- Cracks are emerging in the ongoing rally on Wall Street amid uncertainty over the outlook for inflation, the economy, and interest rates.

- As such, I used the InvestingPro stock screener to search for undervalued technology stocks that are trading are bargain prices and possess solid fundamentals and robust ‘Fair Value’ upside.

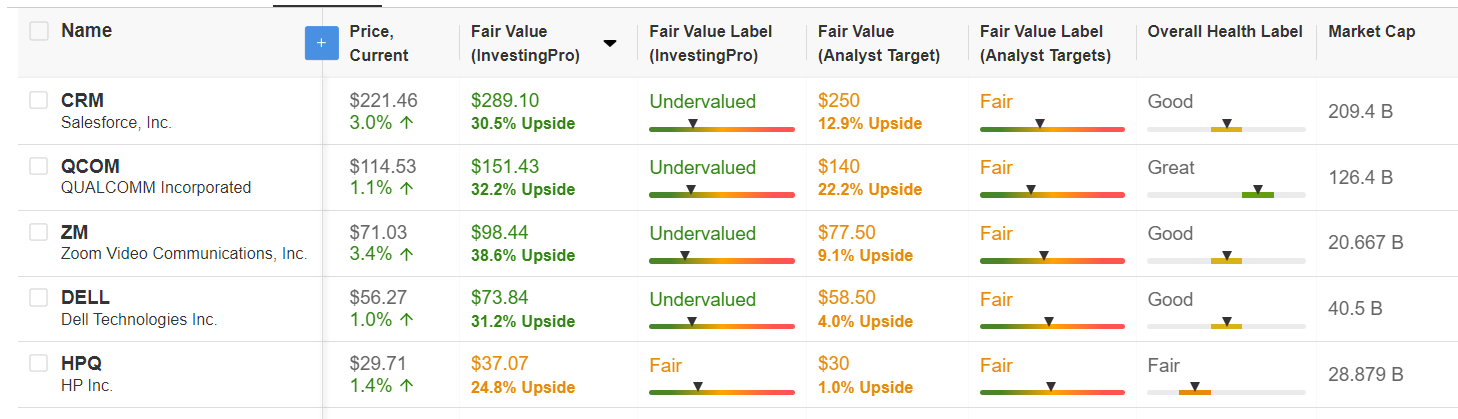

- Below is a list of five tech stocks which are expected to provide some of the highest returns based on the InvestingPro models.

The ongoing year-to-date rally on Wall Street is showing signs of exhaustion amid fresh uncertainty over the Federal Reserve’s outlook for interest rates and as recent data has painted a worrying picture of the economy.

All three main indexes posted losses for August, with the blue-chip Dow Jones Industrial Average falling 2.4%, while the benchmark S&P 500 and the tech-heavy Nasdaq Composite declined 1.8% and 2.2% respectively.

For the Nasdaq, it was the biggest monthly loss since December 2022.

As we head into a historically weak period for the stock market and investors grapple with fresh uncertainty surrounding the economy and Fed's rate plans, identifying undervalued stocks becomes paramount as investors find themselves seeking stability and potential opportunities.

Amid the current backdrop, I used the InvestingPro stock screener to search for the best undervalued technology stocks that have the potential to provide attractive investment returns in the months ahead.

InvestingPro's stock screener is a powerful tool that can assist investors in identifying cheap bargain stocks with strong potential upside. By utilizing this tool, investors can filter through a vast universe of stocks based on specific criteria and parameters, saving you substantial time and effort.

