By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

Are you confused about why EURO is hovering near its March highs ahead of Thursday’s monetary policy meeting? Don’t worry you’re not alone.

The European Central Bank is one of the few major central banks still in the process of easing monetary policy, which is normally bearish for the currency. Not only is the ECB expected to lower interest rates but there are a number of additional steps that it could and will most likely take to boost inflation, add liquidity and spur growth. So if the ECB is expected to ease, why is the euro trading higher? An easy response would be to attribute the move to the central bank’s successful guidance. It has made its intention to ease abundantly clear and has given the market plenty of time to discount the move. However while investors and economists are in total agreement that a deposit rate cut will be announced, they are divided on the size of the reduction, increases to asset purchases, an extension to the QE program, more LTRO and Draghi’s forward guidance. In other words, we don’t believe that the market has fully priced in Thursday’s announcement.

Instead, it is important to realize that the U.S. dollar traded lower against most of major currencies on Wednesday and not just the euro. Also, investors have been short euros for months and the uncertainty surrounding the ECB’s announcement has led some traders to close out their positions. We saw how EUR/USD verticalized after the central bank failed to impress in December and now, investors are worried the ECB could under deliver again. With that in mind, there are no less than 6 things to watch for during Thursday’s ECB meeting and Mario Draghi’s press conference:

6 Things To Watch

- Size of Deposit Rate Cut – The ECB is widely expected to lower rates but anything more than a 10bp reduction will trigger a knee-jerk decline in EUR/USD. Also watch for possible tiering of deposit rates.

- Extension of QE Program – In December, the ECB said it would extend its asset-purchase program through March 2017. Pushing that date out by three to six months would not be a big leap.

- Adjusting the Size of QE – Increasing the amount of bonds purchased per month would be a more aggressive step. Anything from 10 to 20 billion euros would be negative for the currency (the larger the increase, the greater the decline) but if the central bank decides to leave QE purchases unchanged, expect a sharp and aggressive rally in EUR/USD.

- New Long-Term Repo Operation – If the ECB wanted to surprise the market, it could also announce additional LTRO measures but it may forgo doing so if the deposit rate is reduced and QE purchases increased.

- Revisions to Staff Forecasts – We also expect the ECB to lower its inflation and growth forecasts after underlying inflation dropped to a 10-month low.

- Mario Draghi’s Guidance – The future direction of the euro hinges largely on whether the central bank plans to ease after March. If Draghi simply says the door remains open to additional easing, we don’t expect a significant sell-off in the currency. Stronger rhetoric on the other hand could be very damaging for the euro.

