RBA Hawkish? Huh?:

Following the Reserve Bank of Australia’s decision to yesterday leave interest rates unchanged, the Aussie dollar doesn’t really know where it is at the moment. Hawkish, hawkish, hawkish. All I read is hawkish. But how is this line hawkish?

“Members also observed that the outlook for inflation may afford scope for further easing of policy, should that be appropriate to lend support to demand.”

Sure, the RBA noted that conditions have firmed over the last few months and offshore improvements have helped to stabilise the Australian economy, but I can’t help but look at trading the Aussie from the point of view of a fader.

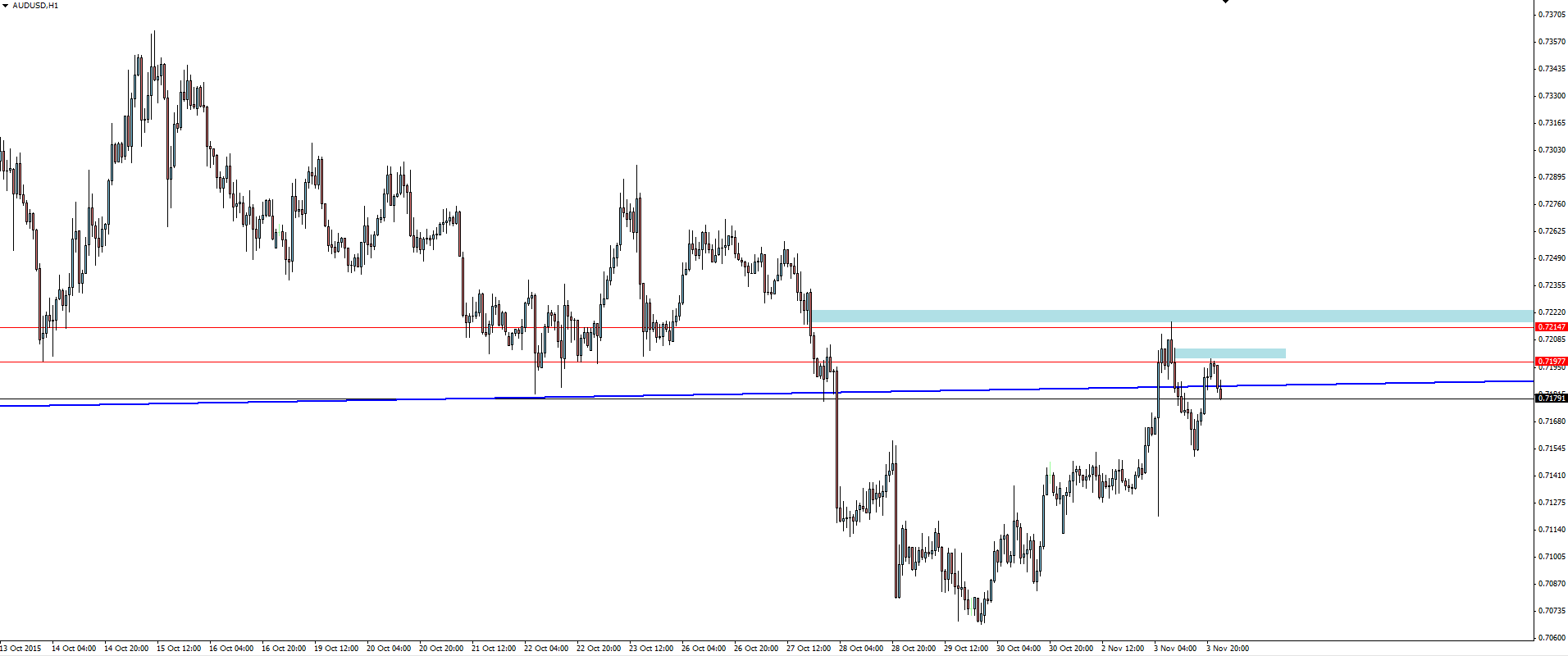

The AUD/USD hourly chart in yesterday’s Daily Market Update had an hourly resistance zone in which we thought that sellers could potentially smash the Aussie down inside if we got there.

AUD/USD Hourly:

The hawkish perception got us there and the buying couldn’t be sustained, giving us multiple entries short if you were active throughout London.

With the horses and RBA behind us, attention now turns to the run in to Friday’s all important NFP release. Traders are cautious about the labour market data confirming any perceived hawkish bias from the Fed. Stay alert for ADP in the lead up tonight, possibly giving us a clue either way.

Enjoy your hump day!