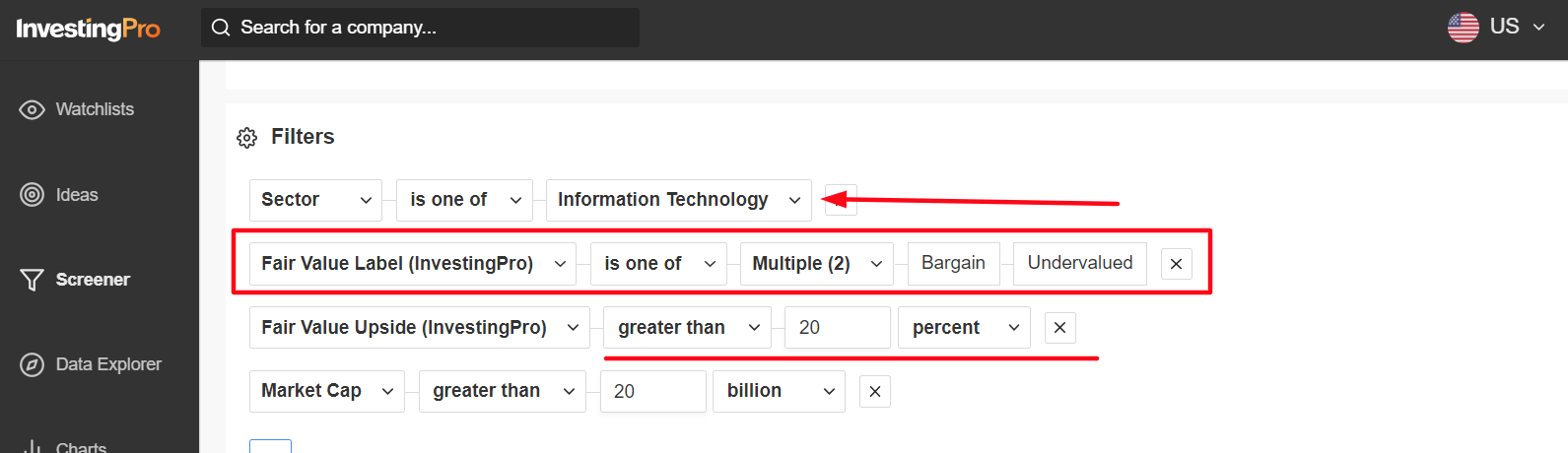

To identify technology stocks that are currently trading at bargain prices, I first scanned for companies with an InvestingPro ‘Fair Value’ Label of either ‘Bargain’, or ‘Undervalued’.

Source: InvestingPro

I then filtered for names with an InvestingPro ‘Fair Value’ upside greater than or equal to 20%. The Fair Value estimate is determined according to several valuation models, including price-to-earnings (P/E) ratios, price-to-sales (P/S) ratios, and price-to-book (P/B) multiples.

And those companies with a market cap of $20 billion and above made my watchlist.

Once the criteria were applied, I was left with a total of just five companies. All five stocks offer compelling valuations, strong fundamentals, and the potential for long-term growth.

These 5 Stocks Are Trading At Bargain Prices According to InvestingPro

Among the information technology space, here are the top five stocks that are expected to provide investors with some of the highest returns, based on InvestingPro ‘Fair Value’ price targets. Source: InvestingPro

