By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

Hotter inflation does not equal a hotter dollar. The greenback either held steady or traded lower against all of the major currencies Tuesday as inflation grew by 0.3% up from 0.2% the previous month. This took annualized CPI growth to 1.5%, the strongest level in nearly 2 years but the problem is that all of the increase came from energy prices, which rose strongly last month. Excluding food and energy costs, CPI growth actually slowed to 0.1% from 0.3%, dragging the year-over-year rate down to 2.2% from 2.3%. Energy cost can be extremely volatile month to month and with OPEC working on capping production, the recent rebound in oil prices could fade quickly. Rate-hike expectations have not been altered by the CPI report and the mild pullback in Treasury yields confirms that. For the second trading day in a row, USD/JPY ended the North American trading session below 104. While we are long-term dollar bulls, four days of lower highs raises the possibility of a deeper correction that could see the pair down to 103.00. How far USD/JPY falls will be determined by yields. If U.S. rates continue to slip, USD/JPY will follow. But if they rebound and head back above 1.80% (and we think they eventually will), the currency pair could find its way back to 104.50. U.S. housing starts and building permits are scheduled for release on Wednesday along with the Federal Reserve’s Beige Book report. The latter should be more market-moving as investors will be combing through the report for fresh insight into the performance of the U.S. economy.

The pound led a furious charge against the weakening greenback, gaining almost 1% on the day. GBP/USD surged from 1.2183 to 1.2325 before settling near 1.23. This was the strongest one-day rally for GBP/USD since September. The rally was driven by comments from James Eadie, a lawyer representing the UK Government who suggested that it was “very likely” that MPs would be able to vote and ratify a deal before Brexit can happen. Although no formal decision has been announced as of yet, reports of Parliament’s involvement is positive for the currency as many members disapprove of a “hard Brexit.” The news about Brexit overshadowed mixed U.K. data. CPI was in line with expectations on a month-over-month basis, reporting an increase of 0.2%. Compared to last year, CPI increased 1% vs. 0.9% expected. PPI, however, showed the flipside, as data missed, registering a 0.0% increase when an increase of 0.4% was expected. U.K. labor data is scheduled for release Wednesday and based on the PMIs, labor-market activity should have improved significantly last month but the focus will be on wages. Considering that it will be a long rocky road for Britain from here to the official departure from the European Union, we still view sterling as a sell on rallies. But with the potential for stronger labor-market data, it may be smarter to wait until the pair breaches 1.24 or, better yet, 1.2450.

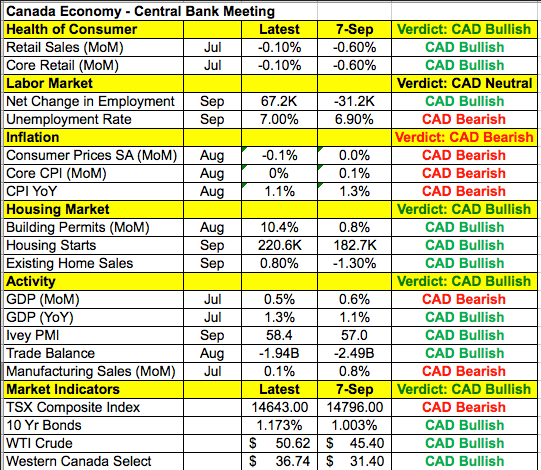

The Canadian dollar recovered earlier losses to end the day unchanged ahead of the Bank of Canada’s monetary policy announcement. It was much stronger during the early North American session but gave up a significant part of its gains as the day progressed. Oil ended the day unchanged and the lack of big moves meant it had very little impact on the currency. The BoC is widely expected to leave interest rates unchanged. When they last met in September, their concerns about lower inflation and growth sent the Canadian dollar tumbling. This month, there’s been more improvement than deterioration in Canada’s economy, as shown in the table below. Housing-market activity has been particularly robust and manufacturing activity rebounded. Oil prices are also up more than 17% and job growth rose sharply in September, giving the central bank reasons to be optimistic. While there’s no need for a near-term rate cut, with retail sales continuing to fall and consumer price growth slowing, the BoC has plenty of reasons to remain dovish.

Meanwhile the Australian and New Zealand dollars extended their gains against the greenback. It has been 5 trading days now since we’ve seen a sizable correction in both currencies. The New Zealand dollar traded higher thanks to upticks in consumer and dairy prices. Auction prices continued to rise, this time by 1.4%. CPI was expected to remain unchanged but increased 0.2%. Recent economic reports continue to refute the Reserve Bank’s dovish bias with Tuesday’s CPI report likely to temper rate-cut expectations further. The Reserve Bank of Australia released minutes from last month’s policy meeting. RBA Governor Lowe confirmed that policymakers were currently in “wait-and-see” mode. They hope to get more clarity from CPI numbers for the September quarter. Concerns still revolved around the country’s uneven housing and labor markets. Housing demand in Sydney and Melbourne remain robust, but activity in other areas of the country has cooled. Labor-market activity improved but most of the job increases were part time. As a whole, Governor Lowe noted that there was a reasonable prospect of sustaining growth in economic activity that would support the labor market and inflation. As a result, AUD soared. Chinese industrial production, retail sales and GDP data were due Tuesday night. We are worried that Chinese growth and retail sales slowed because in addition to the softer Chinese trade data, the PBoC felt that it was necessary to significantly devalue the currency. But whether they allow it to show up in the data is a separate question.

Tuesday's most confusing price action was in the euro, which dropped back below 1.10 versus the U.S. dollar. No Eurozone economic reports were released and U.S. data was far from inspiring. U.S. Treasury yields also fell more than German Bund yields, which should have been positive for EUR/USD. The only explanation is EUR/GBP selling. It is not often that EUR/GBP is the day’s worst performer but on Tuesday it fell more than 1% and the pressure on the currency could have translated into pressure on the EUR/USD.