S&P 500 total return index at all time high

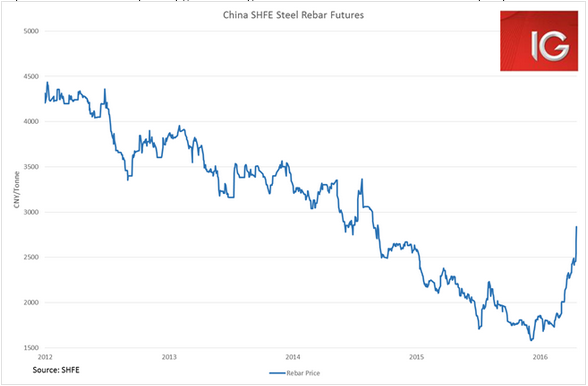

Despite a disconcerting 4% drop in Chinese equities yesterday, US and European markets managed to push higher. The all-important weekly US Department of Energy oil inventories number saw a further 2 million barrel increase in inventories, but this number was below consensus estimates and Tuesday’s API inventories number as well. This helped see WTI crude oil gain 3.8% overnight. But the Chinese stimulus driven surge in commodities continued to rally industrial metals. While the Chinese stock markets were selling off, Steel Rebar futures in Shanghai gained 6.3% to trade at their highest level since September 2014. Unsurprisingly, the energy and materials sectors were the strongest performers in most markets in the overnight session.

While the S&P 500 only added 0.1% overnight, the total return measure of the index broke to its highest level ever. With the current momentum, it is really only a matter of time before the nominal index follows it higher as well. It is not a market to be shorting at the current juncture; new all-time highs are bullish in short term, even if one may be expecting a reversal at some point. Currently, 83 out of 500 companies in the S&P 500 have reported earnings, with 85.5% beating earnings estimates and 60% beating revenue estimates.

The Asian session looks like it will have strong momentum at the open, with all indices expected to open higher. The USD/JPY is close to breaking through 110 after a 0.6% gain in the DXY dollar index overnight. This should be very positive for the Japanese market again today (IG calling it up 1.8% at the open), and investors are also hopeful that there may be some increase in ETF purchases at next week’s Bank of Japan meeting.

The ASX finally closed above 5200 for the first time since January 4, and the next key level in its sights if this momentum continues would be the 5300 level. BHP (LON:BLT) and RIO (LON:RIO)’s London listings performed well on the FTSE overnight. The iron ore price added another 3%, and the ASX materials and energy sectors look likely to see another strong day. The rally in the Big Four banks did appear to wilt in the second half of the session yesterday, and if the banks begin to fall out of favor again it will make it very difficult for the ASX to hit 5300, given their heavy market capitalization weighting. Myob (AX:MYO) is showing up in our momentum screeners again today, and is joined by Graincorp (AX:GNC) this time as well.

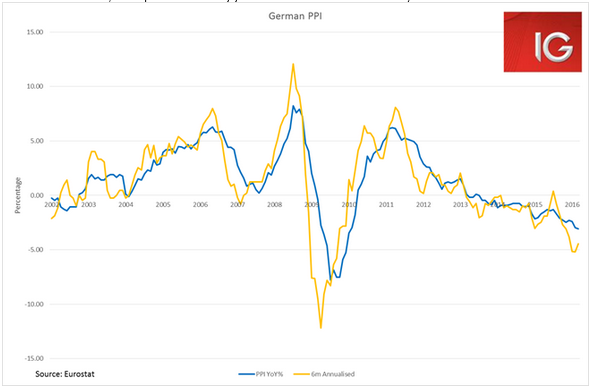

The ECB is expected to leave their policy settings unchanged at their meeting tonight. Although yesterday’s German PPI release will have done little to ease deflation concerns, as it posted the biggest decline seen since January 2010.

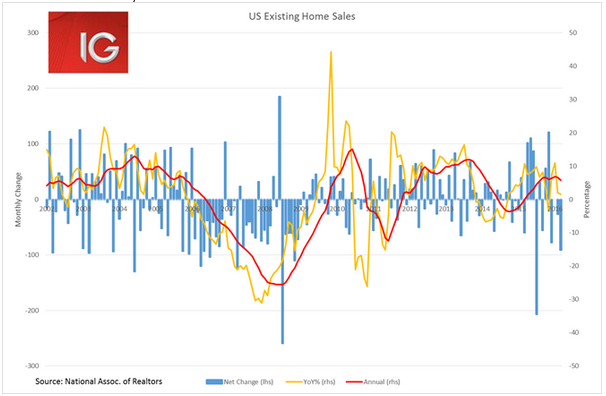

Even though poor US housing starts and building permits drove the USD sell off on Tuesday, last night’s existing home sales were little better and the USD rallied. The US housing market has not started 2016 well.

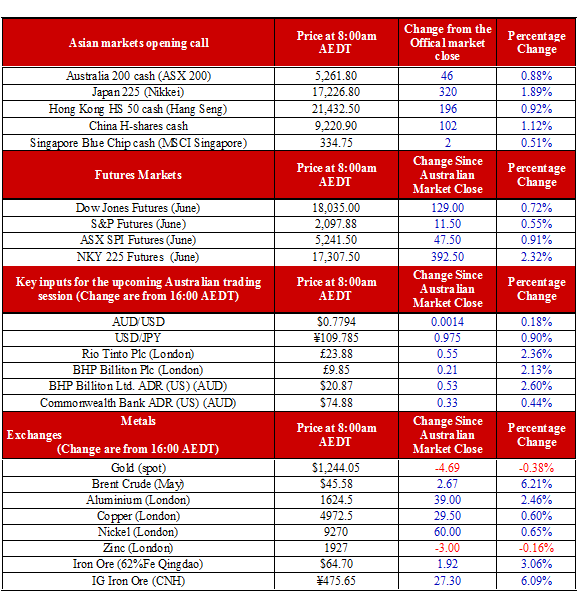

IG MORNING PRICES