This article was written exclusively for Investing.com

With zero interest rate policy, and massive QE driving rates on the long end of the borrowing curve lower, investors have been looking for an expansion in multiples to drive stock prices up. After all, the claim is that there is no alternative, and with earnings expected to plunge due to the coronavirus pandemic, the only thing that can push stocks higher are the multiples. But history tends to tell a different story. Low rates do not produce higher multiples, earnings do.

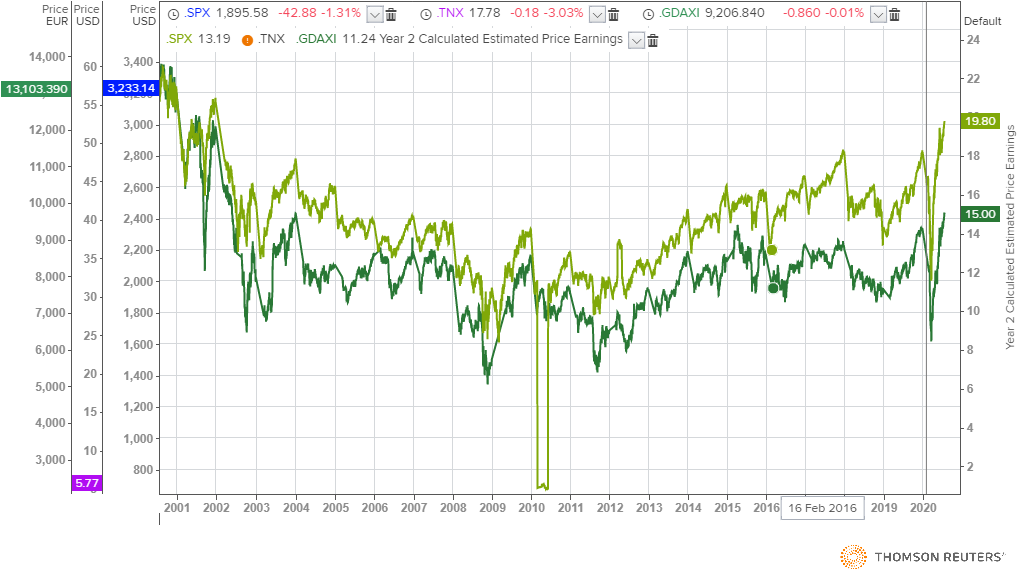

We saw this low-rate narrative before, when rates plunged following the financial crisis of 2008 and 2009. It took years for multiples to expand. Europe has had low rates for just as long of a period, and even multiples in an export-driven, robust economy like Germany have not seen the same level of expansion as we have in the US today.

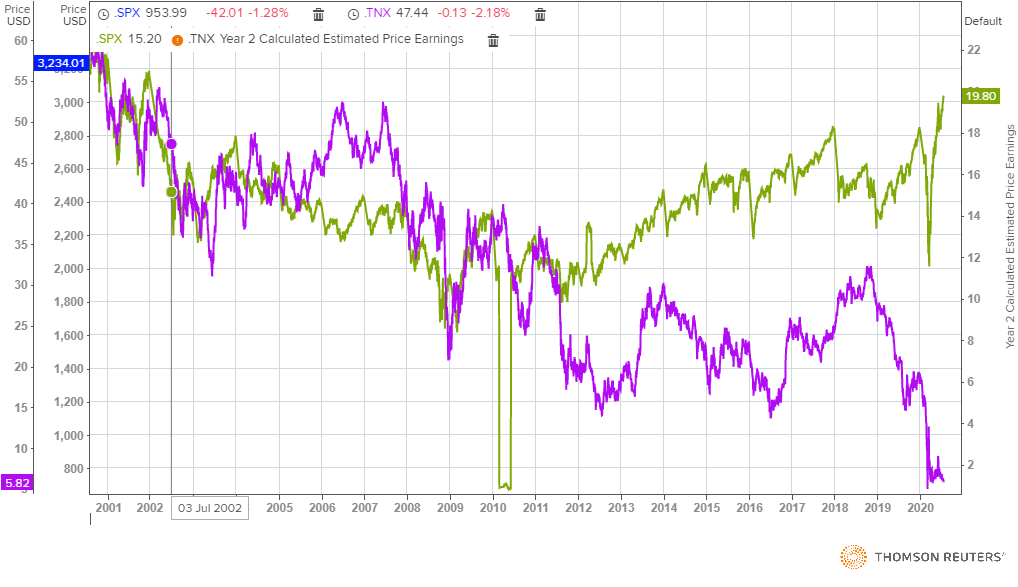

Yields And Multiples

The one-year forward price-to-earnings ratio for the S&P 500 has recently risen to 19.8, its highest since April 2002. Back then, PE multiples were contracting following the bursting of the dot.com bubble. Multiples fell to close to just 9 by 2009. Then, as the Fed cut rates following the recession of 2009, and Treasury yields plunged and PE multiples did begin to expand, almost doubling to 18 by December 2017.

Surprisingly, from 2011 to 2013, even as the Federal Reserve kept the fed funds rate unchanged at 0.25%, the yield on the 10-year Treasury climbed from around 1.6% to nearly 3%. As this occurred, the PE on the S&P 500 expanded from 11 to 15.

When 10-year yields began falling to around 1.5% by the summer of 2016, there was very little increase in PE, which edged up to approximately 16. After that, yields began to rise, in anticipation of the first increase in Fed rates since 2005, and continued to do so through for another two years, to October 2018. In that time, the PE ratio on the S&P rose to 18.

Earnings May Matter More

While lower rates, have, in the past, coincided with an increase in PE multiples, this isn't always the case. It seems to suggest that the direction of interest rates may have little, if any, bearing on the actual earnings multiple of the S&P 500. And it also does not suggest that there is no other way for multiples to expand other than via a falling-rate environment.

What seems to matter more for the direction of the earnings multiple is the rate of change for the actual earnings themselves, with higher and faster earnings growth spurring multiple expansion. The correlation appears to be incredibly close when using just the naked eye, with this chart that shows the S&P PE ratio against aggregate earnings per share.

Even looking at Germany, where the benchmark 10-year government bond yield is trading at -50 basis points, the DAX trades with a PE ratio of 15. This is at the upper end of its historical range going back to 2003. Multiples on the DAX collapses fairly sharply in 2009, falling to a low of around 7, from closer to 14 a year earlier, and have since more than doubled. But it has taken over a decade of low bond yields and at least five years of zero-interest rate policy by the European Central Bank for this to happen. Multiples on the S&P doubled in far less time.

So interest rates too have little bearing on the expansion, or contraction, of PE multiples, at least not over the past 20 years, when, across the developed economies rates were at, or near zero. If it is the case, this could be a big problem for the equity market. It suggests that a contraction in earnings should lead to a contraction in multiples. If so, then the S&P bull may struggle to push higher from here, and may even face a steep decline.