Street Calls of the Week

This article was written exclusively for Investing.com

- Bull markets rarely move in straight lines

- It’s been a bullish relay race in commodities since 2020

- High-flying commodities could correct and get ugly

- Inflation is not going away any time soon

- DBC is a diversified commodity ETF product with a weighting to traditional energy prices

The stock market has been volatile in early 2022. Rising interest rates make fixed-income products more attractive and shift capital from stocks to bonds. The prospects for higher corporate and individual taxes are also a factor weighing on the stock market.

The Fed liquidity and government stimulus pushed stock prices higher from the early 2020 lows until the end of 2021. A correction was long overdue, and the recent volatility could get ugly over the coming weeks and months. A severe decline could cause a risk-off period in markets across all asset classes. Some of the high-flying commodities could see downdrafts if stocks decline.

Meanwhile, the ascent of commodity prices has been a function of rising inflationary pressures because of central bank liquidity and government stimulus. In 2008, the tools used to combat the global financial crisis pushed commodity prices to multi-year and, in some cases, all-time highs in 2011-2012. The price action following the 2020 worldwide pandemic is eerily similar, but that does not mean we may not see periods of ugly selloffs in the raw material markets.

Commodities tend to be far more volatile than stocks and bonds, and we could see wide price variance in the raw material sector over the coming weeks and months. Meanwhile, if the period from 2008 to 2012 is a guide, any significant corrections will be buying opportunities in the commodities asset class.

Bull Markets Rarely Move In Straight Lines

Bull and bear markets experience corrections and recoveries that often occur at lightning speed, with prices exploding or imploding before reverting to the path of least resistance and trend. In bear markets, a “rip-your- face-off rally” is a painful event that can occur when market participants increase leverage on short positions and the market extracts a pound of flesh. Bull market dips can be short-term implosive moves that shake the confidence of even the most committed market participants holding long positions.

Commodities tend to be far more volatile than stock, bond or currency markets, and raw material prices do not move higher or lower in a vacuum. A risk-off period in the stock market or a geopolitical event can disrupt longer-term trends, causing lots of indigestion for those carrying speculative risk positions when a market gets loaded up on the long or short side.

The latest example came last week in the natural gas futures market. After correcting from a continuous contract high of $6.466 per MMBtu in October 2021, natural gas declined below $4 per MMBtu. A winter storm heading for the US east coast, tensions surrounding Ukraine in Europe and a complacent natural gas futures market caused the expiring February contract to explode.

Source: CQG

After trading in a mostly bearish trend of lower highs and lower lows from early October through late January, the nearby NYMEX futures contract was below $4 per MMBtu on Jan. 24. On Jan. 27, a rip-your-face-off rally took the price to a high that was more than 87% above the opening level during the week. Natural gas rose to the highest price since 2008. As the February contract rolled to March, the price adjusted to end the week at $4.639 per MMBtu on Jan. 28, but was at the $5.35 level on Feb. 2.

The same action often occurs on the downside. Lumber futures rose to a high of $1,711.20 in May 2021.

Source: CQG

The chart shows that four short months later, lumber futures fell to a low of $448 per 1,000 board feet, less than one-third the price at the May high. Lumber returned to the $1,000 level by December 2021, rose to over $1,300 in January, and corrected to below $1,000 on Feb. 2.

It’s Been A Bullish Relay Race In Commodities Since 2020

As the pandemic gripped markets across all asset classes in early 2020, most commodity prices fell to multi-year lows in a tsunami of risk-off selling. The fear of a pandemic-inspired global depression had far-reaching consequences that planted the seeds for future higher prices. The cure for low prices in the world of commodities is those low prices. When demand evaporates, producers curtail or suspend output, leading to shortages. The pandemic poses unique issues as lockdowns made production impossible.

The treatment for economic instability, central bank liquidity and government stimulus stabilized the financial system. The policies lit an inflationary fuse that lifted commodity prices at a time when pandemic-inspired shortages and supply-chain bottlenecks added to the bullish trajectory of many markets.

