By Kathy Lien, Managing Director of FX Strategy for BK Asset Management

It is not unusual to see big moves in currencies at the end of a month but Monday’s fluctuations give investors a taste of the heightened volatility they can expect this week. Between 2 monetary-policy announcements, labor data from the U.S., Canada, Germany and New Zealand — along with PMI reports from all corners of the world — it will surely be an active week in the forex market. EUR/USD probably won’t be the only currency pair to hit multi-year highs or lows. This week kicked off with fresh losses for the greenback, which broke 1.18 versus the euro for the first time since January 2015. Investors took the dollar lower against all of the major currencies except for the Canadian and New Zealand dollars. Although pending home sales increased more than expected, the Chicago PMI index fell sharply, reminding everyone about the troubles plaguing the U.S. economy. The Fed intends to raise interest rates but data still doesn’t support its views and in order for that sentiment to change, Friday’s nonfarm payrolls report needs to be exceptionally strong. Whether that’s true or not remains to be seen but traders will be skeptical up until the last moment before payrolls are released. For this reason, USD/JPY is eyeing 110, a level that could be broken ahead of the jobs report. Personal income, spending and the ISM manufacturing index are scheduled for release on Tuesday but none of these reports are significant enough to change the market’s views for December tightening – only Friday’s jobs number is capable of doing that, which itself is questionable.

