When Warren Buffett speaks—via Berkshire Hathaway's (NYSE:BRKa) quarterly reports or through his much anticipated annual letter to shareholders, released this past weekend—investors, whether they're stakeholders in Buffett's multinational conglomerate holding company or not, pay close attention.

Dubbed "the Oracle of Omaha," because of his legendary skill as a value investor, the CEO of Berkshire Hathaway has built a reputation for picking up undervalued shares of otherwise strong companies and profitably holding them for years, via his company's portfolio.

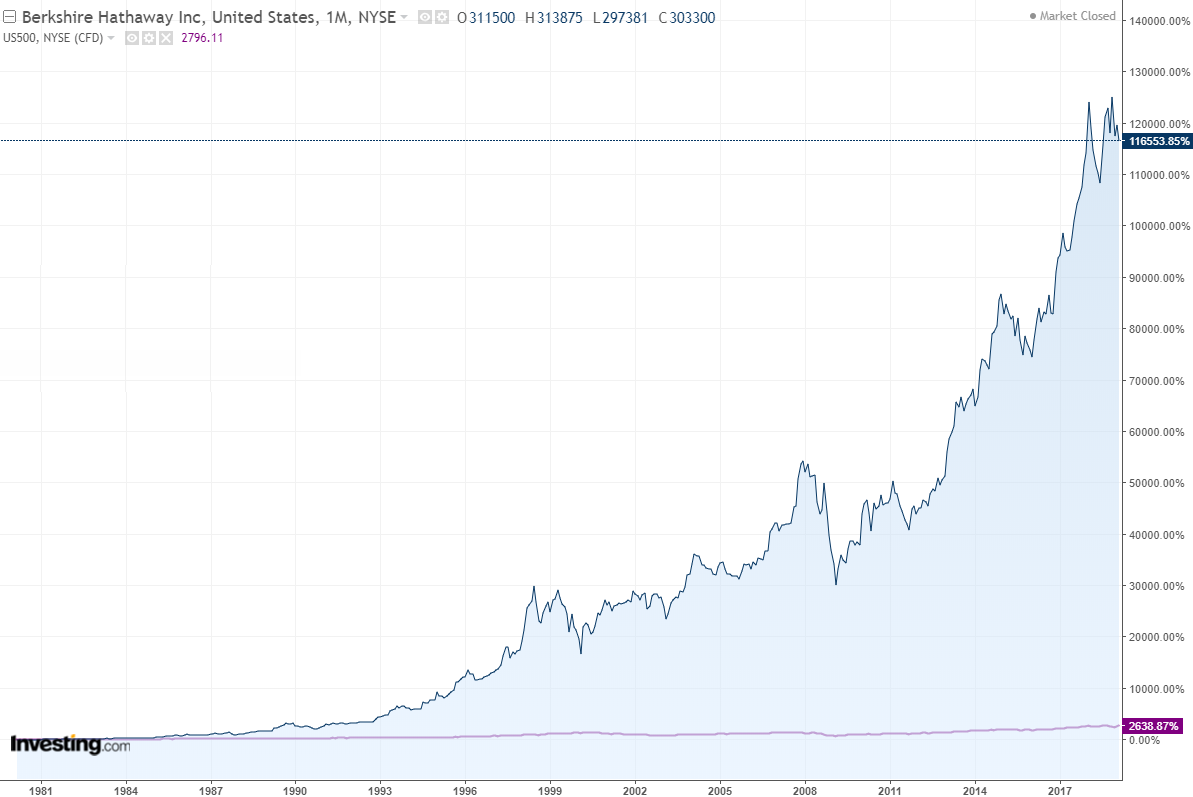

The brilliance of his game plan is evident in the chart above. Over the past 40 years, while the S&P 500 grew a respectable 2638%, BRKa returned a staggering 116,553%.

But Q4 2018 wasn't particularly good to Berkshire; the value of its portfolio dropped by $38 billion, or 17%, from $221 to $183 billion. The portfolio contains 48 stocks; Buffett's top holdings currently are Apple (NASDAQ:AAPL), Bank of America (NYSE:BAC), and Wells Fargo (NYSE:WFC).

The entire market took a dive as 2018 came to a close, thus the S&P 500 gained just 1.89% over the past 12-month; BRKa fared worse, losing 3.51% over the same period. But quarterly ups and downs don't seem to faze Buffett. As he's as often said, he's in it for the long term.