On the Calendar Wednesday:

NZD Employment Change q/q

NZD Unemployment Rate

AUD Retail Sales m/m

AUD Trade Balance

EUR ECB President Draghi Speaks

GBP Services PMI

USD ADP Non-Farm Employment Change

CAD Trade Balance

USD Trade Balance

USD Fed Chair Yellen Testifies

USD ISM Non-Manufacturing PMI

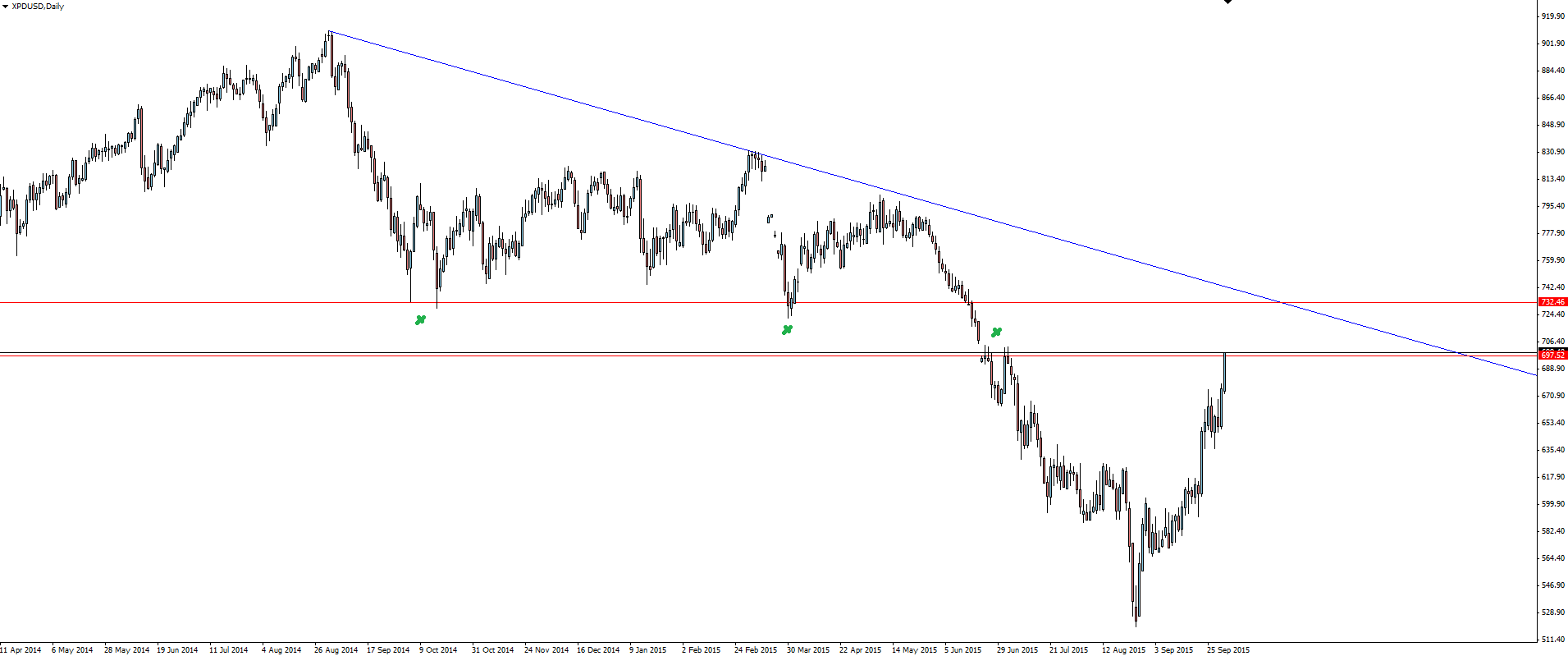

Chart of the Day:

Going to give some love to one of the lesser traded Commodities on the Vantage FX Market Watch: Palladium

“Palladium is a chemical element with the symbol Pd and atomic number of 46. This metal was named after the asteroid Pallas, which was itself named after the epithet of the Greek goddess Athena.”

XPD/USD Daily:

The setup is just an overall bearish trend line with price flagging almost vertical back up to test the resistance level again. The fact that resistance lines up with the previously broken horizontal support level adds some confluence to the level. Keep your eye out for any short term resistance levels forming or slow down in price momentum and fading into it looks to be the play here.

The volume that goes through our palladium book is minuscule in comparison to big brothers gold and silver, but this post has me on a mission to find a successful trader with palladium (or platinum!) incorporated in their strategy.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex Broker Vantage FX Pty Ltd, does not contain a record of our prices, or an offer of, or solicitation for, a transaction in any financial instrument. The research contained in this report should not be construed as a solicitation to trade. All opinions, news, research, analysis, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person opening a trading account and acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and FX Broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.