This article was written exclusively for Investing.com

- Shares plunged from February 2018 through March 2020

- A rebound to over the midpoint of the move

- Inflationary pressures lift all raw materials - Iron ore and steel prices have roared higher since March 2020

- US infrastructure rebuilding bullish for US Steel: earnings trend and forecasts

- Levels to watch in the volatile stock

One of my all-time favorite movie sagas is the Godfather series. In Godfather II, gangster Hyman Roth tells Michael Corleone, referring to their nefarious business operation in the US and Cuba, “We’re bigger than US Steel.”

Hyman Roth was a fictional mobster based on Meyer Lansky, a prominent American organized crime figure. With his associate, Charles “Lucky” Luciano, Lansky was instrumental in developing a national crime syndicate in the United States. The line from the Godfather was an example of fiction meeting fact as Lansky reportedly made that statement, comparing his business to US Steel, to his wife while watching a news story on the Mafia.

In Lansky’s heyday, United States Steel (NYSE:X) was a leading American company. As of Aug. 30, 2021, X’s market cap stood at just above $7.46 billion, with the stock at the $27.06 per share level. If Lansky wanted to compare his business to a leading company today, he would likely pick Apple (NASDAQ:AAPL) instead, with its over $2.456 trillion value.

Meanwhile, US Steel has made quite a comeback over the past year. The stock sank to its lowest level in decades during March 2020 when it reached $4.95 per share, and the market cap dropped well below the $2 billion level.

Shares plunged from February 2018 through March 2020

In late February 2018, US Steel shares reached a high of $47.64, where they turned lower.

Source: Barchart

As the chart above highlights, X made lower highs and lower lows, falling to $4.54 per share during March 2020, less than one-tenth the price two years earlier.

At the height of selling on the back of the global pandemic, X looked like it was heading for bankruptcy, but the company survived. In fact, investors who purchased the shares near the 2020 low were handsomely rewarded.

A rebound to over the midpoint of the move

The midpoint price from the February 2018 high to the March 2020 low is at $26.09 per share. Over the past seventeen months, US Steel made an incredible recovery as inflationary pressures caused a turnaround in the prospects for the steel market.

Source: Barchart

The chart shows X climbed to its most recent high, at $30.57, on Aug. 18 and was trading at the $27.06 level on Aug. 30. The two-year price plunge ended in early 2020, and X has been trending higher for almost a year and a half.

Inflationary pressures lift all raw materials; Iron ore, steel prices have roared higher since March 2020

Iron ore is the primary ingredient in steel. The price of the raw material has been nothing short of explosive since reaching a low of $61.57 per ton in April 2020.

Source: Barchart

The chart above shows the price to a high of $219.77 per ton in July 2021, over three and one-half times the price at the April 2020 low. At near the $149 level on Aug. 30, iron ore was still well over double the price at the low.

