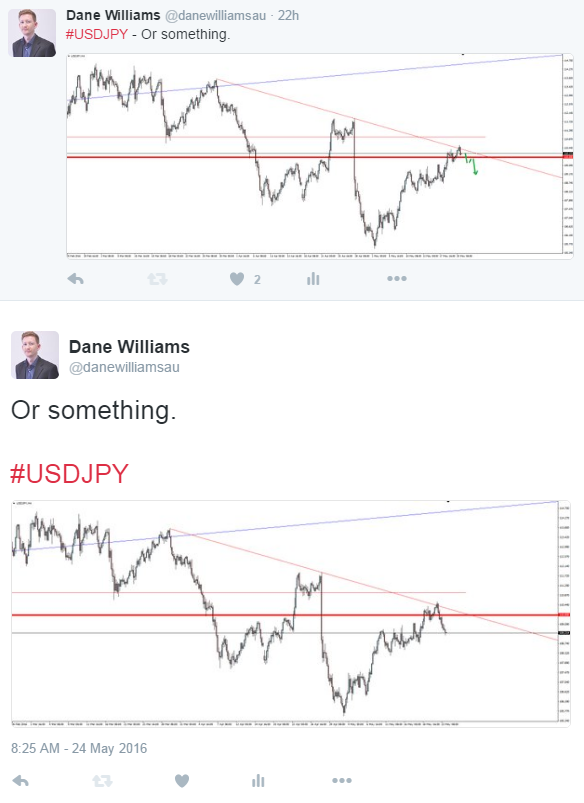

USD/JPY Scenarios, Brexit Quotes and a Lead in to Stevens’ Speech:

The confluence of resistance on the USD/JPY 4 hour chart that we spoke about in yesterday’s currency wars flamed blog held, and our trading scenario played out nicely.

Well done to the Vantage FX traders who managed to get on board short at the pull-back into resistance when the 110 level failed to be reclaimed.

On the fundamental side, Japanese flash manufacturing PMI and industries activity actually missed expectations. Yes the trade balance improved, but with imports and exports both declining, this seems to trump the headline print.

So why is the yen the big beneficiary on the day you might ask? Ah, the battle between technicals and fundamentals. The technical move was also backed up by the G7 calling out the BoJ on intervention and the tier 3 data misses just got lost in the noise.

But seriously, as if a G7 comment is going to have any sort of an influence on internal monetary policy decisions at the BoJ though… Come on.

As always, you can’t go wrong finding your major levels and managing your risk around them.

Speaking of fundamentals and major levels, we yesterday Tweeted a BBC article on recent Treasury analysis of a Brexit. I don’t want to get into the political tit for tat and what is actually true, but the bottom line is that for traders it doesn’t matter what is true. The figures are out there and markets are reacting to them. For us, that’s all that matters.

Here are some of the quotes that markets are digesting from Chancellor George Osborne and PM David Cameron:

“A ‘leave’ vote would cause an immediate and profound economic shock, with growth between 3% and 6% lower.”

“Leave was the self-destruct option for the country.”

Obviously, they’re not messing around and this sort of thing is going to have an impact on pricing.

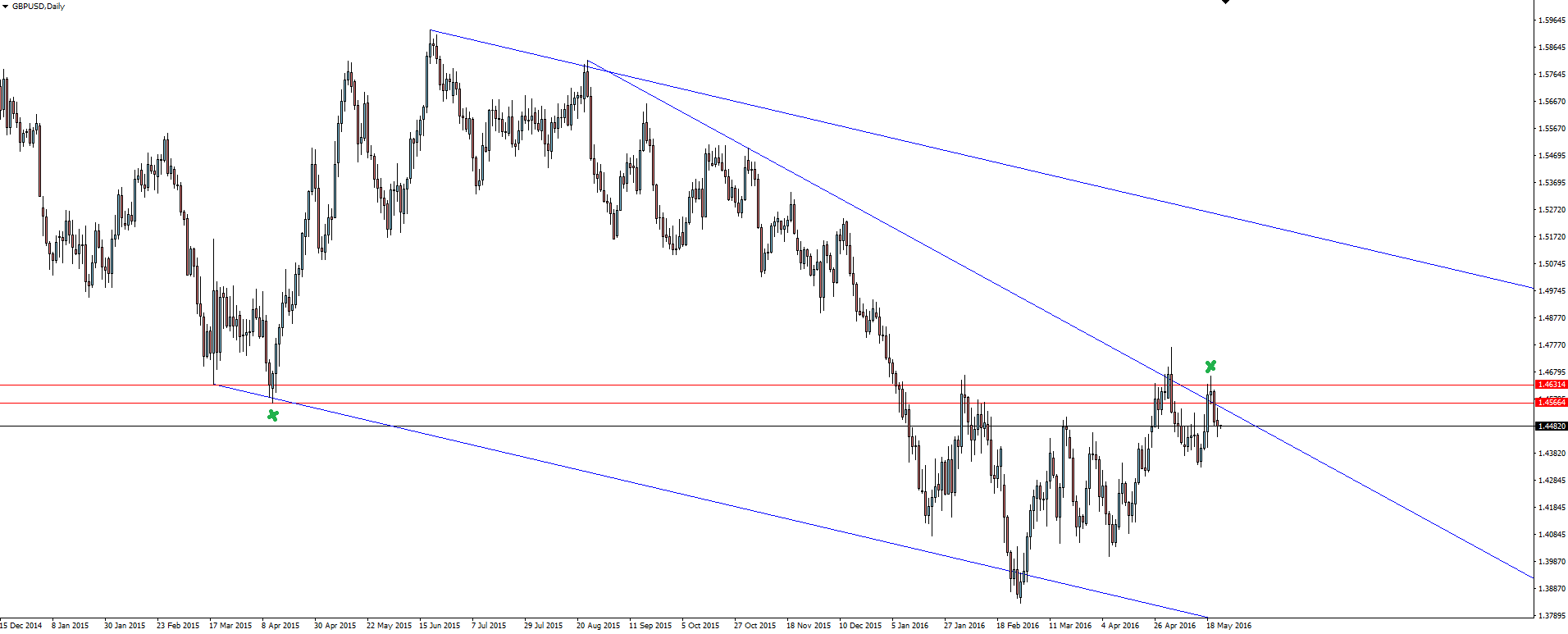

GBP/USD Daily:

I think about the Scottish referendum and how cable reacted to the vote there. I see a parallel between Scotland voting to stay within the UK and a Bremain vote because they would both be GBP positive. The polls were also in a similar position, in that the stay vote was always leading. But GBP/USD actually sold off into the vote and continued south from there.

With price pulling back to re-test previous support as resistance on that above daily chart, could history repeat itself?

Chart of the Day:

As for the Australian dollar, the charts in last week’s AUD/USD blog still hold true, with the major AUD/USD support levels still in play.

Be aware that today Reserve Bank of Australia Governor Glenn Stevens is due to speak in Sydney at the Trans-Tasman Business Circle briefing. After the most recent rate cut and meeting minutes, I’m not expecting too much in terms of adding to the monetary policy narrative, but really who knows.

AUD/JPY Daily:

I’ve included a nice little AUD/JPY coil at higher time frame support. It also goes along with the buy narrative outlined in the AUD/USD blog post linked to above.

On the Calendar Tuesday

AUD RBA Gov Stevens Speaks

EUR German ZEW Economic Sentiment

GBP Inflation Report Hearings

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex Broker FX Broker Vantage FX Pty Ltd does not contain a record of our prices, low spreads or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and marketing material – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, Australian Forex Broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.