- Investors are concerned about futures S&P 500 earnings

- A decent P/E valuation today might actually be quite pricey if estimates retreat

- Data show earnings recessions can last years but are things really that bad?

The million-dollar question in the investing world right now is, “What will S&P 500 earnings be over the next year?” The common, almost obligatory, response to any article or tweet suggesting stocks are a decent bargain now based on reasonable P/E multiples is something along the lines of, “But we don’t know what the ‘E’ will be.”

And that’s a fair point. We never know how today’s forecast earnings will verify. But we can use history to get a general idea of just how much SPX per share profits might drop this time using results from prior economic downturns. While no two recessions are the same, at least getting a ballpark sense of what the future holds can be useful to address the question on all market participants’ minds.

Historical Trends

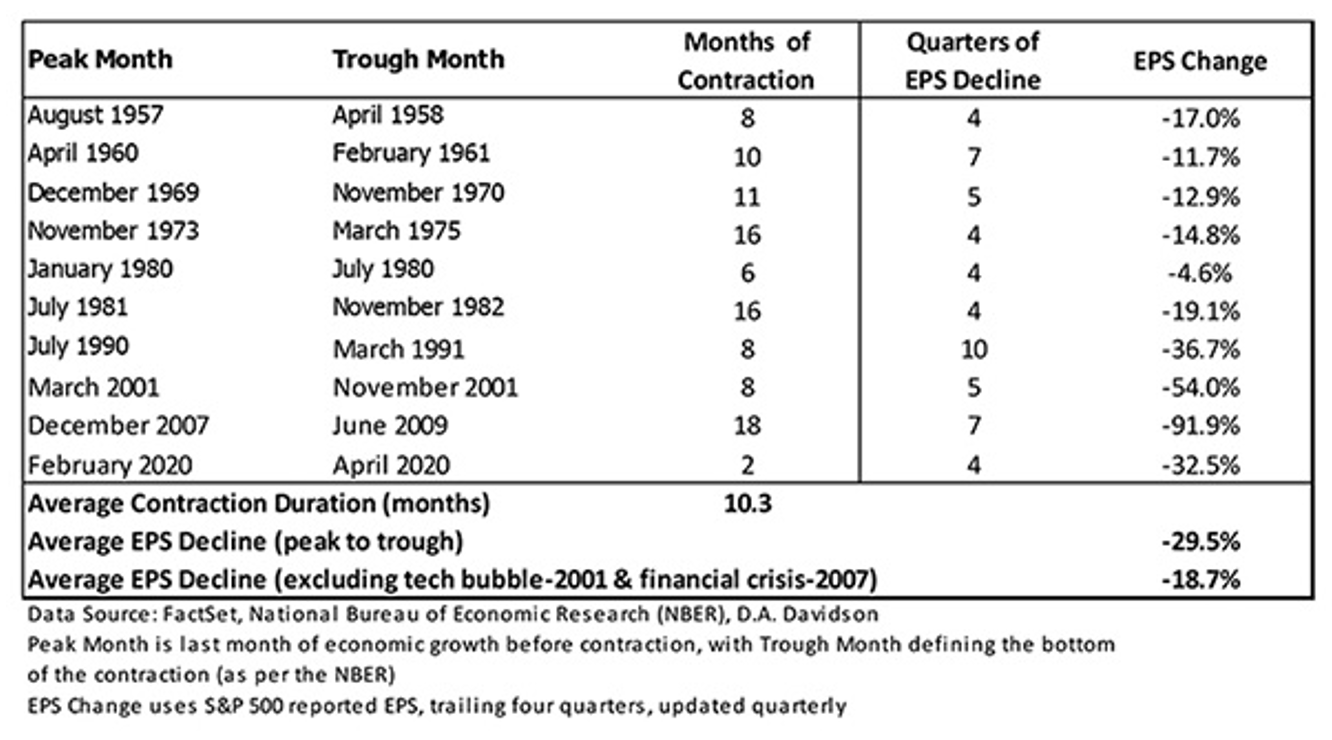

I dug through some data to see what prior earnings recessions looked like. According to research from James Regan of D.A. Davidson, the average U.S. stock market peak-to-trough GAAP trailing 12-month earnings decline in all such periods since 1957 is –29.5%. Backing out extreme profit declines seen during the dot-com bust and 2008 financial crisis, that figure is milder at just 18.7%.

