By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

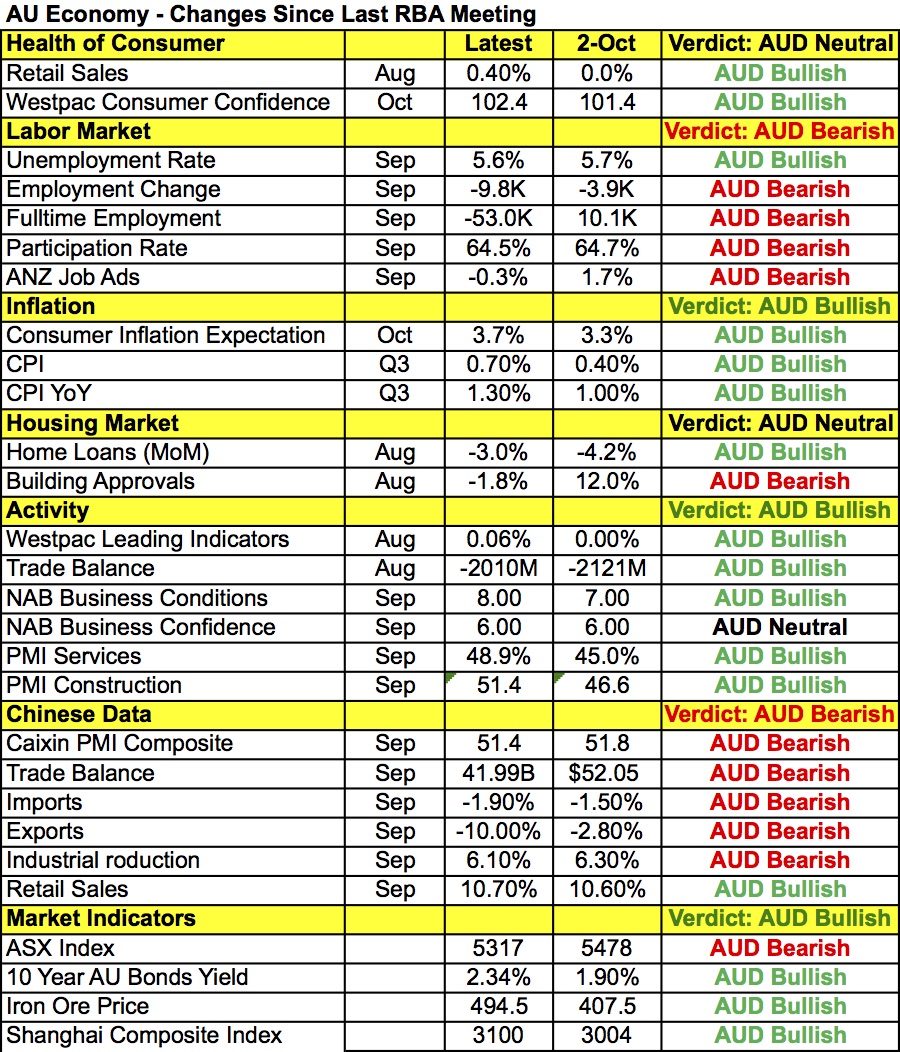

We’ve had a relatively quiet start to a very busy week in the foreign-exchange market but that will soon change with the Reserve Bank of Australia and the Bank of Japan monetary policy announcements. The Australian dollar moved slightly higher ahead of the rate decision while the Japanese yen traded broadly lower. We do not expect changes from either central bank but a small subset of investors believe that the RBA and BoJ could ease. Starting with the RBA, there were major full-time job losses in September. The Chinese economy has also been slowing with imports and exports falling. However the RBA could look past softer labor-market conditions and weaker growth in China because the central bank is optimistic and inflation is on the rise. According to the table below, since the last monetary policy meeting, retail sales is up, consumer and business confidence increased, the trade deficit narrowed and most importantly, iron ore prices rose more than 20%. AUD/USD is trading at roughly the same rate today compared to October 4, so their concerns about a strong currency shouldn’t change. The RBA can afford to wait and see how the local and global economies perform over the next month before moving away from their neutral monetary-policy bias. Continued optimism from the RBA should reignite demand for the Australian dollar as the central bank is the second-least dovish behind the Federal Reserve. However if they indicate that slower growth in China is becoming a more serious problem, AUD/USD could make a run for 75 cents.

