Trump announces $1,776 ‘warrior dividend’ payout for military personnel

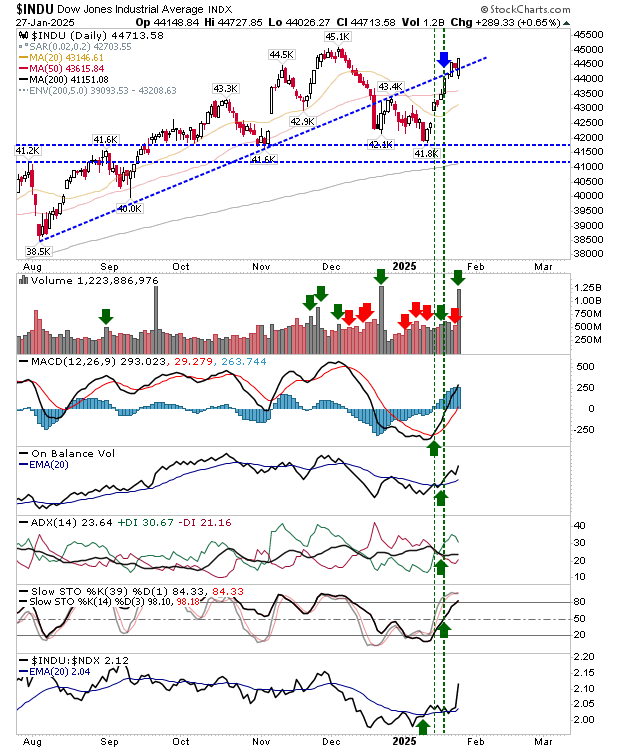

Yesterday's market action turned ugly as tech declines stalled broader rallies but failed to derail them entirely. Surprisingly, the Dow Jones Industrial Average bucked the trend, defying expectations of a straightforward reversal off resistance.

Whether DeepSeek triggers a more significant decline remains uncertain—confirmation hinges on support levels breaking across the affected indexes.

The good news is that Dow Jones posted a solid day and is on its way to challenging 45.1K highs. Volume climbed to register as accumulation. Technicals are solidly net positive.

The Semiconductor Index headed sharply in the other direction. The warning signs of a reversal came last week on the inverse hammer at resistance, then Friday's losses (the whisper figure), before yesterday's slice through lead moving averages. Technicals are negative but not net bearish.

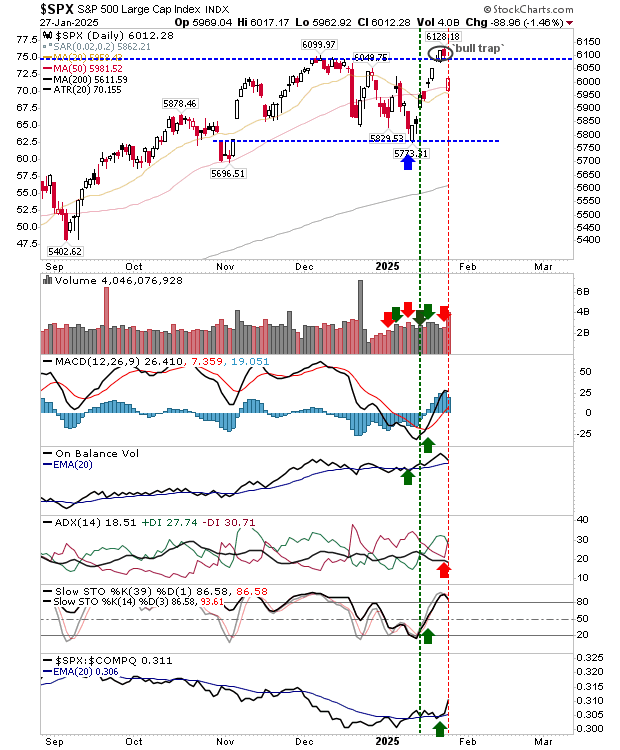

For the S&P 500 we have a new 'bull trap' on higher volume distribution. yesterday's selling coincided with a new 'sell' trigger in +DI/-DI. On 'bull traps' indexes typically retrace back to prior trading range support, which for the S&P is 5,775.

