There wasn't a whole pile of buying volume to go with gains, but the Nasdaq, S&P 500, and Russell 2000 (IWM) all did their bit to keep the nascent bounce going.

It has the look of a zig-zag-like bounce, but until we see the "zag", these indexs' gains are set to challenge March highs. Traders have Thursday's lows for assessing any risk-to-reward ratio longs for the coming week, although if we were to head down there this week it would probably amount to the start of the "zag".

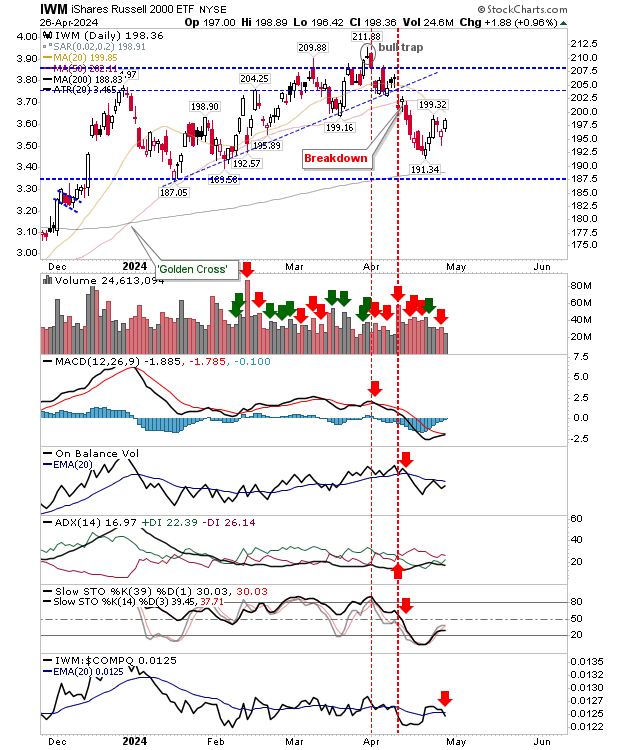

Of the three lead indexes, the bounce in the Russell 2000 ($IWM) looks to offer the best risk-to-reward ratio. Technicals remain net bearish, and the move out of oversold stochastics is one I would view with more skepticism than optimism (I want to see a mid-line cross in stochastics to be more confident of a long-term bullish recovery), but if it can make a higher low and stay above its 200-day MA it's an attractive option for longs.

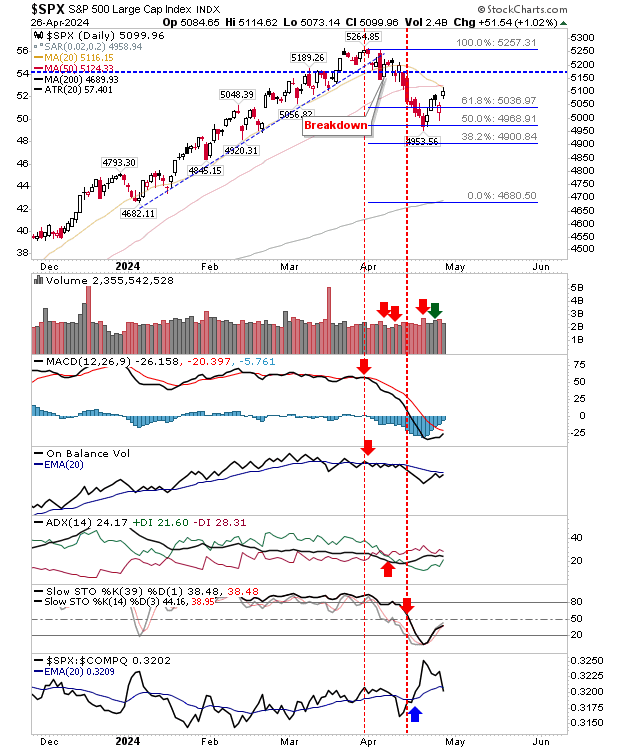

The S&P 500 experienced an intraday reversal right at the convergence of 20-day and 50-day MAs. It remains close enough to this point that it could do so again today, but it has similar challenges as the Nasdaq; if one goes, I would expect the other to follow. The S&P 500 has a smaller spread between Friday's highs and Thursday's lows, so it might be the index to make the first move in this regard. One to watch for Monday.

While I'm not entirely convinced we have retraced enough off March highs to suggest the selling is done, we also have had an uninterrupted rally since October 2023 that has controlled the market up to now. I think this move lower will attract enough buyers to take the indexes back near their (or above?) March highs, before a stronger wave of selling send indexes toward their 200-day MAs.

Strong trend moves are typically followed by scrappy trading ranges, not new trends in the opposite direction. What I'm looking for are the lows for these ranges, and 200-day MAs make for a nice psychological bottom. Time will tell if this proves to be true.