This article was written exclusively for Investing.com

The equity market may be setting itself up for disappointment this summer. Earnings trends for the S&P 500 have been rising despite growing concerns of a US recession due to the Fed tightening cycle. This has created a strange divergence between the earnings trends in the S&P 500 and the NASDAQ 100. The variation could be a warning that earnings estimates for the S&P 500 are too high and need to come down.

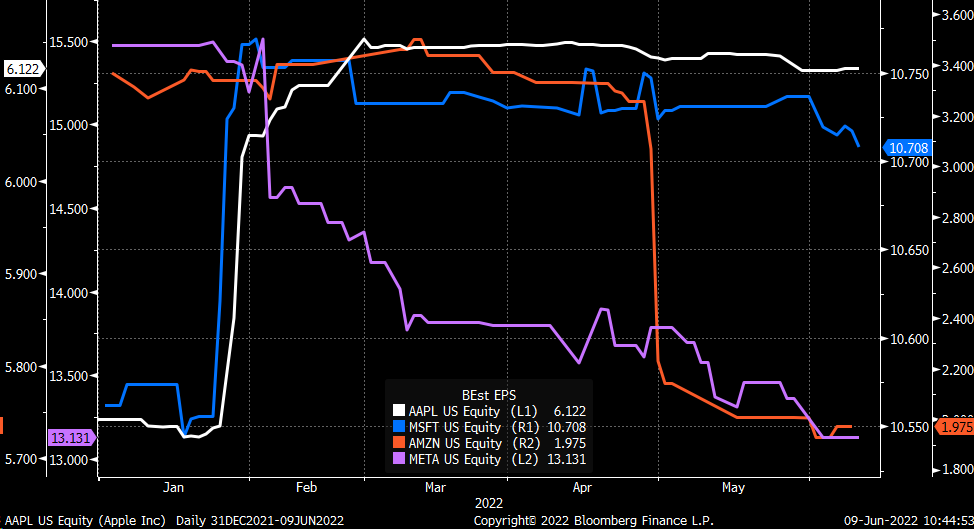

Even odder is that many of the top companies in the S&P 500, like Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), and Meta Platforms (NASDAQ:FB), have seen their earnings estimates for the calendar second quarter falling along with the entire year. On top of that, while we hear a lot about rising costs and inflation, analysts have yet to adjust their operating margin estimates for the S&P 500, which remain near historic highs. This could be setting the market up for a disappointing earnings season, bringing a fresh round of downgrades.

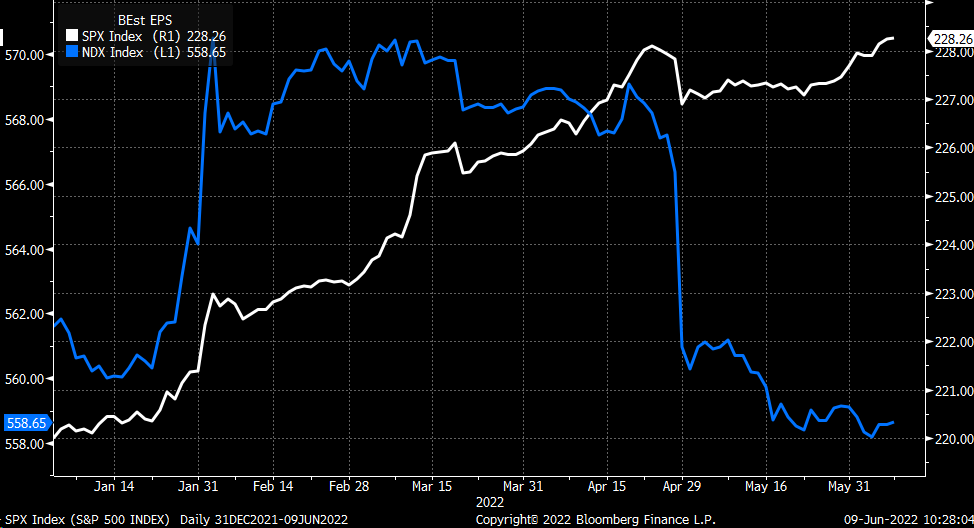

Earnings estimates for the S&P 500 in 2022 have climbed to fresh highs, reaching $228.26 per share, while those for the NASDAQ 100 are trading near their lows. It seems like an odd combination considering the overlap between the two indexes and the number of large companies among the top holdings.