The ascent of the commodities asset class has been like a bullish relay race, with one market handing the torch to another. The first commodity that took off on the upside was gold. The yellow metal rose to $2,063 in August 2020, an all-time high. While gold corrected and digested the move in 2021, a host of other commodities took the baton. In May, lumber, copper and palladium prices rose to new all-time highs. Crude oil, natural gas, oil products, coal and ethanol reached multi-year highs, with most remaining in bullish trends in early 2022. Agricultural commodities moved to levels not seen in years along with metals and minerals prices.

Meanwhile, addressing climate change has only exacerbated the bullish commodity trends at a time when production cannot keep up with the rising demand. The latest commodities to hold the bullish torch were natural gas, frozen concentrated orange juice futures, and palladium. Palladium traded to a low of $1,549 in December, and the price was back at the $2,375 level on Feb. 2. Signs that the semiconductor shortage is easing are increasing palladium demand as car-makers begin to increase production at assembly plants. Palladium is a critical component of automobile catalytic converters.

The bottom line is the bullish relay race in the raw materials asset class continues as we move into February.

High-Flying Commodities Could Correct And Get Ugly

Just as commodity prices fall to levels where productions slow, when they rise, higher prices incentivize more output as producers scramble to meet requirements and increase profits. Therefore, the higher prices rise, the more susceptible they become to sudden and brutal downside corrections. The price action in lumber is an example of that carnage. Copper corrected from nearly $4.90 per pound in May to under $4 in August. Palladium fell from more than $3,000 per ounce last May to under $1,600 in December.

With the stock market on shaky ground, interest rates set to increase and the US dollar trending higher, commodities face a triple threat of a risk-off period. The commodities that have soared tend to be the likely candidates for a significant correction. Those corrections are likely to test the fortitude of even the most committed bulls, as declines could become hideous.

Inflation Not Going Away Any Time Soon

I would view any significant corrections in the commodities asset class as a temporary event. I believe the asset class’s price action from 2008-2012 is a guide to what we can expect from raw material markets over the coming years. The liquidity and stimulus that stabilized conditions during the 2008 global financial crisis were far less than during the 2020 pandemic.

Remember what Albert Einstein once said: the definition of insanity is doing the same thing repeatedly and expecting a different result.

Liquidity and stimulus lit a bullish fuse in commodities starting in 2008, and they have ignited an even hotter fuse in 2020 and 2021. We may only be in the middle innings of the commodity bull market in 2022.

Even though interest rates will rise, the US dollar is moving higher, and stocks look shaky, inflation indicators are at the highest levels in four decades. The Consumer Price Index increased by 7%, and the Producer Price Index rose by nearly 10% in 2021. Core inflation, excluding food and energy, may be at 5.5%, but at the current Fed funds rate, the Fed would need to hike rates by 25 basis points 22 times to lift rates from negative territory at the current core inflation rate. Meanwhile, since food and energy costs impact all businesses and individuals, inflation is likely at far higher levels.

Meanwhile, rising oil, gas and coal prices fuel inflation, as traditional energy remains a critical input cost for most commodity production. As energy prices rise, it puts upward pressure on metals, minerals and agricultural prices. Inflation is a vicious economic condition that erodes money’s purchasing power. While the US dollar is appreciating against other world currencies, higher commodity prices mean its purchasing power is only eroding at a slower pace than other foreign exchange instruments.

Unless the Fed holds its nose and gets uber-hawkish, inflationary pressures are not going away any time soon. The shift in US energy policy to address climate change has handed pricing power in the oil market back to OPEC and Russia. The cartel would rather sell one barrel of petroleum at $100 than two at $50. Rising energy prices will make inflation a challenge to tame.

DBC Is A Diversified Commodity ETF Product With A Weighting To Traditional Energy Prices

The commodity bull continues to charge as we enter the second month of 2022. However, corrections are part of any bull market, and they could get nasty. The optimal approach to commodities over the coming months should be to buy on price weakness, leaving plenty of room to add on deeper corrections. Lightening up and taking profits on long risk positions during rallies that take prices to multi-year highs is an integral part of the strategy. JP Morgan once said he got rich by selling too early.