Source: InvestingPro

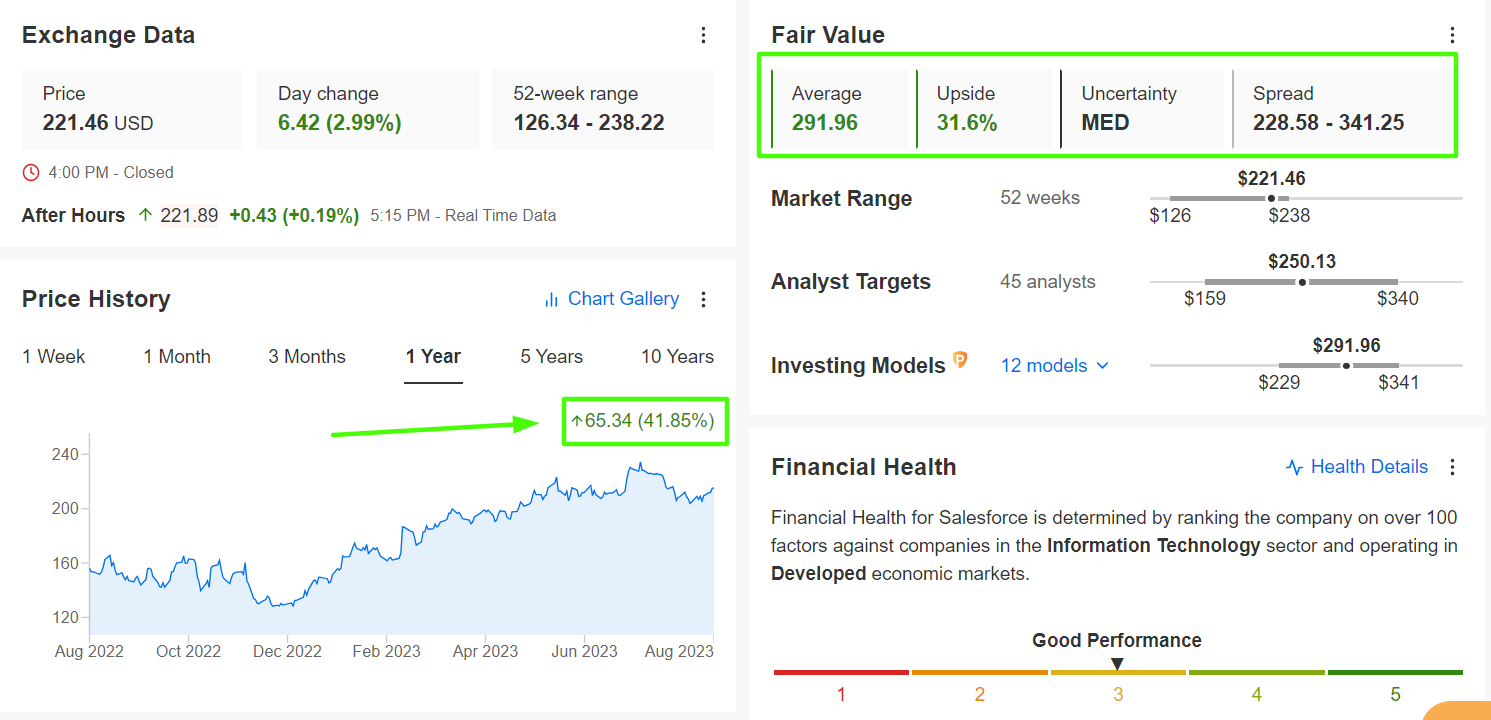

1. Salesforce

- Thursday’s Closing Price: $221.46

- Fair Value Estimate: $291.96 (+31.5% Upside)

As a leader in the customer relationship management (CRM) sector, Salesforce (NYSE:CRM) has consistently displayed impressive growth potential. Its innovative cloud-based software solutions have propelled the tech company to the forefront of its industry.

As businesses and organizations increasingly embrace digital transformation, Salesforce is well positioned to grow its profit and revenue amid resilient demand for its customer relationship management tools. Source: InvestingPro

Source: InvestingPro

Despite its strong year-to-date performance, Salesforce's stock is still extremely undervalued, according to the quantitative models in InvestingPro, making CRM an enticing option for investors. Even with the recent upswing, shares could see an increase of 31.5% from Thursday’s closing price of $221.46.

