- Markets expect ECB to hike rates for the first time in 11 years

- Earnings reports may be luring investors in for a bull trap

- US Dollar rallies

Dow, S&P, NASDAQ, and Russell 2000 futures and European shares all traded slightly lower ahead of today's expected interest rate hike by the ECB. The political instability in Italy didn't help sentiment which was dented further by the Asian Development Bank downgrading its forecasts for growth in developing Asia this year.

Contracts on the Russell 2000 underperformed as smaller firms tend to underperform in a rising interest rate environment.

Russell 2000 futures were forming a bearish Shooting Star, having approached the top of a Falling Channel, reinforced by the 100 DMA. From a technical standpoint, this may offer aggressive traders a shorting opportunity. Moderate traders would wait for either a long red candle or a full correction to the channel's top. Conservative traders would wait for a long red candle following the total correction to the channel top.

Consensus on the ECB's first rate hike in 11 years has put traders on the defensive. The eurozone inflation print for June came in at 8.6%, up from 8.1% in May, and German producer prices in June were 32.7% higher than a year earlier. Deutsche Bank's Mark Wall said,

"The ECB may want the option of a 50bp hike because of something it has seen in the unpublished inflation expectations data."

The STOXX 600 Index declined for the second day.

After completing a small bottom, between the June 15 low and the July 19 breakout, the current drop could be a Return Move, following a short squeeze, before the price retests the downtrend from the pan-European Jan. 4 all-time high. Aggressive investors could short if the price returns to the downtrend line, reinforced by the 100 DMA. More cautious traders will wait on a short after breaking the 400 support.

China's economic woes resumed, with another property developer defaulting on offshore debt, as COVID cases remain high.

Yesterday, US shares advanced to their highest since early June amid volatile trading. The NASDAQ 100 and the Russell 2000 outperformed with both gaining about 1.55%. Earnings season has not been as bad as some analysts had feared. According to FactSet, about 12% of S&P 500 members have released quarterly results thus far, with 68% doing better than expected.

However, be wary, as just because a company's performance was less bad than expected, it does not mean it was good. And the results are based on a performance going back up to three months, which may have little in common with what will happen three months or six months in the future.

Netflix (NASDAQ:NFLX) surged 7.21% after losing half of the subscribers analysts' expected. So, is this positive or negative? What does it say when investors are willing to bid up a stock by more than 7% in a single session because things were not as bad as forecast? Is that a bullish sign, a warning that investors are unrealistic, or a bearish sign?

JP Morgan Asset Management has warned of a bull trap in equity markets as it continues to see downside risk to corporate earnings.

Even though I am bearish on the online streaming service, I am bullish in the short term.

The stock has bottomed out, and I expect it could rise to retest the 100 DMA and perhaps even attempt to fill the gap above.

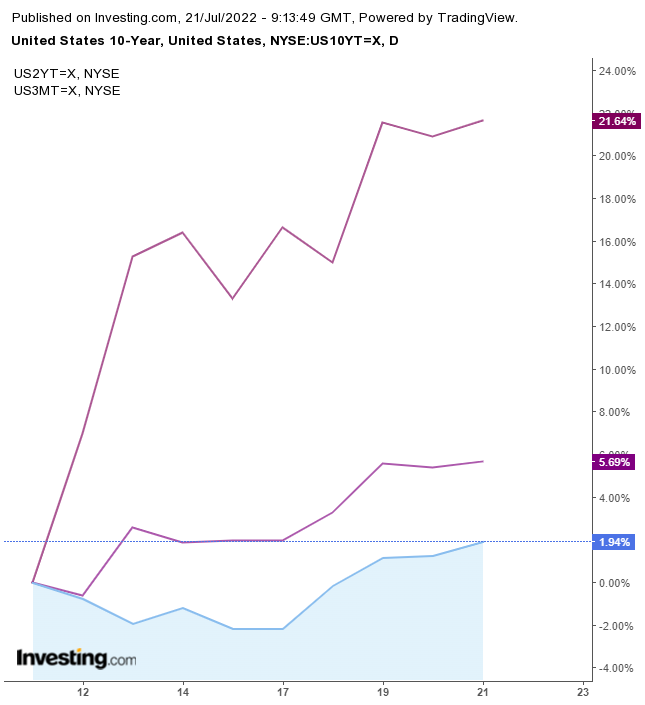

Yields on the 10-year Treasury note climbed for the fourth day, for the first time in 11 days, as investors rotated out of bonds and into stocks.

The 10-2 year and 3-month yield curve remained inverted, with analysts expecting this recession-leading indicators to stay in this state for some time.

St Louis Fed chief James Bullard has argued that the inflation surge twisted the yield curve so the inversion might not be so ominous.

My response to Bullard's assertion is that the Fed's job is to calm investors and to remember this is the same Fed that missed the boat on inflation. Remember, people often say, "this time is different".

The dollar rose for the second day. Gold plummeted, opening 0.43% lower, and extending the drop to 1.18%. Today is the second day of declines to an accumulative loss of 1.78%.

The yellow metal has been testing support since the price bottomed in March 2020.

Bitcoin is falling for the second day.

The cryptocurrency is struggling at the top of a narrow Rising Channel. I remain bearish in the long term.

Oil plunged 3.75%, as growing stockpiles of crude and gasoline tempered fears of a tight market. Ironically, the price is falling on easing supply shortages, while investors are hopeful that the economy can avoid a recession, a concern that had been suppressing prices. Perhaps, this contradiction can be understood when examining supply and demand.

The price fell for the second day after finding resistance below a potential top and I think the price could fall to the $60s.

Up Ahead

- On Friday UK retail sales figures are published.

- German PMI figures are released on Friday.

- Canadian retail sales figures are printed on Friday.

Disclaimer: The author currently does not own any of the securities mentioned in this article.