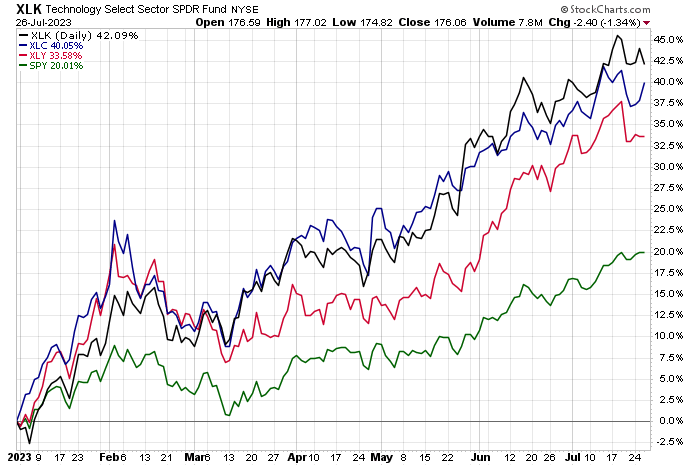

This year’s rally in US stocks continues to rely heavily on a handful of red-hot sectors, based on a review of ETFs through yesterday’s close (July 26). Shares in technology, communications and consumer discretionary are well ahead of the broad market, providing strong upside support.

The top-performing sector so far in 2023: technology. Technology Select Sector SPDR® Fund (NYSE:XLK) is up 42%-plus year to date. That’s more than double the broad market’s gain via S&P 500 (NYSE:SPY).

Close second- and third-place sector performers this year: communications (XLC) and consumer discretionary (XLY) shares. Both are also outperforming SPY by wide margins.

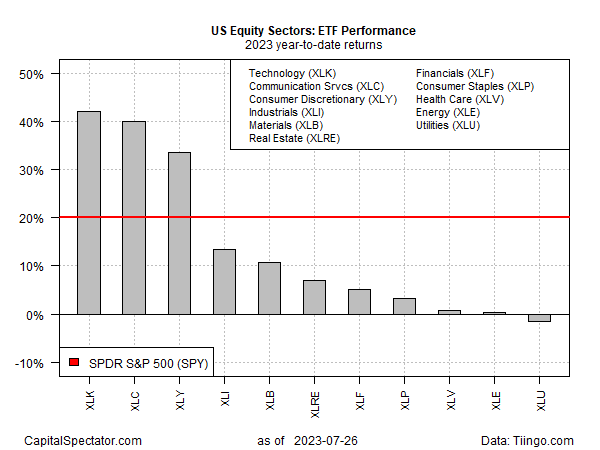

The lopsided performance profile worries some analysts, who say that the reliance on a handful of winners presages trouble for equities generally. Perhaps, but for now, the bullish momentum is helping to lift all, or at least most, boats, albeit in widely varying degrees.

Equity analysts at JPMorgan Chase warn that the stock market’s dependence on a small number of mega-cap names has increased at the fastest pace in decades, which is seen as a warning sign. JPMorgan Chase Chief Global Markets Strategist Marko Kolanovic advises that history suggests that when the market becomes dependent on a small number of big stocks, the trend ends in tears.

The contrast between winners and relative losers this year is certainly stark. As shown above, some of the sector laggards are barely participating in the broad market rally, if at all. Healthcare (XLV) and energy (XLE) have barely increased in 2023. Meanwhile, utilities (XLU) have lost ground.

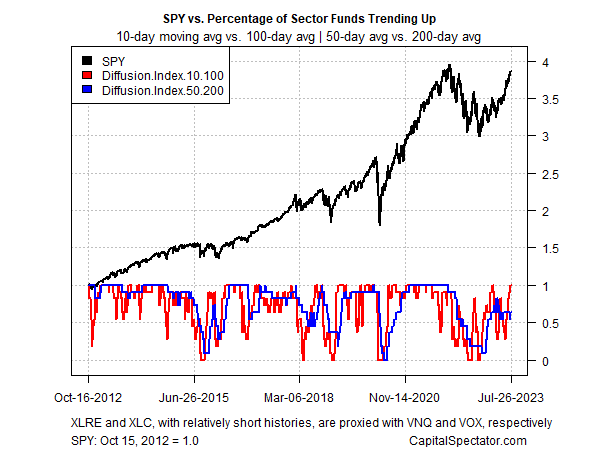

Profiling all the sector funds listed above shows that bullish momentum has gone into overdrive recently, based on a set of moving averages. In particular, short-term momentum (red line) has shot up to the highest level. The lack of confirmation so far, in medium-term momentum (blue line in chart below), raises questions about the durability of the market rally.