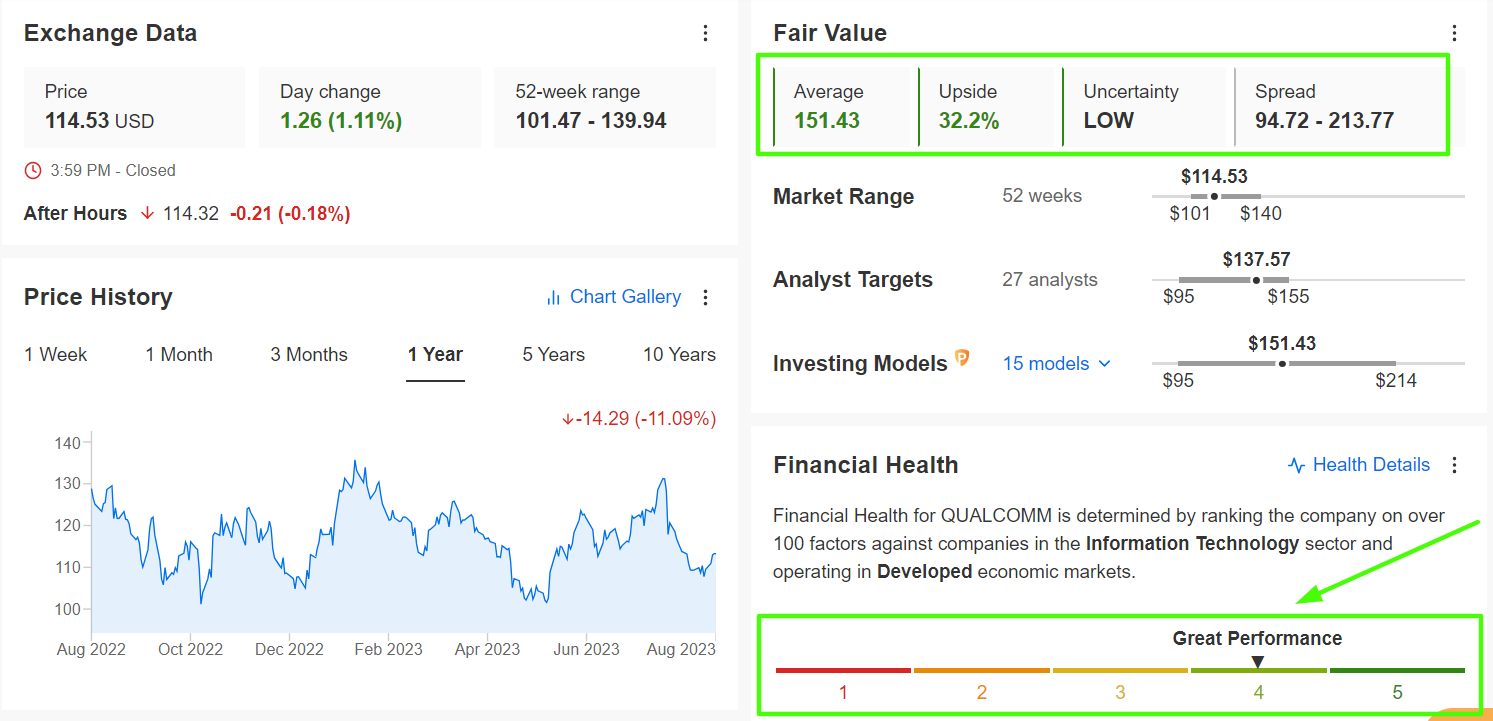

2. Qualcomm

- Thursday’s Closing Price: $114.53

- Fair Value Estimate: $151.43 (+32.2% Upside)

Qualcomm's (NASDAQ:QCOM) leadership in the semiconductor industry, particularly in mobile technology, makes it a compelling growth story. With the rollout of 5G technology, the demand for advanced mobile devices and connectivity solutions is on the rise. The company's prominence in this space gives it a competitive edge over other semiconductor manufacturers.

In a sign of how well its business has performed over the years, the San Diego, California-based chipmaker has raised its annual dividend payout in each of the past 20 years.

Source: InvestingPro

Source: InvestingPro

As per InvestingPro, investors have the opportunity to purchase Qualcomm’s stock at a discounted price. The average ‘Fair Value’ price estimate for QCOM (NASDAQ:QCOM) stands at $151.43/share, implying potential upside of 32.2%.

