- Pharmaceutical stocks, once pandemic favorites, have faced significant corrections.

- Despite broader market highs, many in the sector, including Pfizer have faced selling pressure.

- However, Pfizer's recent return to profitability and undervalued stock price hint at a potential rebound.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

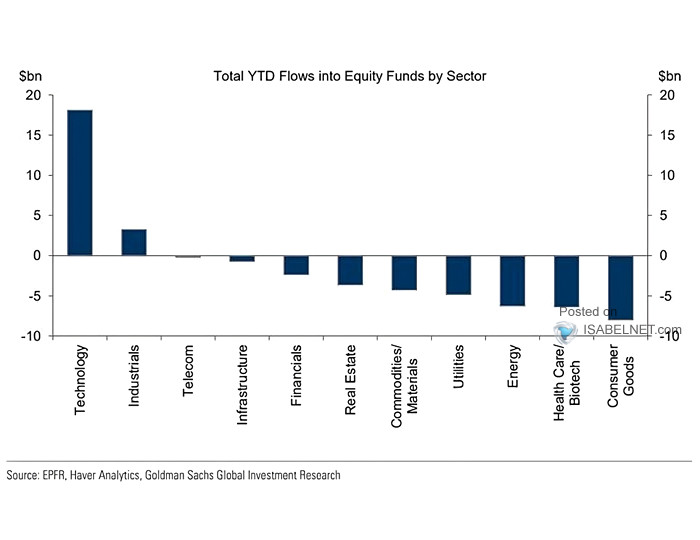

Pharmaceutical stocks, once high-flying heroes of the COVID pandemic, have been facing a harsh reality check over the last couple of years. After a period of exceptional performance, the sector has seen a significant correction, with outflows continuing year-to-date.

Even as broader equity markets reach all-time highs, many of the sector's stocks remain under pressure.

Let's take a closer look at how this trend is impacting one of the most representative companies in the sector: Pfizer (NYSE:PFE).

Pfizer: Potential Rebound in the Offing?

Pfizer, a global biopharmaceutical giant, is known for its research focus and diverse product portfolio. The company discovers, develops, manufactures, markets, sells, and distributes a wide range of biopharmaceutical products.

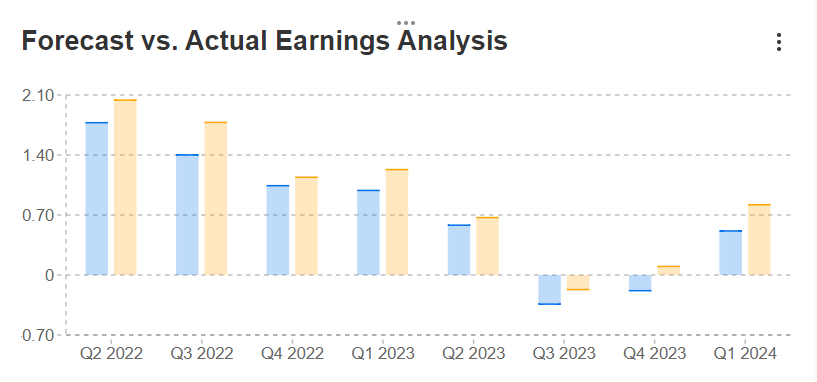

Like many pharmaceutical companies, Pfizer's earnings took a hit in the post-COVID era. However, the past two quarters have shown a return to profitability, suggesting a potential turnaround.

Source: InvestingPro

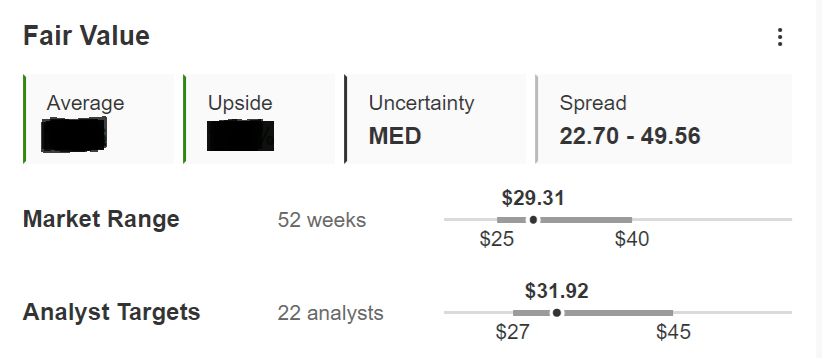

Pfizer's stock price reflects this volatility. After surging to new highs, it has since shed more than half its value. But recent weeks have hinted at a reversal, although a bullish confirmation is still pending.

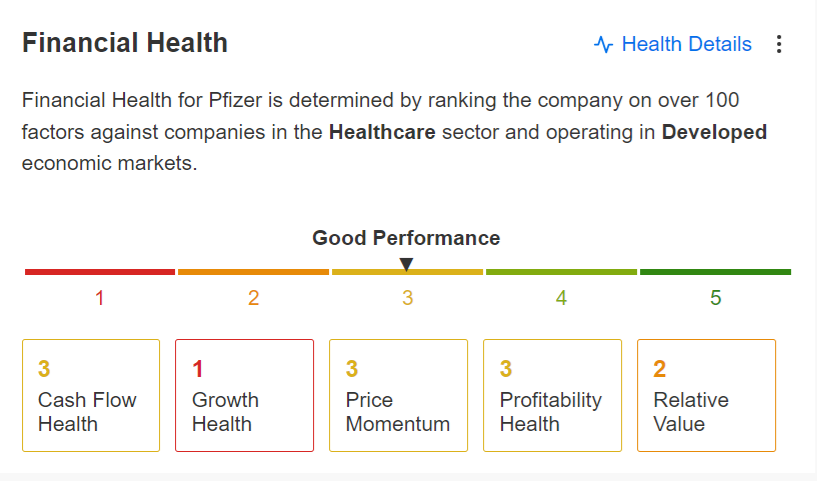

The health score is 3 out of 5, precisely because a return to growth is needed to point to an improvement in this key metric.

Source: InvestingPro

Analysts currently believe the stock is undervalued, setting a target price of $31.92. But the question remains: do the fundamentals and underlying numbers support this claim?

You can find that out by subscribing to InvestingPro here.

Source: InvestingPro

The stock's future hinges on the success of its new cancer treatments. Early indications suggest these treatments may propel Pfizer back to solid profitability.

When could a potential trend change occur? We will have to wait for a bullish confirmation before deciding to invest.

***

Become a Pro: Sign up now! CLICK HERE to join the PRO Community with a significant discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor. The author owns shares in the company mentioned.