Which is why what he buys and sells remains of interest to investors. We believe three moves during the past quarter are particularly intriguing:

1. Banks

Buffett is also a renowned believer in the U.S. economy, famously praising it repeatedly in his annual shareholder letters. His recent moves prove that point.

The U.S. financial sector accounts for 45% of Berkshire's holdings. Even in Q4, as Fed Chair Powell turned dovish, mitigating expectations for future rate hikes (and hurting future profitability for banks), Buffett was buying within the sector. Berkshire Hathaway increased its stake in Bank of America, US Bancorp (NYSE:USB), JPMorgan Chase & Co (NYSE:JPM), PNC Financial (NYSE:PNC), and Bank of New York Mellon (NYSE:BK).

Of particular note, the JP Morgan stake, which was initiated in Q3, grew by 14.4 million shares at an average price of $106 (trading at $106.10 at yesterday's close) adding $1.52 billion to the position. Berkshire's BAC position increased by 18.9 million shares at an average price of $27 ($29.27 as of yesterday's close), a $510 million addition to the position, bringing Berkshire very close to the 10% ownership threshold. If it crossed beyond 10%, government regulations would require Berkshire to be reclassified as a bank holding company, something it wants to avoid. For this reason, Berkshire also cut its Wells Fargo (NYSE:WFC) position by 3%.

Buffett's rationale on these financial positions: though interest rates play a critical role in financial sector profitability, making a sustained low rate environment less ideal in the short term, Berkshire has positioned itself to profit from U.S. economic growth over the longer term. As for individual stocks, JP Morgan is arguably the leader in American banking right, now plus it has a reasonable valuation with a P/E ratio of 11. As well, it pays a nice dividend, yielding 3%. That certainly makes it easier to wait patiently till Powell et al decide to continue raising rates.

2. Technology

Tech shares are where long-time Berkshire watchers can begin to see the passing of the torch to the next generation of management. The 88-year old Buffett has been known for generally avoiding tech stocks, though during the past few years, positions in technology-oriented companies have become more sizeable within Berkshire's portfolio. Three years ago, for example, Apple became Berkshire's largest single holding, worth approximately $40 billion dollars. Still over the past quarter, 2.9 million shares of the iPhone manufacturer were sold, at an average price of $192 ($174.23 today).

Red Hat (NYSE:RHT), an open source cloud company acquired last October by IBM (NYSE:IBM), was added. It's an interesting move since Berkshire revealed last May that it had sold off its long held, multibillion dollar IBM position. Berkshire bought 4.1 million shares of Red Hat at an average price of $160 ($182.40 today). According to the filing, Berkshire started buying Red Hat before the acquisition announcement.

The big news during the past quarter, however, was the liquidation of Berkshire's Oracle (NYSE:ORCL) stake. In Q3, the holding company took a $2.1 billion position in Oracle, only to sell out of it entirely within a few short months, a previously unheard of move for Buffett.

What to make of all this? The cuts to its Apple position are of little consequence...yet. Berkshire still holds $40 billion worth of Apple shares. Though the tech company struggled in Q4, its valuation multiple (P/E ratio of 14) combined with its $245 billion war chest should allow every Apple investor to sleep relatively well.

Red Hat shares post-acquisition are another matter. IBM had to pay a 63% premium to acquire Red Hat, which made the shares much more expensive. Plus, now that they're under IBM's umbrella, we don't see that as a good longer term deal.

As well, the Oracle fiasco makes us wonder if it wasn't one of Buffett's lieutenants who opened the position last quarter, only to have Buffett—who isn't interested in another aging tech company with stagnating revenues and strong competition in the cloud space—close it.

3. A Surprising Stake Increase

While big moves in the financial and technology sectors, which make up a combined 67% of Berkshire Hathaway's portfolio, were to be expected, its 2-million additional shares, for a 37% increase in General Motors (NYSE:GM), which closed at $40.14 yesterday, comes as a complete surprise. At an average purchase price of $34 per share, Berkshire added $680 million to its GM stake, which is now at $2.4 billion.

Was this unexpected move a good one? That's difficult to asses just yet though it certainly plays into Buffett's investment strategy. The Detroit-based automaker is cheap, with a P/E ratio of 6, and pays a 3.8% dividend. And once again, he's bought American, which in his latest shareholder letter is lauded as an "extraordinary" country for its many business achievements.