- SoFi Technologies has recently issued mixed Q2 metrics, which put pressure on the shares

- The fintech group is growing its platform, product offerings and customer numbers

- We’re optimistic on the long-term growth prospects of SOFI stock, which could move first toward $17.5 and then $20.0 in the coming weeks

Investors in financial technology (fintech) disruptor SoFi Technologies. (NASDAQ:SOFI) have had a volatile year so far in 2021. Year-to-date (YTD) SOFI stock is up close to 22%. However, since early June the stock has lost about 37% of its value.

Our readers could well remember that SoFi Technologies went public through a reverse merger with Social Capital Hedosophia Corp, a special purpose acquisition company (SPAC). SOFI shares finished the day at $22.65. After trading between $20-$25 for several few weeks, the stock sold-off starting in early June.

SOFI stock finished Sept. 3 at $15.16. We should also remind readers that on Feb. 1, prior to the closing of the reverse merger, the shares hit an all-time high of $28.26. The market capitalization of SoFi Technologies stands at $12.12 billion.

Investors debate whether now is a good time to invest in SOFI stock. We’re bullish on the long-term growth prospects of SoFi Technologies. Here’s why.

Long-Term Tailwinds

SoFi Technologies was founded in 2011 as a student loan refinancing business. Over the past decade, it has grown significantly to become a fintech disruptor. Its app enables consumers to manage, borrow, spend, save and invest money.

For instance, in May 2020, it acquired the payment software company Galileo Financial Technologies, which helps businesses develop payment, card, and digital banking products. Also in March of this year, management announced it had agreed to buy the California-based community bank Golden Pacific Bancorp, and “The proposed acquisition is a key strategic step in SoFi's path to obtaining a national bank charter.”

On Aug. 12, SOFI issued Q2 financials. Revenue was $231.1 million, up 101% year-over-year (YOY).The company reports revenue in three segments:

- Lending (still the driver of the top line with 71.9% share);

- Financial Services (Q2 revenue was $17.0 million, compared to $2.4 million in Q2 2020);

- Technology Platform (consists primarily of Galileo which has over the past year, increased its number of accounts, to nearly 79 million from 36 million).

SOFI reported a $165.3 million net loss for Q2 2021, compared to net profit of $7.8 million a year earlier. However, adjusted EBITDA was $11.2 million and positive for the fourth consecutive quarter. It was also $35.0 million higher than Q2 2020.

On the results, CEO Anthony Noto commented:

“We drove our 8th straight quarters of accelerating member growth, with even faster growth in cross-buying from existing members.”

For Q3 2021, management expects adjusted net revenue of $245-$255 million, which was lighter than what Wall Street was anticipating. SoFi Technologies also reiterated the full-year 2021 guidance of adjusted net revenue of $980 million and adjusted EBITDA of $27 million.

A number of investors were not fully thrilled with Q2 results, and hit the ‘Sell’ button, pushing SOFI stock to $13.50. However, since then buyers have come in and moved the stock back to $15, a level that is acting as support.

What To Expect From SOFI Stock

SoFi Technologies is still a young company. Therefore on Investing.com, we have two analysts polled, both of whom have rated it a ‘buy.’ The shares have a 12-month price target of $26.50, implying a return of about 75% from current levels.

The stock’s P/B ratio stands at 2.86x. By comparison, the P/B ratios of fintech darlings PayPal (NASDAQ:PYPL) and Square (NYSE:SQ) are 16.25x and 45.93x, respectively

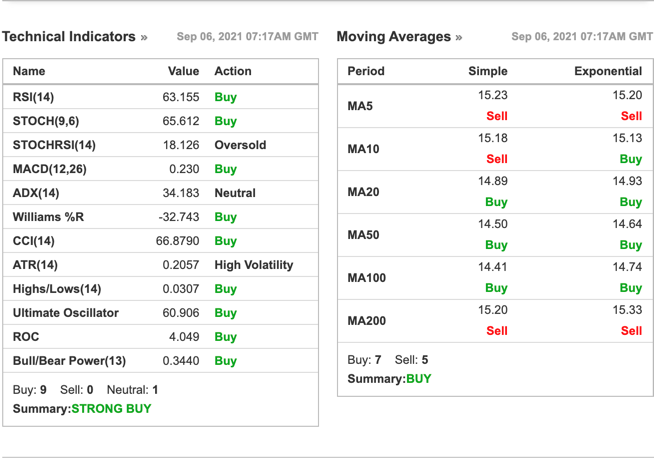

Investors who watch technical charts might be interested to know that an up move toward the $17-$17.5 level is likely. In that case, SOFI stock would possibly hit resistance around $17.5 after which it could trade sideways as it establishes a new base.