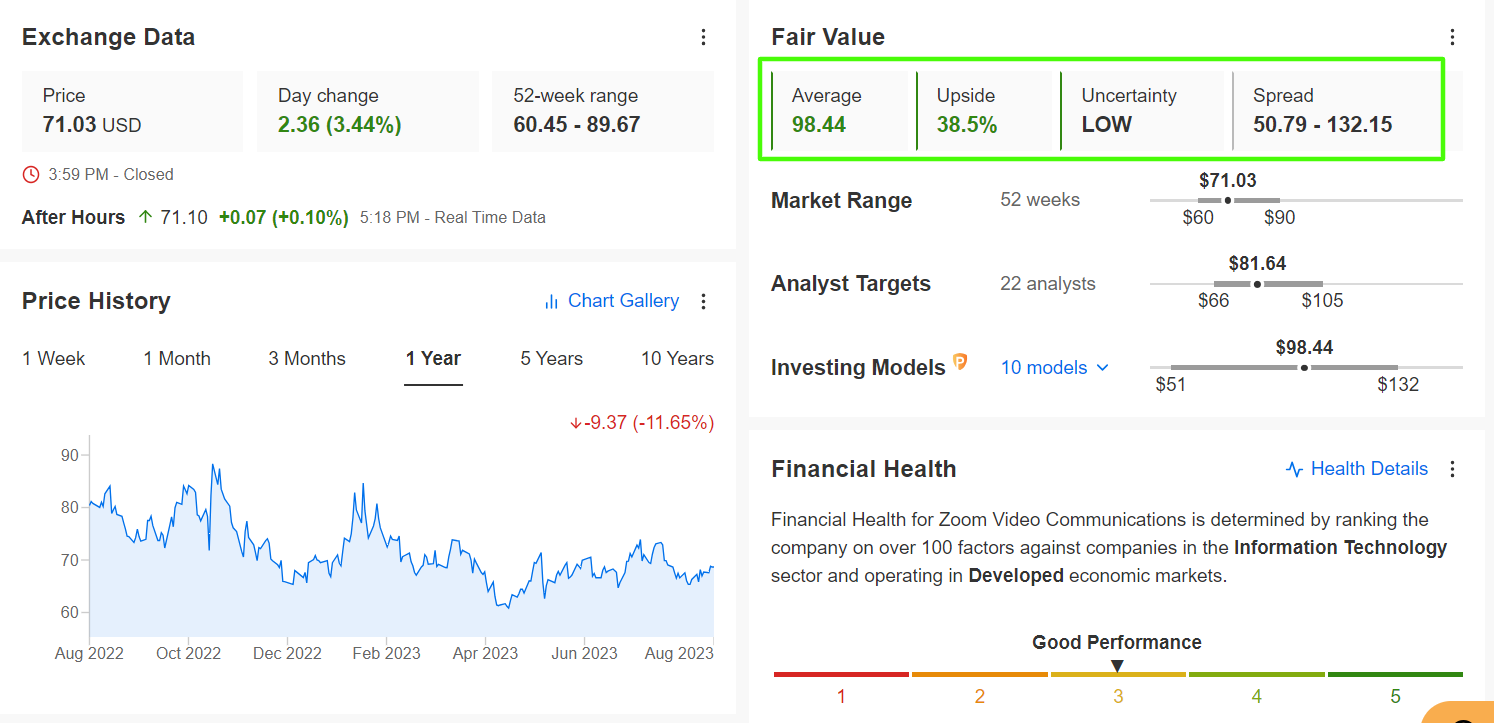

3. Zoom Video

- Thursday’s Closing Price: $71.03

- Fair Value Estimate: $98.44 (+38.5% Upside)

Zoom Video's (NASDAQ:ZM) meteoric rise during the Covid pandemic in 2020 catapulted it to the forefront of the emerging communication and collaboration space. Its user-friendly platform has since become synonymous with remote work and virtual meetings.

As hybrid work continues to shape the future of the business world, the video-conferencing company’s growth prospects remain strong, despite recent headwinds. Source: InvestingPro

Source: InvestingPro

ZM (NASDAQ:ZM) stock is currently trading at a bargain valuation, according to the InvestingPro model. Shares could see an increase of 38.5% from yesterday’s closing price, bringing it closer to its ‘Fair Value’ of $98.44 per share.