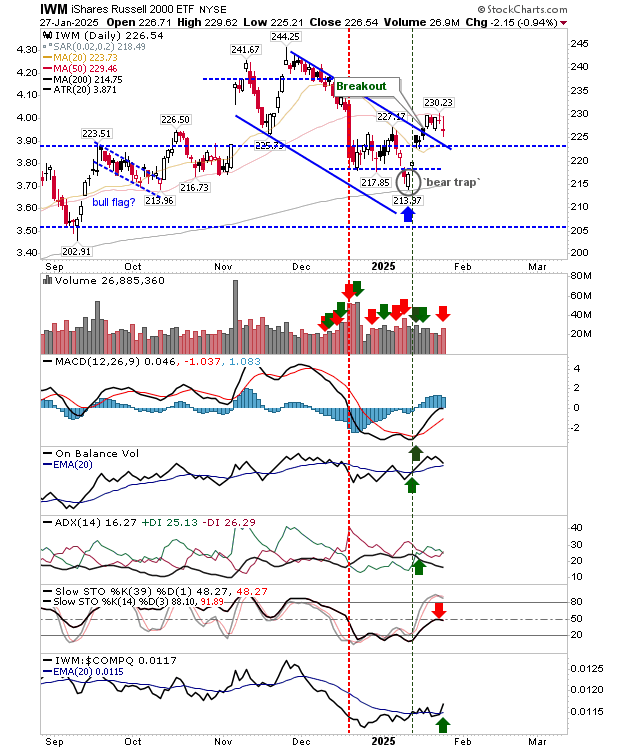

The Russell 2000 (IWM) didn't escape the selling, but it wasn't as badly hit as peer indexes. Volume registered as distribution but the index remained close enough to its 50-day MA to deliver a breakout in the coming days.

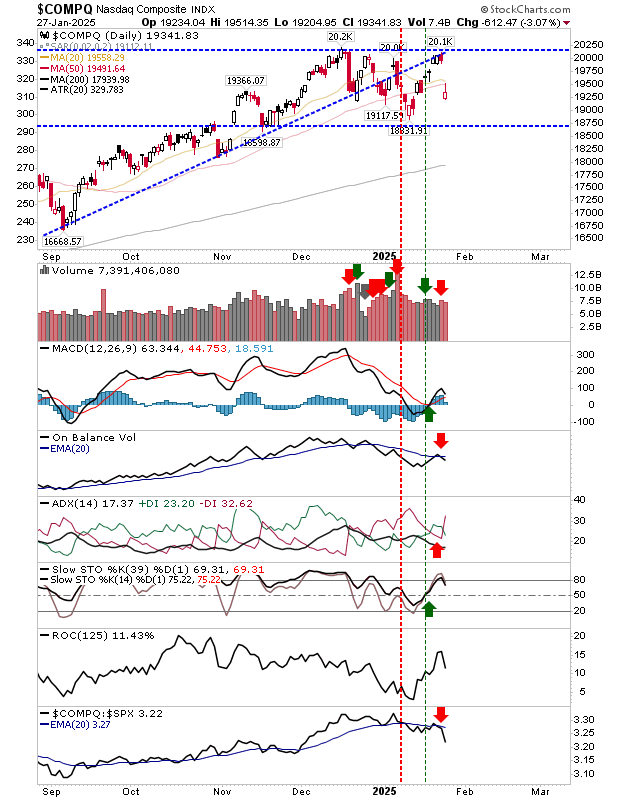

The Nasdaq reversed from converged trend and horizontal resistance, undercutting the 50-day MA in the process. Unlike other indexes, volume didn't climb to register as distribution. Technicals are mixed with new 'sell' triggers in On-Balance-Volume and +DI/-DI.

From an economic/business perspective, the vulnerabilities of the U.S. tech sector and energy sector to Chinese developments in the field of AI and sustainable energy is not one the current administration is equipped to address. Price leads economics, so the next few months will give us an idea as to where market confidence lies. Watch those support levels.