Previous Earnings Recessions: Duration And Magnitude

Source: D.A. Davidson

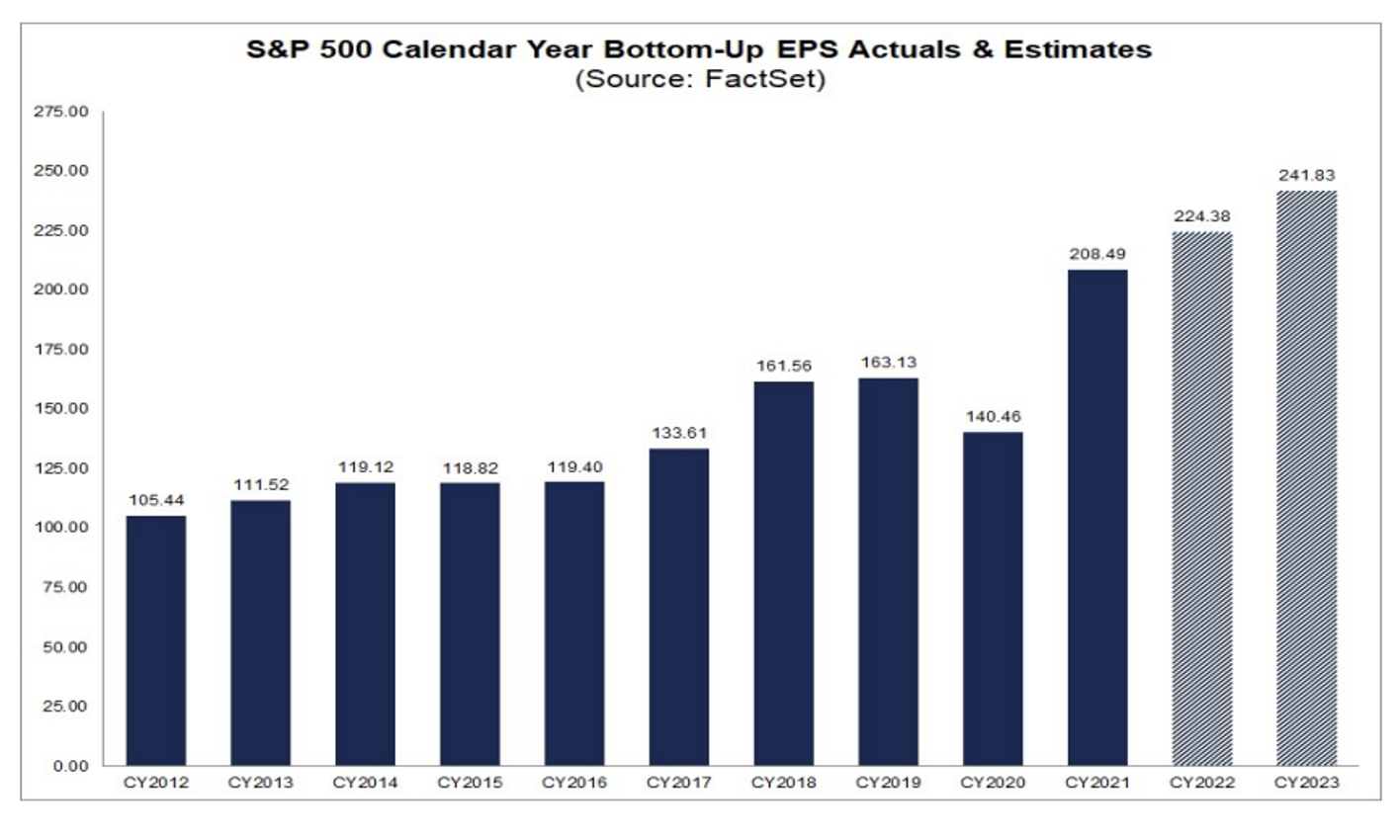

SPX Earnings: Not As Strong As They Appear

Now, it’s reasonable to assume the 2022-23 earnings recession (if there will even be one) should be softer than normal. After all, this past earnings season went just fine despite major economic challenges and macro issues like a surging U.S. dollar.

And Q3 earnings are expected to be positive, though the year-on-year nominal growth rate forecast has fallen from 9.8% on June 30 to just 2.9% as of last Friday, according to FactSet. Back out the energy sector’s monster annual profit jump, and EPS growth is expected to be in the red. Also consider that earnings are a nominal figure, so on an inflation-adjusted basis, S&P 500 ex-energy EPS is expected to be down about 11% year-over-year.