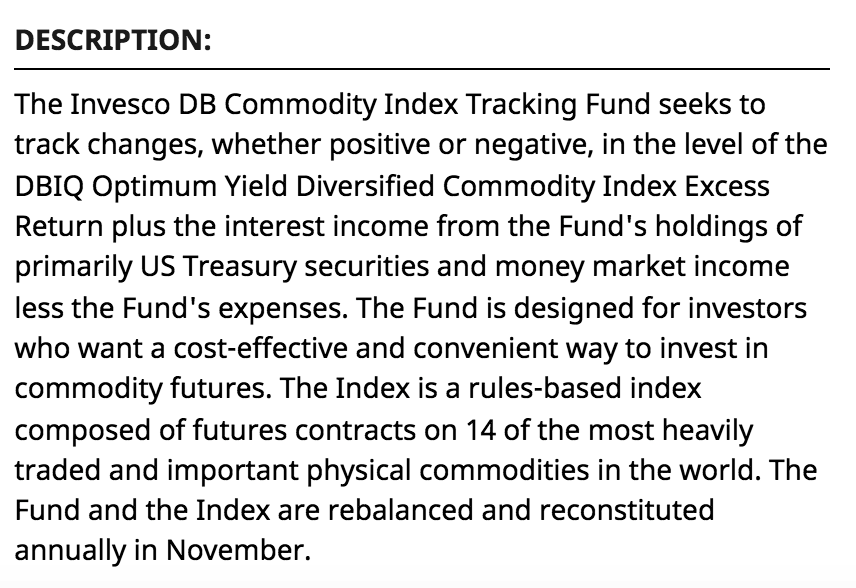

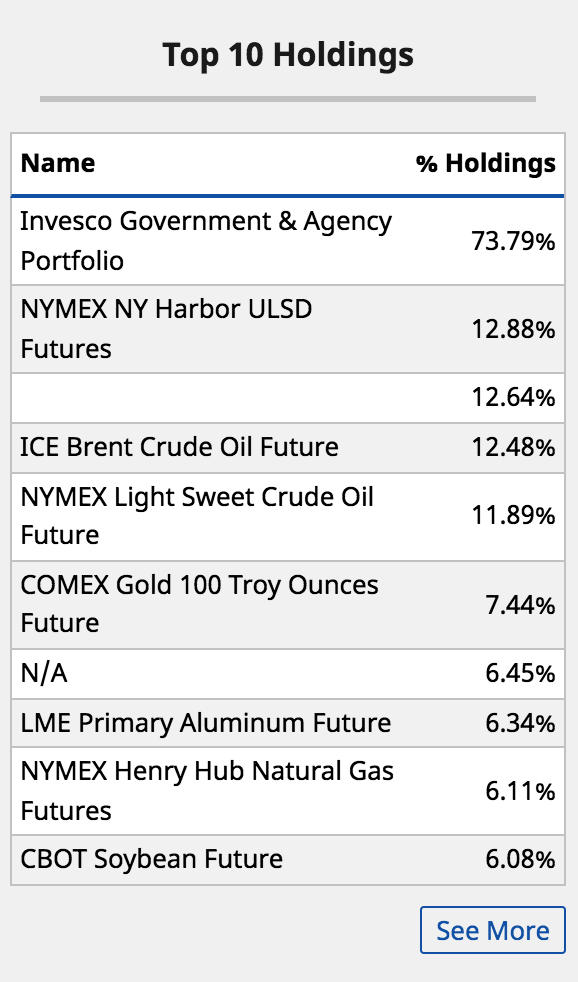

For those looking to participate in the commodity bull market without venturing into the futures arena, the Invesco DB Commodity Index Tracking Fund (NYSE:DBC) is a liquid product that follows commodity prices with weighing towards traditional energy markets. DBC’s most recent top holding and fund summary include:

Source: Barchart

DBC has just over $3 billion in assets under management and trades an average of more than 4.2 million shares each day. The ETF charges a 0.87% management fee.