Without a fresh round of stimulus there is very little chance that the Japanese economy will see a stronger period of recovery. Japan’s economy continued to weaken in the past month with retail sales falling sharply, the unemployment rate rising, labor cash earnings sinking and deflationary pressures worsening. The only area of improvement appears to be manufacturing and that is largely due to the weakness of the yen. The Bank of Japan still has a lot more work to do but their hands are tied and they have been waiting for fiscal stimulus to pick up the slack. They know that more easing is needed, which is part of the reason why they could surprise with a move this week that would crush the yen because they have a history of making unexpected moves. However chances are no action will be taken and at best they will delay the date for bringing inflation back to target.

The U.S. dollar traded higher against all of the major currencies Monday except for the British pound and Australian dollar. Monday morning’s U.S. economic reports failed to impress. Although personal income and spending increased, the rise in incomes was less than anticipated. Meanwhile, manufacturing activity in the Chicago region slowed significantly, adding to troubles already reported in the NY and Philadelphia regions. This signals a downside surprise for Tuesday’s broader ISM manufacturing index, which may give us the opportunity to buy dollars at a lower level ahead of Wednesday’s Federal Reserve meeting. Data in the past week was mostly better with growth accelerating, manufacturing activity improving, new home sales rising and the trade deficit narrowing. Still, a slow recovery in the labor market and upcoming election is making consumers nervous. The Federal Reserve isn’t going to change its message next week so the ISM non-manufacturing and nonfarm payrolls report will be more important as they will either ease or harden the market’s doubt about December tightening.

For most of the European and North American trading sessions investors were focused on the possible resignation of Bank of England Governor Mark Carney, but the air was cleared later in the day as Carney confirmed that he will stay in office until June 2019. This wasn’t the full term that market participants hoped for but it is longer than his initial plan to leave in 2018. This middle ground was chosen in the hopes of helping to “secure an orderly transition to the U.K.’s new relationship with Europe.” Carney was under intense pressure for expressing his views on Brexit before the referendum but his resignation would have been disastrous for the markets and sterling because his steady and proactive hand helped to shelter the economy from a deeper downturn following the referendum. This is a big week for the British pound with the Bank of England meeting, Quarterly Inflation Report and PMIs scheduled for release. The key question this week is whether the BoE will lower its economic forecasts and signal plans to ease. The U.K.’s PMI manufacturing report is scheduled for release Tuesday and we will be looking for a softer reading given the sharp drop in the CBI industrial trends survey.

The euro came within 10 pips of 1.10 before reversing lower to end the day in negative territory. German retail sales dropped -1.4% in September, which was significantly weaker than anticipated. CPI estimates was in line with expectations, reporting 0.5% increase. CPI Core estimates also matched expectations with an increase of 0.8%. Third quarter Eurozone GDP was confirmed at 0.3%. Compared to other major currencies, the data impacting the euro next week is less significant, which means the path of the currency will most likely be determined by the market’s appetite for U.S. dollars.

Lastly, the Canadian and New Zealand dollars traded lower against the greenback. Oil prices fell nearly 4% Monday to below $47 a barrel. Investors remain nervous about next month’s OPEC announcement as non-OPEC oil-producing countries continue to clash. In a meeting in Vienna over the weekend, non-OPEC members Azerbaijan, Brazil, Kazakhstan, Mexico, Oman and Russia met but came away empty-handed. No commitment to an oil freeze or production cut was reached. Adding fuel to the fire was the continued increase in oil rigs to last Friday’s Baker Hugh’s Rig count. Rigs for the week ending Oct. 28 increased to 557 compared to the previous week’s count of 553 rigs. NZD found selling pressure on the back of mixed data. NZ Building Permits increased by 0.2% vs. a reading of -1.5% the previous period but business confidence fell to 24.5 vs. 27.9 the previous month. M3 money supply also decreased to 4.8% vs. 5.3% the prior month. New Zealand’s dairy auction is the main focus for NZD on Tuesday.