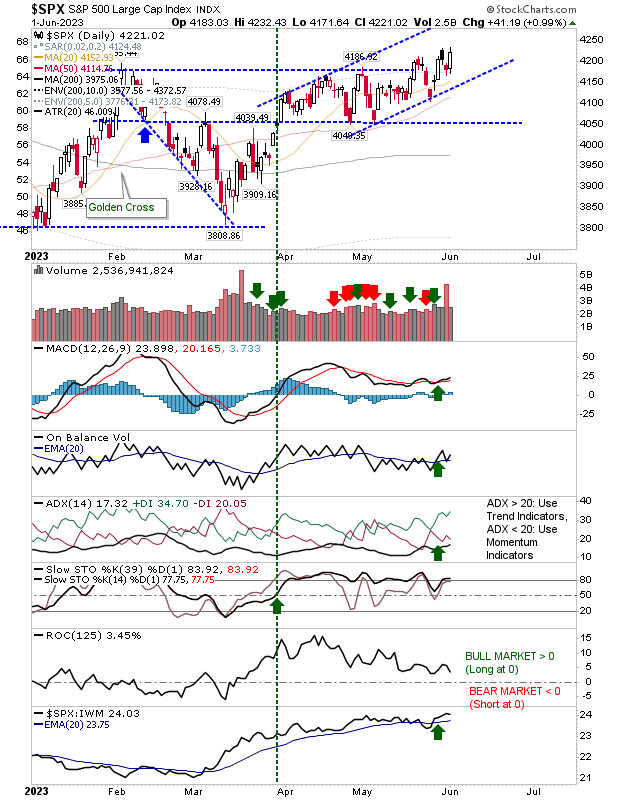

It's not exactly textbook, but whenever bears are able to punish markets, they are quickly undone, often by a single day of strong buying. The S&P 500 is an ideal case in point. After trading below 4,165 for a number of weeks, it has managed a confidence-restoring push above 4,200. Each rise in price will squeeze shorts to help drive the index above its 2023 scrappy action. Ultimately, we will want to see a move comparable to what's occurring in the Nasdaq.

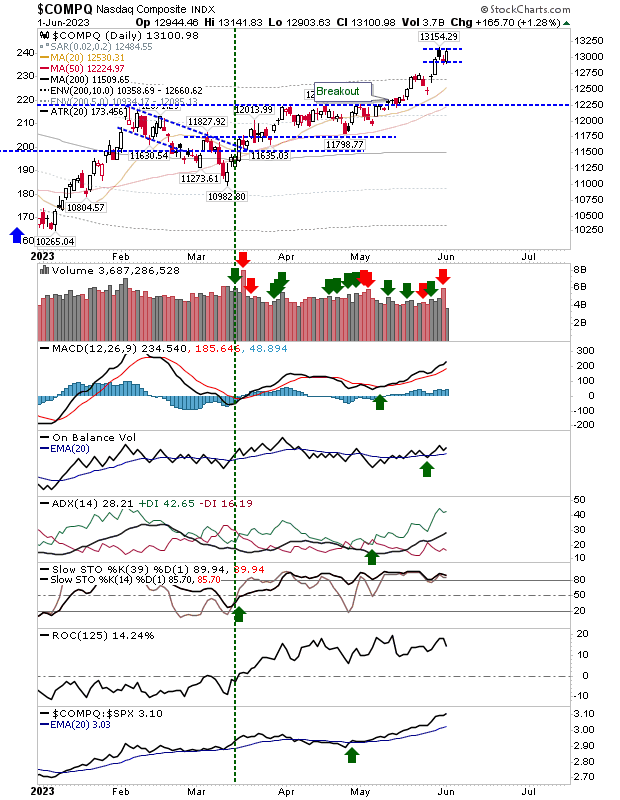

The Nasdaq has cleared moved out of its base into the development of a right-hand base. The 13,000 resistance level is the last challenge before it opens up for a larger move to 16,000. Today's small consolidation and strong finish around 13,000 gives reason for optimism. Technicals remain net bullish, and despite yesterday's distribution, there was little damage to this picture.

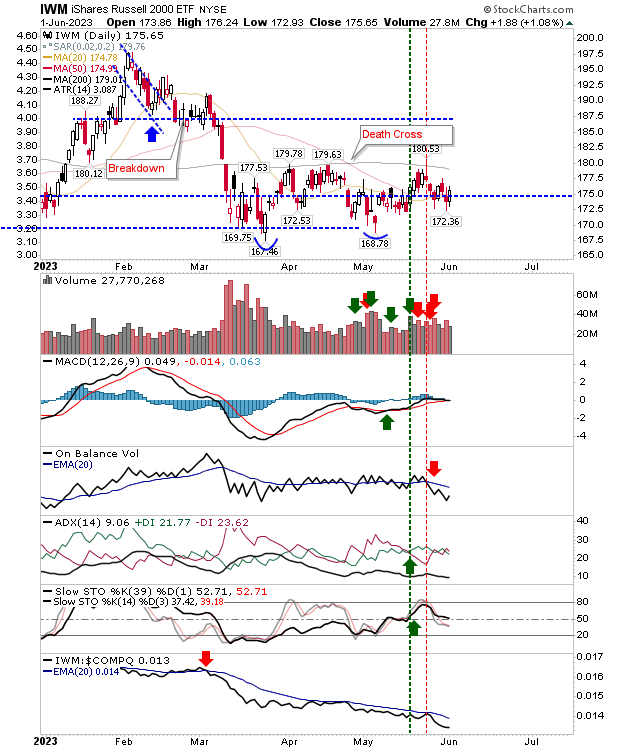

The Russell 2000 (IWM) continued its range-bound performance but held above its 50-day MA. While it holds above the stochastic mid-line, it's bullish. However, On-Balance-Volume has shifted more firmly bearish, and this needs to be watched over the coming days. If volume weakness was to translate to momentum, it would risk bringing down with it the improving bullish situation in the Nasdaq and S&P 500.

The Nasdaq is doing all the hard work here and is bringing the S&P 500 along for the ride. The Russell 2000 (IWM) is stuck in its base, but there is suffering more from a lack of interest than any concerted selling. Plenty of pessimism in social media towards the markets, and the summer is not typically associated with strength, so indexes are well-placed to swim against this tide and defy the doubters.