By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

Currency traders are bracing for a busy week in the financial markets. There are 2 monetary policy announcements, 4 labor-market reports and a handful of PMIs. We started with U.S. dollar weakness but the greenback could easily regain strength if the Reserve Bank of Australia or the Bank of England is dovish -- or if non-U.S. data surprises to the downside. The greenback traded lower Monday against most of the major currencies despite an uptick in the ISM manufacturing index and personal income. The problem is that PMI rose less than anticipated and remained in contractionary territory for the 4th-straight month. Personal spending also stagnated toward the end of the year while construction-spending growth rose less. While these reports only serve to solidify our view that the Fed will forgo raising interest rates in March, for the time being the focus is on easier monetary policies and weakness abroad.

On Sunday night we learned that China’s manufacturing sector grew at its slowest pace in 3 years. The PMI index dropped to 49.4 from 49.7 with non-manufacturing PMI also slipping to 53.5 from 54.4. What's interesting about these numbers is that they conflict with the private Caixin report, which actually showed an improvement in manufacturing activity. Yet the fact that China did not show stronger numbers suggests that there could be even more significant underlying weakness. This is bad news for Australia but an easing bias for the RBA is not a done deal.

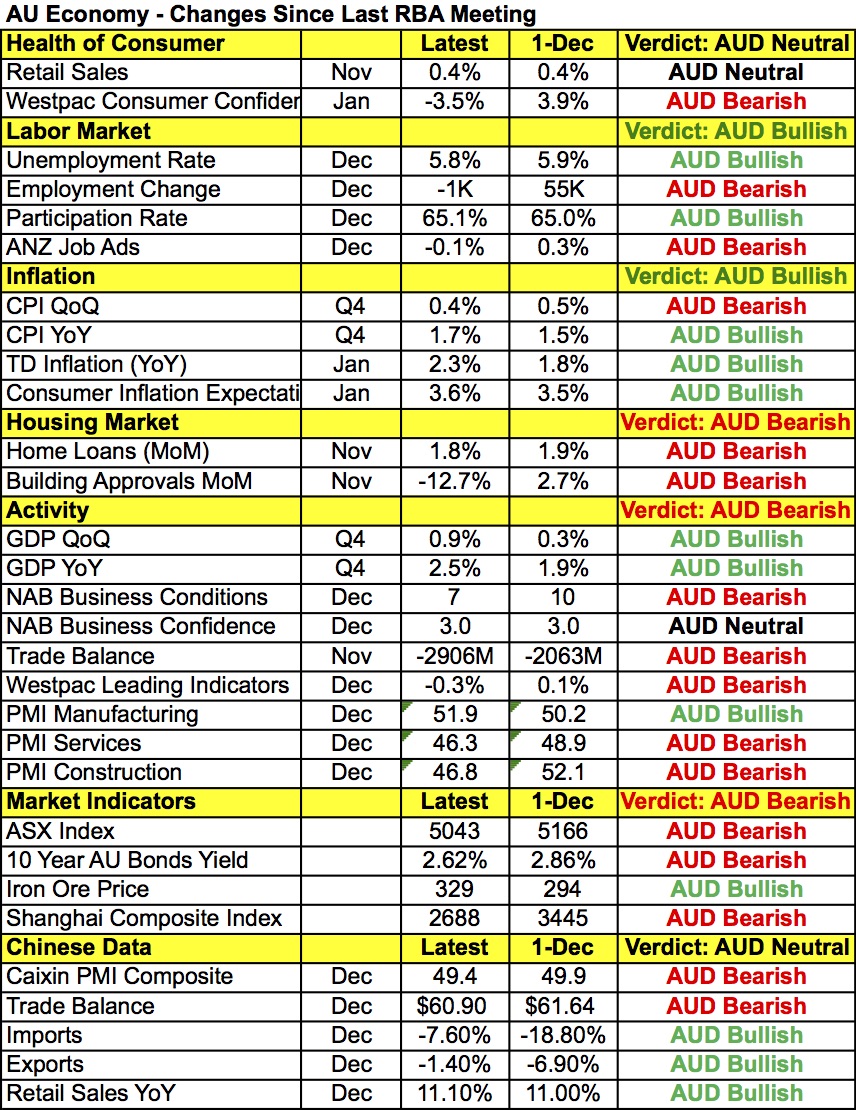

A lot has changed in the past 2 months, giving the Reserve Bank of Australia much to think about heading into Monday evening. While no change in interest rates was expected, investors were looking for signs of easing in the coming months. From the perspective of Chinese growth, financial market volatility and the decline in global inflation, the RBA should consider another rate cut. Taking a look at the table below, consumer confidence, job ads, housing-market activity, trade, business conditions, service and construction activity all deteriorated since the last central bank meeting in December. However steady retail-sales growth, stronger manufacturing activity, a drop in the unemployment rate, rise in the participation rate and relatively healthy job growth in October and November along with higher annualized CPI and inflation expectations provide reasons for the RBA to be optimistic. While oil prices are lower, gold and iron ore prices are higher now than in December, which means the prices of commodities that are important for Australia have increased.

Back in December, the RBA described the post-boom economy as “quite respectable” noting that looking ahead, “the outlook appears to be for a continuation of moderate growth". While there’s a lot more to be concerned about in 2016, the RBA also has reason to hold off adjusting its monetary-policy stance. This lack of clarity means that the best way to trade the RBA rate decision is to wait because, if it shifts to a dovish bias, the move lower in AUD/USD could be significant.

Meanwhile, many investors were confused about why the 6% drop in oil prices Monday failed to send the Canadian dollar sharply lower. Instead, USD/CAD closed firmly below 1.40. Apparently there was heavy selling by leveraged funds, which may continue. However when USD/CAD diverges that much from oil on a day where the U.S.–Canadian 2-year yield spread moved in favor of USD/CAD gains, we can’t help but view that as an attractive buying opportunity. The biggest risks for the Canadian dollar this week are the regularly scheduled weekly oil inventory data and Friday’s employment report.

Sterling was the day’s best-performing currency. Stronger-than-expected manufacturing activity and an uptick in mortgage approvals set the tone for trading. However GBP/USD didn’t gain traction until the North American session. The Bank of England meets this week and while we are still waiting for a few pieces of data to be released, we looked at how the U.K. economy performed over the past month and there has actually been material improvements since the January meeting. Most importantly, price pressures increased, consumer confidence improved and the unemployment rate ticked lower. Between Monday’s better-than-expected PMI manufacturing report and overstretched positioning (CFTC report short sterling positions at their highest level since 2013), Monday’s move in GBP/USD is a classic short squeeze.

Euro also traded higher against the greenback despite dovish comments from ECB President Draghi. Nothing new was said, but equally negative comments from ECB members Nowotny and Coeure confirm that the central bank is serious about easing. Nowotny said China is a particular concern and Coeure said the central bank may reconsider policy stance in March as it stands ready and able to play its part in recovery. As such, we continue to view the euro as a sell on rallies.

Finally, with a Global Dairy auction and fourth-quarter employment numbers scheduled for release Tuesday, the New Zealand dollar will also be in play. If dairy prices fall for the third auction in a row, it will reinforce the Reserve Bank’s concerns about the economy and revive the decline in the currency. However if prices recover, then part of these worries will fade and the recent rebound in NZD/USD will be justified.