.4, which was less than expected. New Zealand manufacturing PMI and GDP numbers were also scheduled for release Wednesday evening. Given the strong rise in spending and trade in the second quarter, we were looking for growth to accelerate. In Australia, however, weaker job growth was anticipated given the sharp decline in the employment component of manufacturing, services and construction sector PMIs.

Unlike AUD and NZD, the Canadian dollar traded lower Wednesday. Oil took an interesting turn as an initial report of US inventory originally sent prices soaring past $45, but the rally faded with oil ending the day sharply lower. DOE US Crude Oil Inventories took an expected drop this week by 559k barrels when an increase of 4000k barrels was estimated. Cushing Ok. Inventories also took a larger-than-expected hit, falling by -1245k when only a decline of 100k was expected. Yet oil prices continued to fall as the downtrend resumed. There are no economic reports scheduled for release from Canada on Thursday.