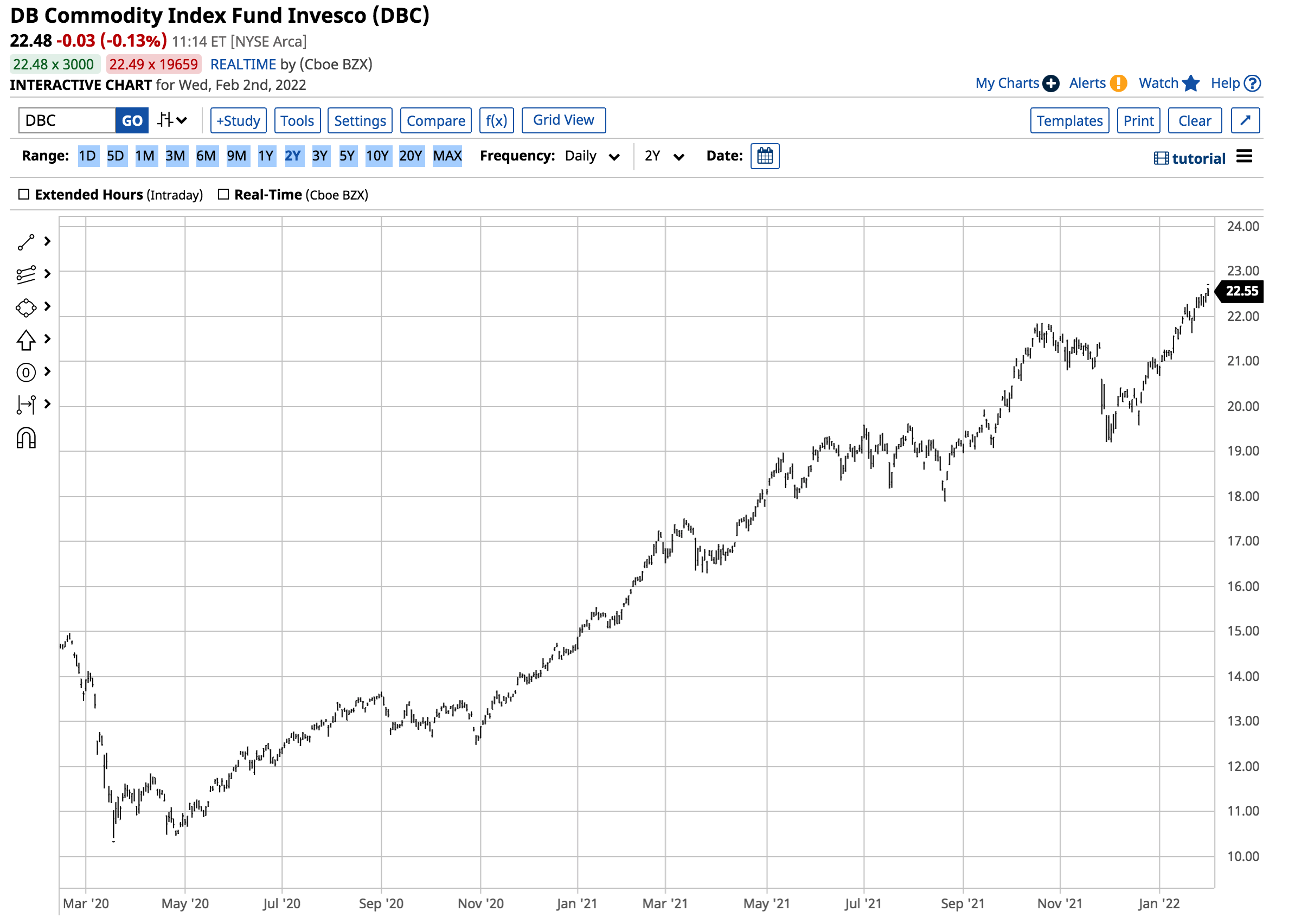

Source: Barchart

The chart shows DBC rose from $14.70 to $20.78 per share or 41.4% in 2021. At $22.48 on Feb. 2, DBC is 8.2% higher so far in 2022.

Commodities are volatile assets, and the higher they rise, the greater the odds of substantial corrections. Buying commodities on dips over the coming weeks and months could continue to be the optimal approach. Meanwhile, any risk-off periods in markets because of a stock market correction or geopolitical event could create bargains in the raw materials.