The February Fed minutes may reveal that rates have to go much higher.

It will be a holiday-shortened trading week, but it will still be full of market-moving data. The Fed minutes will be released on Wednesday, and on Friday, we will get PCE inflation data, along with the University of Michigan Inflation Expectations. The minutes will likely provide some color in terms of what the Fed is looking for when pausing its rate-hiking cycle. I suspect they will want to see a clear trend in month-over-month inflation readings that imply the Fed is running the economy at a 2% rate.

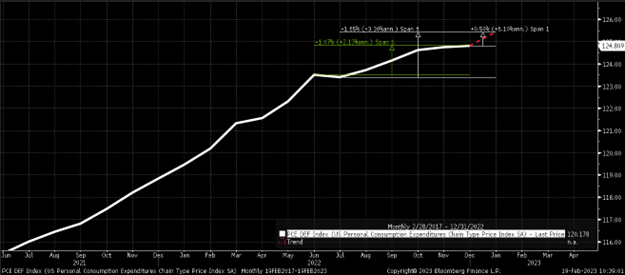

PCE is expected to rise 0.5% month-over-month, up from 0.1% in December and 5% year-over-year, unchanged from December. If that month-over-month value comes as expected, it would suggest that the 3-month annualized trend for PCE rose to 3.35% (Nov., Dec., Jan.) from an annualized 0.9% (Oct., Dec., Jan.). At the same time, it is running at 3.3% annualized from July to January, up from 2.1% annualized over the same period.

So, you can see that while the 3-month and 6-month year-over-year changes are down sharply from where they had been, they are still well above the Fed’s target for headline PCE of 2% and show a significant acceleration from the prior running trend. While one data point won’t panic the Fed, a hot reading in February could. So, if January comes as expected, it likely means that the Fed is taking a step back in achieving its goal.

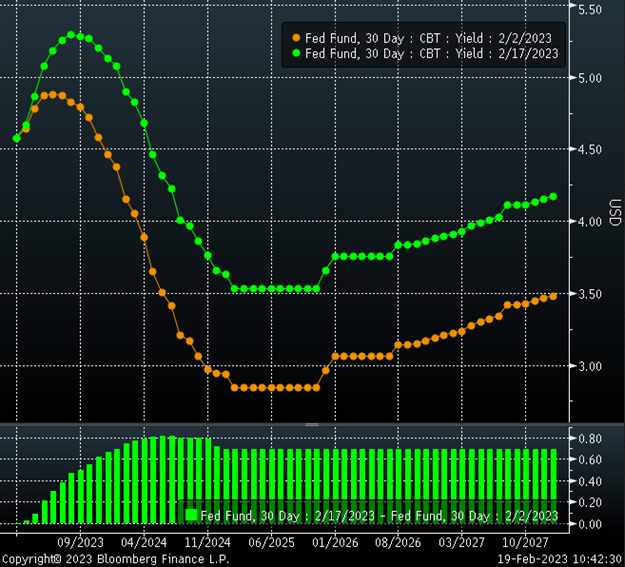

The CPI and PPI of this past week certainly gave investors pause and even caused analysts to increase their PCE estimates. As a result, the Fed Fund Futures have been repriced and are now more than 80 bps higher than where they stood on February 2, the day before the January job report. The peak terminal rate is now seen at 5.3% in August, up from roughly 4.85%.

10-Year Rate

This has resulted in higher nominal rates, with the 10-year moving up to and testing resistance at 3.9%. It also appears to have broken out of a bull pennant pattern, and the RSI breaking above two downtrends. This likely suggests that the overall momentum in the 10-year has shifted to higher rates.

Additionally, should the 10-year rise above 3.9%, it would likely confirm a double bottom and potentially result in a retest of the highs around 4.25%

TLT

We can see a similar development in the TLT ETF, which has fallen below a major uptrend off the October lows. The momentum in the TLT has also shifted from bullish to bearish, with the RSI breaking below an uptrend and a new downtrend in the RSI forming. At this point, support comes in around $99.70, and if that price point breaks, it sets up a double-top pattern and the potential for the shares to reach their lows.

DXY

The dollar index has also broken out, rising from a falling wedge. I think the dollar can move back to the 105.80 area.

SPX

More importantly, the S&P 500 appears to be completing a bump-and-run pattern. The first uptrend of the bump-and-run pattern has been completed, and now the S&P 500 is likely to continue to drift lower toward the lower trend line, around 3,950.

QQQ

At this point, the question is whether the QQQ has completed a broadening wedge. If it has completed wave “E,” then the next stop for the QQQ will be around $270.

QQQ vs. TIP

On top of that, there has been a massive disconnect between the QQQ and the TIP ETF. The TIP ETF represents real rates, and when it falls, it indicates that actual rates are rising. Rising real rates are bad for equities and the NASDAQ especially. The gap between the QQQ and the TIP is vast right now, suggesting that the QQQ is overvalued relative to real yields.

NVDA

Nvidia (NASDAQ:NVDA) will report results this week, and I would venture to guess that Nvidia will not post results deserving of the 51% rally in the stock since the beginning of the year. The stock has stopped rising around the 1% extension of the wave A retracement and is now very close to breaking support at $209. The next level of support would come at $200.

AAPL

Keep an eye on Apple (NASDAQ:AAPL). I have owned this stock for a really long time, but it has had a monster move off the lows. The stock has stalled at $156 despite a few attempts to break out. The shares are flirting with moving below the 10-day exponential moving average. If it breaks below that moving average, it would signal a change in trend and would likely work to fill the gap at $145

Good luck this week.