So much for the Cleveland Fed and their CPI projection. figures, I have been following the thing for months, and the one time I publically discuss it, everything falls apart. It must be my bad luck.

The bond and FX market certainly didn’t view the CPI 'miss' as a big deal. I say 'miss' because who cares if the headline CPI runs at 9.1% or 8.5%? It is still more than 6% away from the Fed’s target.

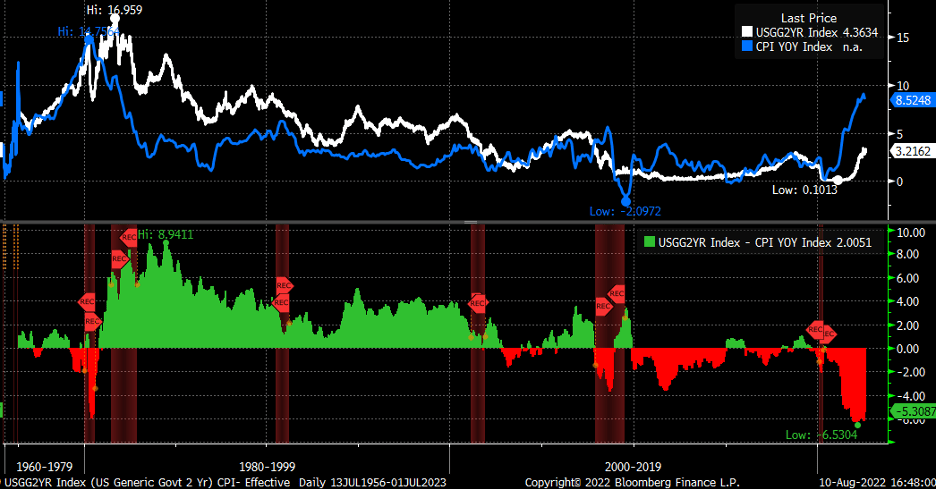

Look at it this way; the 2-year rate is now 5.3% below the inflation rate. That is on par with 1980, and for inflation to come down, the 2-year rate needs to keep rising. That was what brought inflation down in the 1980s. The bigger problem may be that the dovish pivot may have received another nail in its coffin today when the Atlanta Fed GDPNow tracker showed third quarter GDP growth of almost 2.5%. This number tends to decrease over time, but that is a significant change from the first and second quarters. If correct, then there is no reason for a weak economy to warrant a dovish pivot because it means the economy isn’t weak. It could even mean that the Fed’s neutral rate is much higher than what the Fed thinks, and rates may have to rise even more. It is a significant number that needs to be watched.

But fear not, the stock market, which is never the brightest light, soared by 2.1%. Yep, it makes sense, CPI missed right, so inflation has peaked. Whatever that means. Yes, so even if inflation stays at 8% for the next three months, it matters not because inflation peaked; yes, that makes perfect sense to me.

It doesn’t matter that the Atlanta Fed’s 12-month Sticky CPI hit a new cycle high of 5.8%.

S&P 500

The bad news for me is that my 2b top reversal pattern broke yesterday. The rising wedge is still present, and now I can add a rising flag pattern (RED) to the bearish pattern list. Yes, well, I call it a rising flag. That is when you have what looks like a flag, but instead of it sloping down, it slopes up. So, again, I’m still thinking we see the 3,950 region. I’m not saying it happens today; this is over the next couple of weeks.

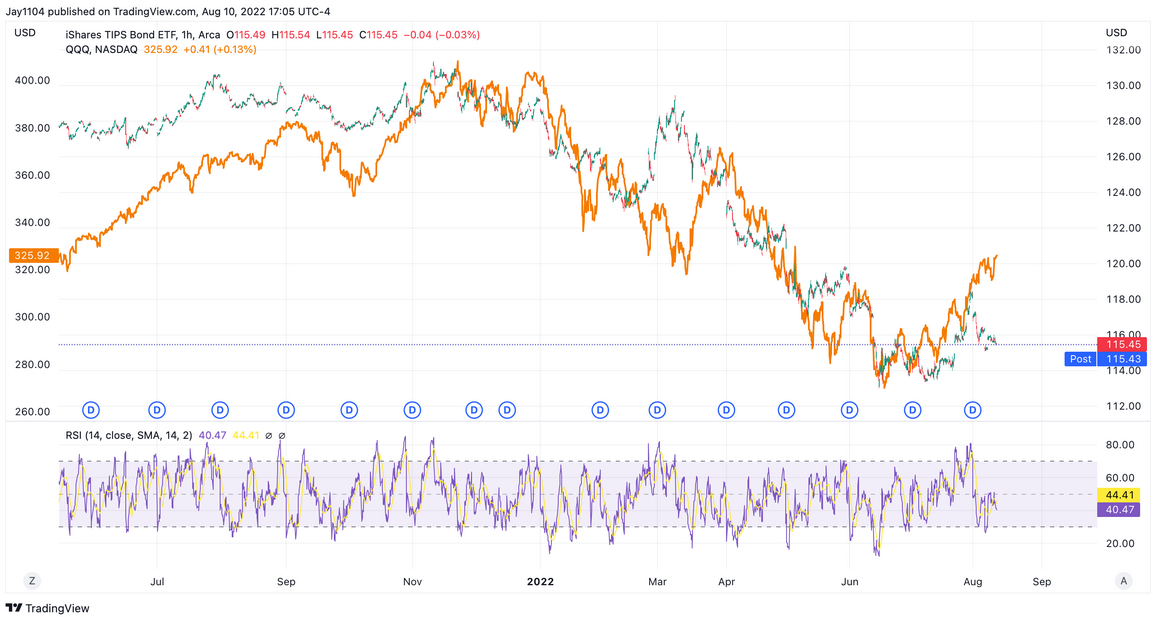

TIP

Meanwhile, TIP rates rose yesterday, and the divergence between the QQQ and the TIP ETF is getting to very uncomfortable levels. It is important to remember that the QQQ follows the TIP because the TIP represents real yields, and when the TIP ETF is falling, real yields are rising, and the more the TIP falls, the more expensive the QQQ gets relative to rates. Remember in the good ‘ole days when the Nasdaq was rising, and everyone was saying stocks were cheap because of negative real yields? Well, this is now working in reverse.

It means it will be painful when the QQQ catches down to the TIP.

VIX

The VIX fell below 20 yesterday, and the VVIX closed above 90 yesterday. The VVIX measures the expected volatility of the 30-day forward price of the VIX. Basically, implied volatility measures for the VIX are rising. So if the VVIX value is rising, it is probably a good indicator that the market is slowly and quietly starting to price in higher volatility levels.