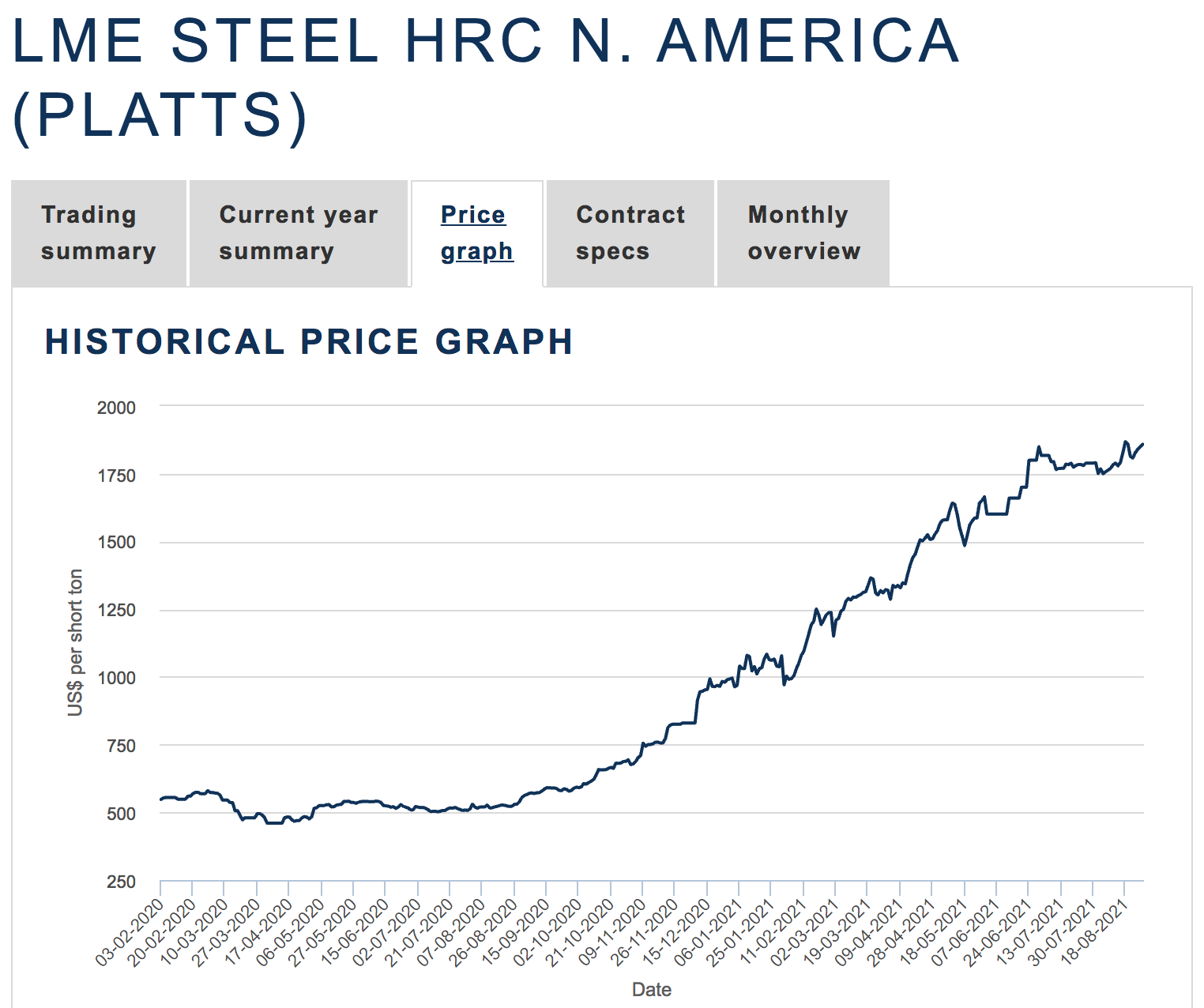

Steel prices have roared higher along with many other commodities since making lows in early 2020.

Source: LME

The chart shows that steel forwards HRC North America rose from $460 in April 2020 to the most recent high of $1868.50 per short ton. At the end of last week, the price was just below the high at $1859 per short ton. The rise in steel prices has been highly bullish for US Steel shares.

US infrastructure rebuilding bullish for US Steel: earnings trend and forecasts

With the US pouring billions, if not trillions, of dollars into infrastructure rebuilding over the coming years, steel demand will rise, supporting US Steel’s earnings and shares.

At $27.06 per share, X’s market cap stood at $7.461 billion. The stock trades an average of nearly 19 million shares each day. US Steel pays its shareholders a small 4.0 cents per share dividend, which translates to a 0.15% yield.

X’s earnings have moved from a loss to a profit over four consecutive quarters, beating forecasts with each report.

Source: Yahoo (NASDAQ:AABA) Finance

The chart shows that the market expects X to report earnings of $3.50 per share when it releases its next quarterly results on Oct. 27. A survey of nine analysts on Yahoo Finance expects the share price to rise to an average of $34.09, with estimates ranging from $24.30 to $49 per share. Analysts remain bullish on the prospects for X shares.

Levels to watch in the volatile stock

The technical trend in US Steel remains bullish as we move into September 2021.

Source: Yahoo Finance

The long-term chart shows the first upside target sits at the early 2018 $47.64 high, which is just below the high end of the analyst’s forecast range. Above there, the February 2011 $64.03 and April 2010 $70.95 highs are resistance levels.

The trend is always your friend in markets across all asset classes. Commodity prices are trending higher, with iron ore and steel prices sitting not far from the highs. US Steel profits are likely to continue to rise with the demand for steel in the US and worldwide.

The company’s shares have made an amazing comeback and look poised to continue their ascent.