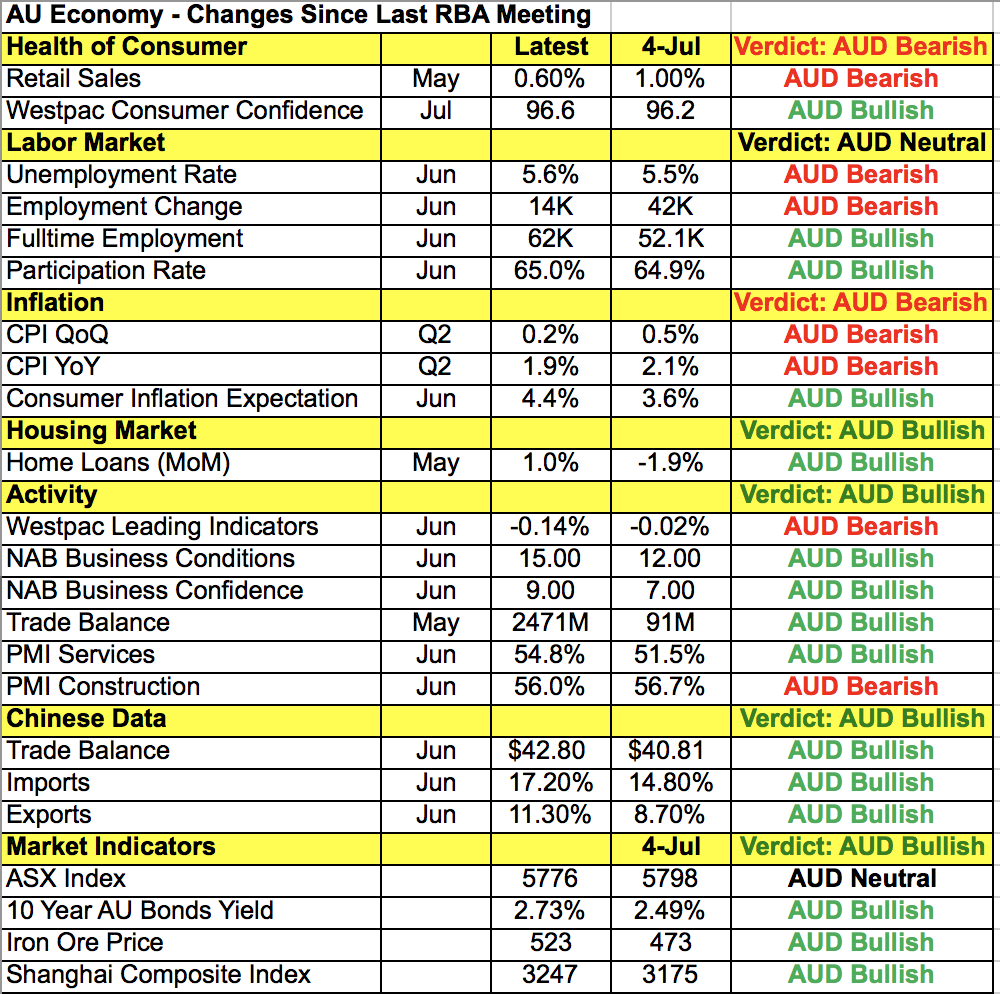

Monday's big story was the new high in euro but Monday night's focus was on the Reserve Bank of Australia’s monetary policy announcement. The Australian dollar was trading near 80 cents ahead of the rate decision but this strength had less to do with the market’s expectations for RBA than U.S. dollar weakness. No one expects the Reserve Bank to change interest rates but with other central banks talking about tightening, investors are eager to find out how far the RBA will lag behind. We know from Governor Lowe’s recent comments that he doesn’t’ feel the urgency to hike because they did not ease as much in the past few years and therefore won’t “need to move in lockstep with their global peers.” But just what type of tone will the RBA adopt? Taking a look at the table below, the fact of the matter is that retail sales, wage growth and inflation all weakened in July with the currency appreciating 4.5% against the greenback. However the labor market and housing market are doing well while commodity prices have recovered. So the RBA could express only limited concern about low wage growth, the currency and inflation, which in an environment of a rising AUD could be interpreted as positive for the currency. Here’s what to watch: if the RBA emphasizes the negative impact of the strong currency and low inflation, AUD/USD could drop below 79 cents but if the statement is relatively benign, the preservation of yield could be enough to lift AUD/USD to 0.8060.

Although USD/CAD ended the day higher and NZD/USD was little changed, both CAD and NZD recovered from earlier lows. Talk of sanctions on Venezuelan oil helped to drive crude, and in turn the Canadian dollar, higher while the sell-off in the greenback helped NZD shrug off weaker business confidence. According to the latest reports, prices in Canada are falling (industrial product prices dropped 1% while raw material prices fell 3.7%). Markit Economics’ Canadian manufacturing PMI report is scheduled for release on Tuesday along with New Zealand’s dairy auction.

For the first time in over 2 years, the euro traded above 1.18 versus the U.S. dollar. Eurozone data continues to surprise to the upside with retail sales in Germany rising strongly in June. The 1.1% increase was the largest since October. Eurozone inflation also ticked up according to the advance CPI core release while the unemployment rate dropped to 9.1%, the lowest level since 2009. As all news was good, a little bit of dollar weakness was all that was needed to send EUR/USD to fresh highs. The EUR/USD could extend to new highs on the back of Tuesday’s German labor-market report as the PMIs showed an elevated level of private-sector employment growth. While 1.20 is in sight, the 50-month SMA at 1.1895 could stall the currency’s gains. Meanwhile, the euro and Swiss franc continue to move in completely different directions, driving EUR/CHF to fresh 30-month highs. As the Swiss National Bank won’t stand in the way of franc weakness, we could see EUR/CHF 1.16 before the rally starts to lose steam.

Sterling rose to its strongest level versus the U.S. dollar since September 2016. Like many other major currencies, its strength is a direct function of U.S. dollar weakness. The latest housing-market numbers were mixed with net lending rising but mortgage approvals falling. The Bank of England has a monetary policy meeting this week and will be releasing its Quarterly Inflation Report. Investors are hopeful that the central bank will validate the hawkishness of a handful of policymakers but mixed data makes it a tough call. The U.K.’s latest manufacturing, service and composite PMI reports will be released over the next 48 hours and they will be critical in shaping the market’s expectations for Thursday’s rate decision. Based on the drop in the CBI index, we look forward to a softer report that should ease GBP from its highs.