All charts courtesy of Bloomberg

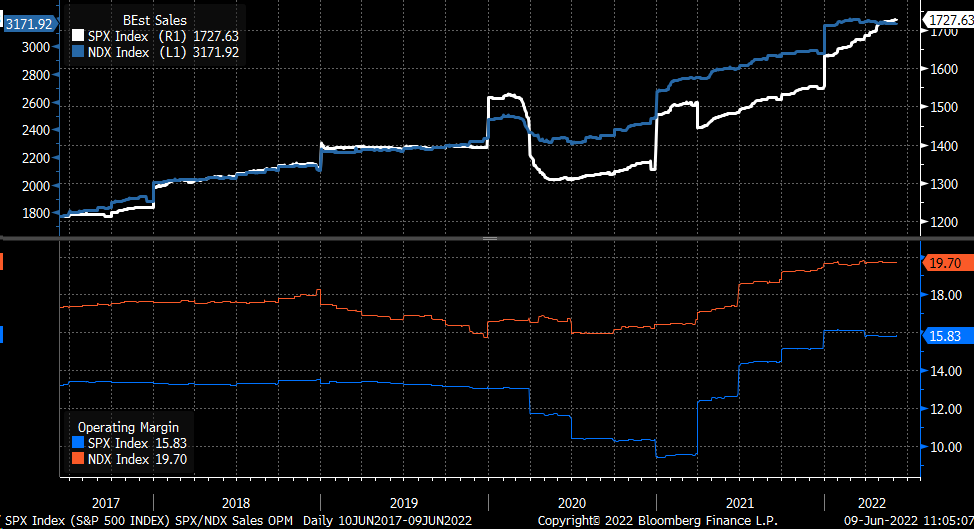

One reason for this divergence is that sales estimates for the S&P 500 have continued to rise while falling for the NASDAQ 100. Additionally, despite concerns over rising prices and the potential impacts on the consumer and company margins, operating margin estimates for the S&P 500 remain at very high levels, with analysts very slow to reduce those estimates. This poses the most significant risk to earnings forecasts because higher inflation can help drive sales higher, but if margins are contracting, that is where earnings come under pressure.

On top of this, we have seen signs of some mega-cap names like Apple, Amazon, and Meta showing falling earnings estimates for this calendar year. For Microsoft, estimates have started to fall for next year since the company’s fiscal year ends in July.

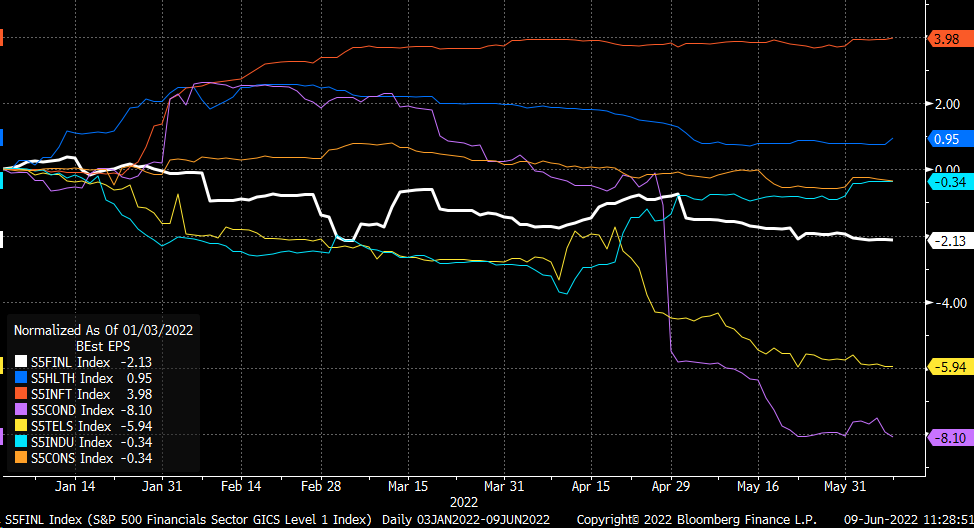

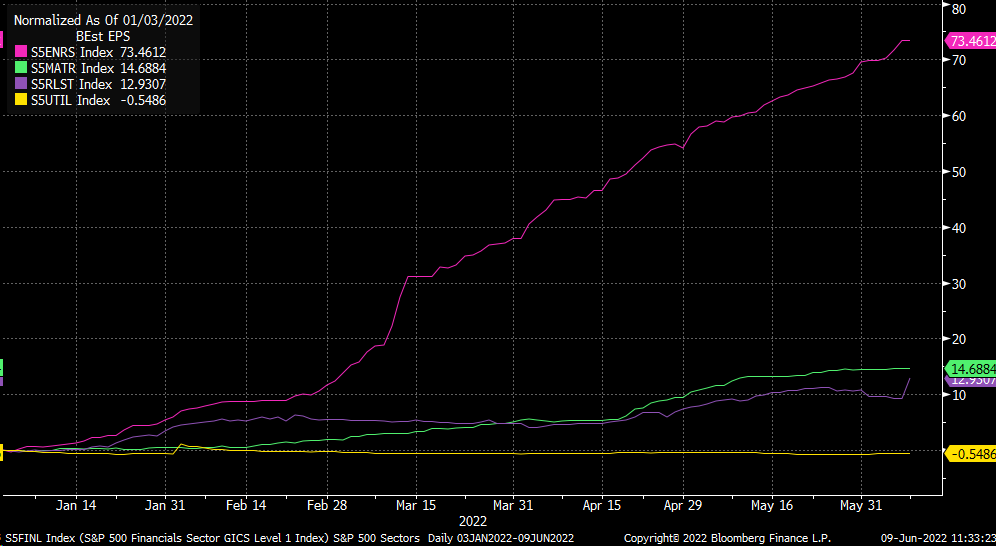

The falling earnings estimates among some large companies that have overlap in the indexes seem to point to a deteriorating trend in earnings expectations, which does match that of the NASDAQ 100, but not the S&P 500. That difference may lie in sector breakdowns. Still, nearly 90% of the S&P 500 earnings trends by sector show earnings estimates to be falling or flatlining at best.

At this point, it seems like it may very well be the bottom 10% of the S&P 500 holding up and helping drive earnings estimates higher for the entire market, with Energy and Materials leading the way.

It gives the market a potential problem going into second quarter results because there will be no room for error, especially from the energy sector. If the energy sector disappoints, it could mean the next shoe to drop for the S&P 500 is right around the corner.