The labour market hasn't been this tight since September last year, when the unemployment rate was 3.6%.

- The unemployment rate dropped to 3.7% in February, well below forecast.

- The RBA are hoping to see labour conditions ease through the year.

- An unemployment rate of about 4.5% is considered non inflationary.

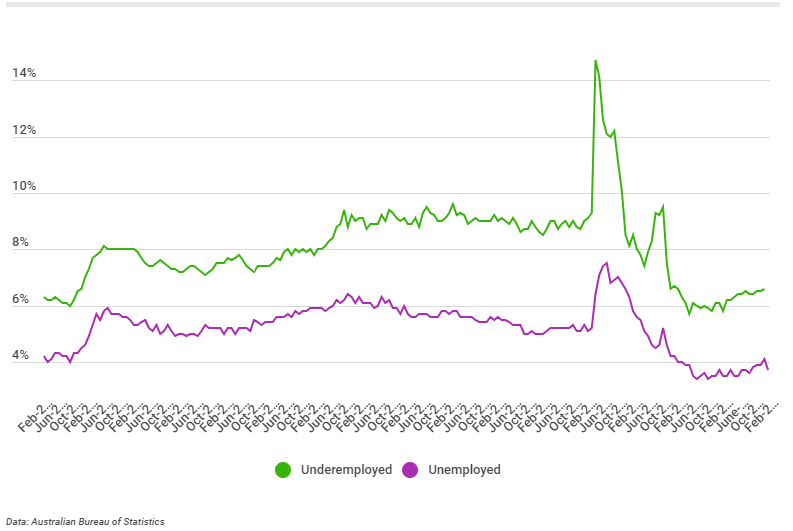

Employment to population rose slightly from 63.9% in January to 64.2%, while the underemployment rate was steady at 6.6%.

Data from the first couple months of 2024 has been described by economists as "choppy", with changing trends in how people leave and start new jobs affecting the data.

The trend measurement of unemployment was steady at 3.8%, suggesting the ABS' 'seasonal adjustment' may have failed to account for the changing nature of jobs and job hunting.

"Driving this pattern has been more than usual people 'attached' to a job but still waiting to start work over year-end," said Tapas Strickland, NAB's head of market economics.

"Pandemic era behaviour by firms shifting hiring given holiday shutdowns and mandated annual leave taking looks to be persisting in the post-pandemic era environment."

A slight drop in unemployment back down to 4% was forecast by economists from all of the big four banks, with CBA economist Harry Ottley explaining the January jump in unemployment.

"The soft print in January was impacted by seasonal changes in hiring patterns," he said.

"More than usual people were unemployed but expected to start a job soon."

ABS Head of Labour statistics Bjorn Jarvis said the numbers were partly attributable to a "wider gap than we would usually see" between those entering employment and those leaving.

"In 2022 and 2023, around 4.3% of employed people in February had not been employed in January," he said.

"In 2024 this was higher, at 4.7%, and well above the pre-pandemic average for 2015 to 2020 of around 3.9%.

"In contrast, we again only saw around 3.1 per cent of employed people in January leaving employment by February, which was similar to last year and has remained relatively constant over time."

RBA watch

The RBA will be paying close attention, with part of the inflation outlook dependent on the unemployment rate rising to 4.5%, considered to be the lowest rate that isn't inflationary.

In Tuesday's cash rate decision, RBA boss Michele Bullock said one of the ongoing uncertainties moving forward is the labour market, and how wages will respond to low unemployment.

Per the ABS, wages are now growing faster than inflation, with growth expected to soften as the labour market loosens.

While today's numbers suggest the labour market is holding up tighter than expected, the most recent RBA Statement on Monetary Policy forecast the average quarterly unemployment rate to be 4.2% for June, which could still be on the cards

In a speech last year, Michele Bullock said the RBA was taking a different approach to other nation's central banks, choosing to accept inflation returning to target more gradually to preserve more employment gains.

"A faster return to target would likely mean more job losses in the short term," she said in June.

"Our judgement is that if we can return inflation to target in a reasonable timeframe, while preserving as many of the employment gains as we can, that would be a better outcome."

Calls for Jobseeker to increase

An increase in unemployment is usually seen as a necessary evil to reduce excess demand in the economy.

For those who lose their jobs however, this probably isn't very consoling, and the Australian Council of Social Services is calling for the government to raise social security payments for people who are doing it tough.

"People living on woefully low income support payments are doing things like eating one meal a day, turning off the fridge at night to save electricity and cutting diabetes medication by half to make it last longer," ACOSS CEO Cassandra Goldie said.

ACOSS is calling for tax reforms to fund these increases, including additional levies on superannuation investment income post retirement, new royalties on offshore gas and cutting capital gains tax discounts in half to 25%.

"Unemployment rate drops to 3.7% in February" was originally published on Savings.com.au and was republished with permission.