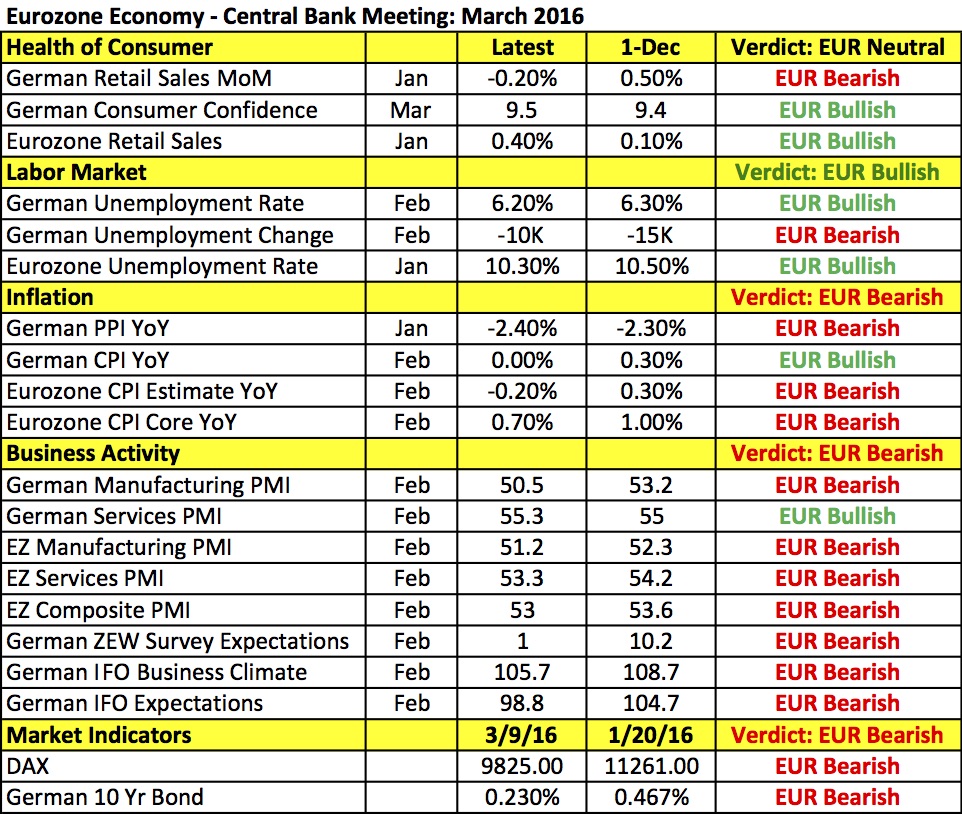

The following table shows how the Eurozone economy performed since the last meeting. Aside from a 5-cent rise in the currency, inflation has fallen, while manufacturing- and service-sector activity weakened. Consumer spending and labor-market conditions are mixed but improvements in that part of the economy won’t be enough to stop the ECB from easing. The only thing that the central bank can be truly encouraged by is the recovery in oil prices, which could go a log way toward solving its low-inflation concerns. Still, it remains to be seen whether the ECB believes the turnaround in oil is here to stay.

Meanwhile the Reserve Bank of New Zealand surprised the market with a 25bp rate cut and a warning that further easing may be required. The decision to lower rates to 2.25% from 2.50% caught almost every economist and investor off guard and sent the currency spiraling lower. According to the monetary policy statement, the decision was motivated by low inflation as the central bank cut its 2016 Q1 annual inflation outlook from 1.2% to 0.4%. It also lowered its Q4 2016 annual inflation rate to 1.1% from 1.6%. The Reserve Bank now expects its 2% inflation target to be reached in the first quarter of 2018 vs. the fourth quarter of 2017. Domestic risks contributed to the decline in inflation expectations and RBNZ's worry that prices will remain low for some time before recovery. China building and manufacturing sectors are also under significant stress creating a number of serious imbalances -- it's clearly more worried about China than its Australian counterparts.

In contrast, the Canadian dollar traded sharply higher Wednesday after the Bank of Canada expressed very little concern about the strength of the currency. After leaving interest rates unchanged (which was widely expected), the BoC said the Canadian dollar and oil were averaging close to levels assumed in its Monetary Policy Report. Many investors were worried that despite the turnaround in oil and improvement in Canadian data, the BoC would focus on the 8.8% appreciation in the currency. Surely it would not want to send the loonie even higher. However instead of lamenting over the drag that a strong CAD would have on exports, the BoC suggested that everything is status quo, with Canada's near-term outlook broadly the same as January and the U.S. expansion broadly on track. Inflation is evolving as anticipated while rate-sensitive energy exports are gaining momentum. USD/CAD dropped to a 4-month low following the monetary policy announcement with the move stopping right above the November 15 low, near 1.3225.

The Australian dollar hit an 8-month high against the U.S. dollar despite softer economic data and lower commodity prices. Even as oil prices moved higher, the price of gold, copper and iron ore moved lower. Australian consumer confidence also declined in March while home loans and investment lending fell at a faster pace. The only explanation for the persistent strength of AUD is its yield. On the eve of another ECB rate cut, investors are valuing the steady 2% rate offered by Australia. The Reserve Bank has no immediate plans to lower rates and this high and steady return has made the Australian dollar extremely attractive. With that in mind, AUD/USD is finding resistance near 75 cents and may struggle to extend its gains in light of the RBNZ’s concern about China and recent double-digit declines in Chinese imports and exports.

With no major U.S. economic reports on the calendar, the recovery in Treasury yields and rise in U.S. stocks drove USD/JPY to its strongest day of gains since the first of the month. Although the rise in wholesale inventories and drop in wholesale trade sales is disappointing, next week will be a far more important week for the dollar.

Lastly, better-than-expected U.K. data helped sterling avoid additional losses. U.K. industrial production rose 0.3% in January compared to a 0.4% forecast. This lower headline reading was offset by the stronger year-over-year rise, upward revision to December figures and big upside surprise in manufacturing production.