Markets were set up for a sizable down day, or at least one to undercut breakout support, but this didn't happen. While there was no real change on the day the fact that there were no major losses should be viewed as a positive.

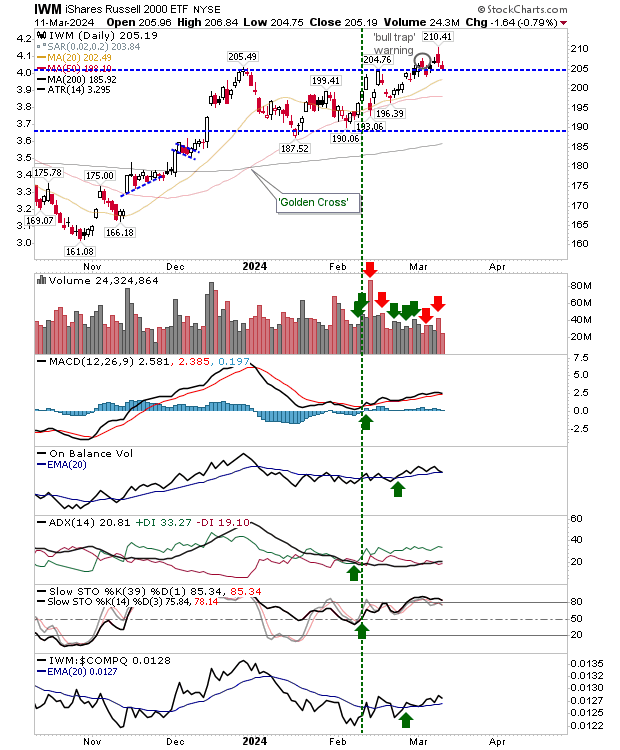

The Russell 2000 (IWM) finished right on $205 support with no technical change.

The index is still outperforming the Nasdaq and the S&P 500. I'm watching for an intraday spike down to the 20-day MA, but would expect a close above $205 to maintain the story for a successful breakout.

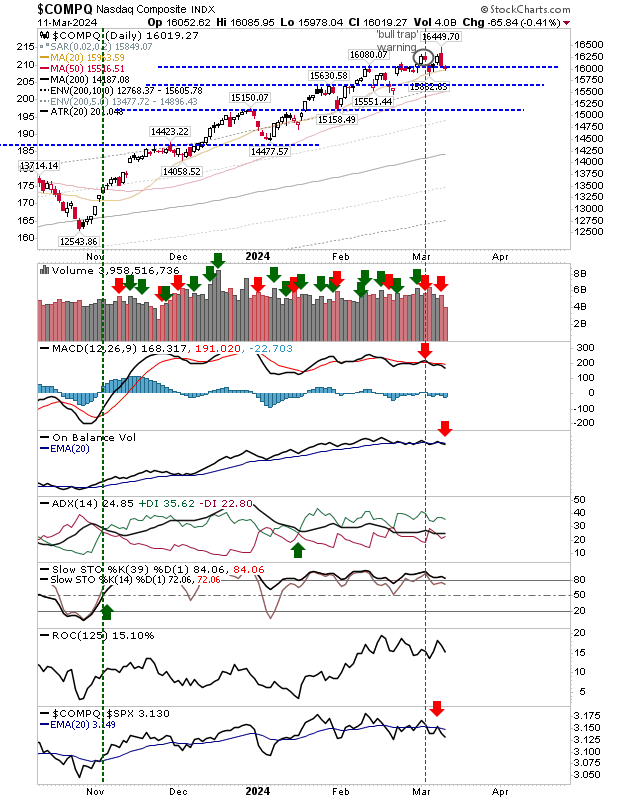

The Nasdaq also finished above psychological (and breakout) support of 16K with the 20-day just below this key support level.

Yesterday's volume didn't rank as distribution, but it was enough to see a new 'sell' trigger in On-Balance-Volume - although this particular indicator has been in flatlined/whipsaw territory since the end of February.

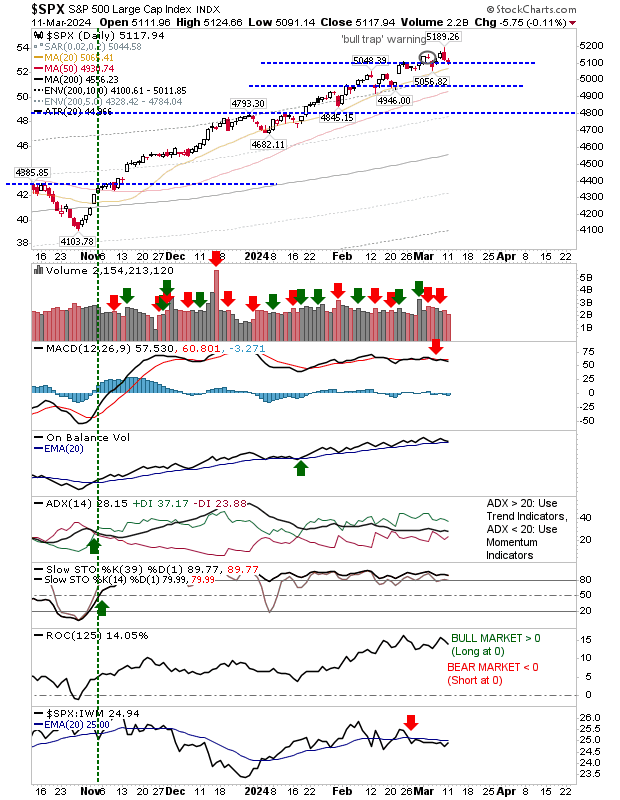

The S&P 500 finished just above breakout support near 5,100 but without the 'sell' trigger in On-Balance-Volume. Again, I still think an intraday move to the 20-day MA would seem more likely, but a straight bounce off support can't be ruled out.

Heading into today, watch for early losses in the first 30-60 minutes, and then buyers step in to bring things back above breakout support.