S&P 500 EPS Actuals And Estimates

Source: FactSet

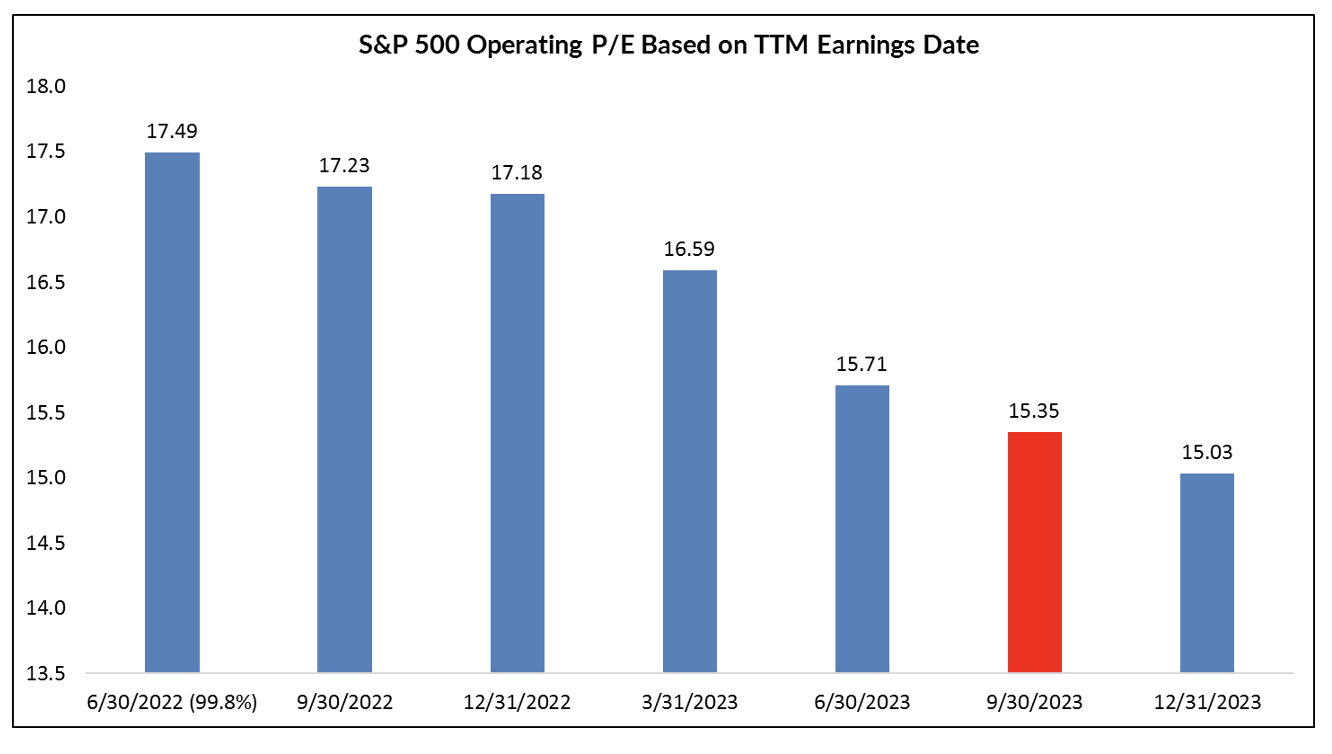

Tweaking the 'E'

It is anyone's guess as to how much SPX EPS will change in the coming four-plus quarters, but if we assume per-share profits drop, say, 10%, then today’s 15.4 forward operating price-to-earnings ratio, according to John Butters at FactSet, would be more like 16.9.

S&P 500: A Declining P/E. If We Trust The 'E'

Source: S&P Dow Jones

A next-12-month P/E near 17 does not appear cheap, according to history. Moreover, bear market bottoms often feature very low earnings multiples—about 12.0x, on average. One twist to consider, however, is today’s sector composition versus history. This is something I wrote about on Monday. Growth-oriented tech/media/telecom stocks command a greater share of the market today than in yesteryear.

More Value, Lower P/E

And we can see valuation differences between the growth-exposed U.S. large-cap stock market and more value-led domestic small- and mid-cap stocks as well as in foreign markets. Those areas of the market have forward non-GAAP P/E ratios in the low teens, not surprisingly.

A Long Road To Recovery

Finally, take a look at the chart above at just how long EPS contractions last. The bears can certainly point to a typical period of between four and seven gruelling quarters of profit growth declines in the S&P 500. That’s a scary thought as recouping a high-water profit mark could then take years.

Earnings Season Kicks Off

This coming earnings season will be critical to watch. The third quarter of 2022 featured massive interest rate changes as the U.S. 10-year yield ranged from near 2.5% at the start of August to a tick shy of 4.0% by late September. Moreover, the U.S. Dollar Index surged 23% from May last year—that is a major headwind for U.S. firms with foreign revenue. According to Wall Street Horizon, Pepsi (NASDAQ:PEP) unofficially kicks off the reporting period next Tuesday evening. The big banks then carry the torch later in the week.

The Bottom Line

Earnings recessions are no joke. They have historically averaged about a 20% to 30% profit retreat depending on how you look at the data. It can take years for corporate America to then make new highs in per-share profits. With that in mind, the Q3 reporting season could be the pivotal quarter to see if we are on the road to earnings perdition or if firms can weather the economic storm.