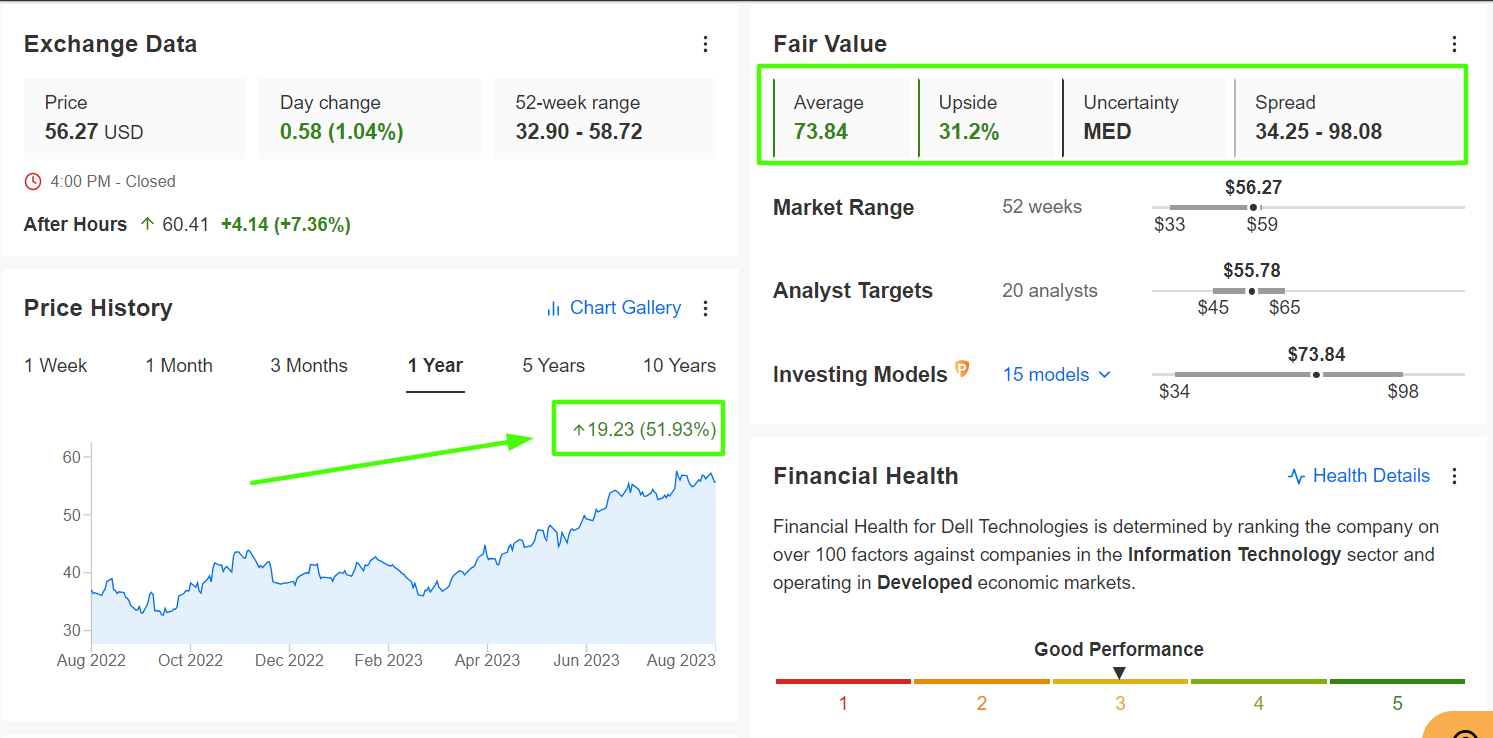

4. Dell Technologies

- Thursday’s Closing Price: $56.27

- Fair Value Estimate: $73.84 (+31.2% Upside)

Dell Technologies' (NYSE:DELL) diversified portfolio spanning hardware, software, and services positions it well for future growth. Its ability to adapt to changing technology trends and deliver comprehensive solutions allows it to cater to a wide range of enterprise needs.

It should be noted that Dell offers investors an annualized dividend payout of $1.48 per share at a yield of 2.66%, one of the highest in the information technology sector. Source: InvestingPro

Source: InvestingPro

Currently trading at a bargain according to several valuation models on InvestingPro, DELL stock presents an affordable opportunity for investors seeking exposure to the tech sector. The ‘Fair Value’ price target for DELL stands at about $74, a potential upside of 31.2% from the current market value.

