The pace of the upcoming disinflationary impulse is likely to surprise many: most of our TMC models and leading indicators confirm our call for US core CPI to be in the 3% area by December, and to drop at or below Fed target in early 2024 already.

We believe markets are far from fully appreciating this major disinflationary impulse which brings important implications for macro portfolios.

Let’s review the evidence first.

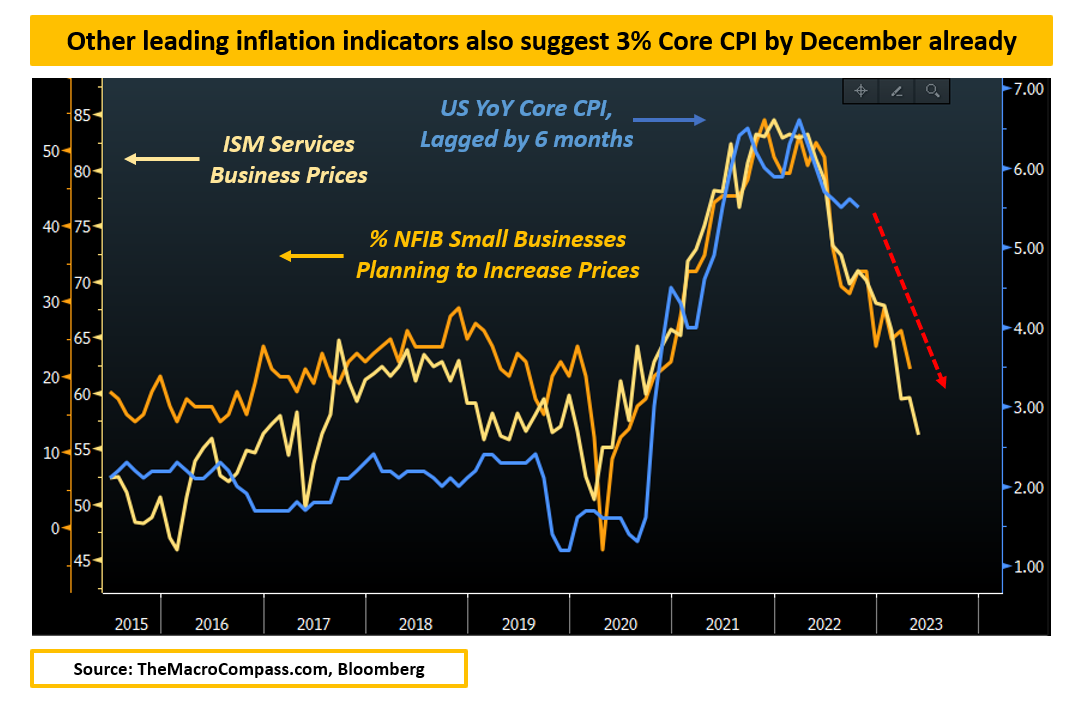

Services Sector Inflationary Pressures Are Abating

The subcomponents that measure expected services’ sector price pressures in the ISM Services and the NFIB Small Business survey (orange and yellow, LHS) tend to lead trends in YoY US Core CPI by 6 months (blue on RHS, lagged by 6 months).

Both indicators widely and correctly anticipated the rapid surge in core inflation in 2022, but they are now somehow ‘’overlooked’’ as delivering false signals on the downside – that’s called recency bias. Core (services) inflation is the most lagging macro variable in each cycle, and as the growth impulse and hiring trends have peaked in 2022 and slowed down ever since it makes sense core CPI would cool off too.

These leading indicators suggest US Core CPI should be in the 3% area by December already, and judging by their downward trend a 2%-handle in 2024 is not out of the question.

That would mean the Fed having effectively achieved their goal: that would be a massive change for macro investors out there.

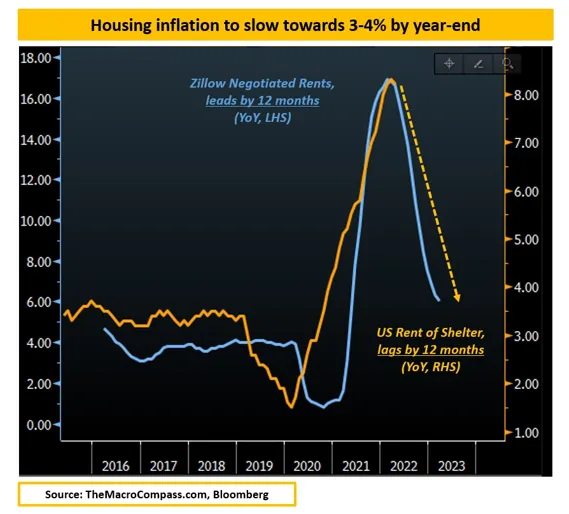

Don’t Forget Rent of Shelter

Rent of shelter represents about 40% of Core CPI, and as negotiated on-the-ground rent inflation has massively cooled off (blue, LHS) since mid-last year, we should start getting some serious disinflationary impulse in the official Rent of Shelter component (orange, RHS) about…now.

This is quite a known unknown amongst Fed members and market practitioners, but let me ask you this: what happens when we start actually getting consecutive 0.2% MoM Core CPI prints?

Even as a decline in rent of shelter inflation is expected, do you think the market is ready? I doubt it, so bear in mind this known unknown for the next few months.

***

Disclaimer: This article was originally published on The Macro Compass. Come join this vibrant community of macro investors, asset allocators and hedge funds - check out which subscription tier suits you the most using this link.