Source: Investing.com

Finally, as part of the short-term sentiment analysis, it would be important to look at the implied volatility (IV) levels for SoFi Technologies options, which typically show traders the market's opinion of potential moves in a security. However, this metric does not forecast the direction of the move.

SOFI’s current implied volatility is 59.7, which is lower than the 20-day moving average of 67.4. This metric means implied volatility is trending lower. Although the current IV level could change, for now, the market does not seem to expect extreme choppiness in the shares.

Although our expectation is for the stock price to increase in the coming weeks, it is not likely to be a straight move higher. There could even be a further decline toward $14 before a new up leg starts. In case of such a decline, potential SoFi Technologies stock investors would then find better value in the stock.

4 Possible Trades

1. Buy SOFI Stock At Current Levels

Investors who are not concerned with daily moves in price and who believe in the long-term potential of the company could consider investing in SoFi Technologies shares now.

On Sept. 3, SOFI stock closed at $15.16. Buy-and-hold investors should expect to keep this long position for several months while the stock potentially makes an attempt, first toward $17.5 and then $20, leading to a return of over 30%.

However, investors who are concerned about large declines might also consider placing a stop-loss about 3-5% below their entry point.

Once the stock is firmly established around $20, it could then potentially make another move toward the record high $28.26. However, such an increase would possibly take several quarters.

2. Sell A Cash-Secured Put Option On SOFI Stock

Our second trade involves a cash-secured put strategy. We have recently covered this option in numerous articles. Here is one example.

Bullish SoFi Technologies stock traders could now sell a Dec. 17, 15-strike put option, which is currently being offered at $2.13.

Assuming traders would enter this put-selling strategy at the current price, the upside is keeping this premium of $213 as long as SOFI stock closes above $15, when the option expires. A total of $213 would be the maximum return for this trade (excluding trading costs and taxes).

The downside is if SoFi Technologies stock trades below $15.00 ahead of expiration. Should that occur, traders could be assigned 100 shares for each sold put at a cost of $15.00 per share.

At expiry, this trade would break even at a stock price of $12.87 (i.e., $15-$2.13).

3. Buy An ETF That Has SoFi Technologies As A Holding

Many readers are familiar with the fact that we regularly cover exchange-traded funds (ETFs) that might be suitable for buy-and-hold investors. Thus, readers who do not want to commit capital to SOFI stock but would still like to have exposure to the shares could consider researching a fund that holds the company.

However, since SoFi Technologies is a small and young company, it is not yet a leading holding in an ETF. This means such an investment would provide only a limited exposure to SOFI shares.

Nonetheless, examples of ETFs that have SOFI stock include:

-

The De-SPAC ETF (NYSE:DSPC): This new fund is about flat since inception in May 2021. SOFI stock’s weighting is 3.85%;

-

JPMorgan BetaBuilders U.S. Small Cap Equity ETF (NYSE:BBSC): The fund is up 17.2% YTD, and SOFI stock’s weighting is 0.38%;

-

First Trust US Equity Opportunities ETF (NYSE:FPX): The fund is up 10.9% YTD, and SOFI stock’s weighting is 0.29%.

4. Buy Shares In Another Fintech Company

Potential investors who are interested in the fintech space, could consider investing in other names in the sector as well. Several names that could appeal to readers are (in alphabetical order):

- Bill.com (NYSE:BILL): up 117.7% YTD;

- Fiserv (NASDAQ:FISV): up 1.6% YTD;

- Green Dot (NYSE:GDOT): down 1.8% YTD;

- JPMorgan Chase (NYSE:JPM): up 25.5% YTD;

- Lemonade (NYSE:LMND): down 36.9% YTD;

- Marqeta (NASDAQ:MQ): down 17.1% since going public in June;

- MercadoLibre (NASDAQ:MELI): up 16.2% YTD;

- PayPal: up 23.4% YTD;

- Silvergate Capital (NYSE:SI): up 62.4% YTD;

- Square: up 23.9% YTD;

- StoneCo (NASDAQ:STNE): down 46.8% YTD;

- Visa (NYSE:V): up 2.9% YTD.

As the returns above highlight, the fortunes of these companies have varied significantly in 2021. Therefore, potential investors would need to research them well before committing capital into the shares.

Bottom Line

Since going public in early June, SOFI stock has been in the limelight. Although the record high share price of $28.26, which was seen in February before the the reverse-merger was completed, seems quite distant now, the company is likely to create better shareholder value in the months ahead. Meanwhile, the company could even find itself a takeover candidate.