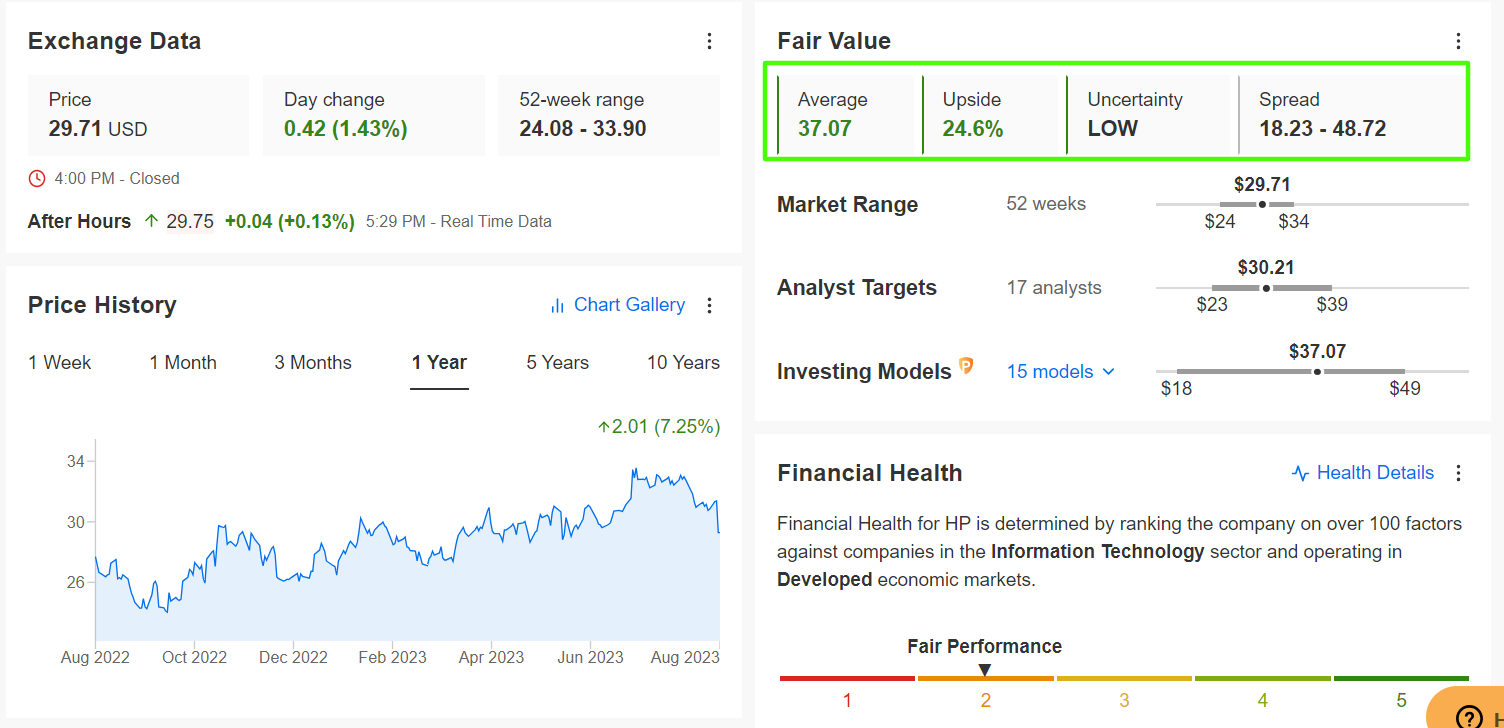

5. HP

- Thursday’s Closing Price: $29.71

- Fair Value Estimate: $37.07 (+24.6% Upside)

HP (NYSE:HPQ) has established itself as a leading player in the technology industry, particularly in personal computing and printing solutions. Its ongoing commitment to research and development keeps it competitive in evolving markets.

In addition to encouraging fundamentals, HP remains committed to returning additional capital to its investors in the form of increased cash payouts, having raised its annual dividend for six years running to $1.05. Shares currently yield 3.58%, more than double the implied yield for the S&P 500 index, which is 1.44%. Source: InvestingPro

Source: InvestingPro

Given the company’s impressive history and growth potential, HP’s stock is trading at an attractive price point according to the quantitative models in InvestingPro. Shares could see an upside of about 25% from Thursday’s closing price, bringing HPQ (NYSE:HPQ) closer to its ‘Fair Value’ price target of $37.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading decisions.

Enjoy the last days of our summer discounts by clicking on the image below!

***

Disclosure: At the time of writing, I am long on the Dow Jones Industrial Average via the SPDR Dow ETF (DIA). I also have a long position on the Energy Select Sector SPDR ETF (NYSE:XLE) and the Health Care Select Sector SPDR ETF (NYSE:XLV). Additionally, I am short on the S&P 500, Nasdaq 100, and Russell 2000 via the ProShares Short S&P 500 ETF (SH), ProShares Short QQQ ETF (PSQ), and ProShares Short Russell 2000 ETF (RWM).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.